ECB to decarbonize its corporate bond purchasing and collateral framework: from intent to almost immediate action

20 - minute read

****

Executive Summary

Pursuant to its climate action roadmap released in 2021 (see our July 2021 article “European Central Bank’s historic pledge on climate”)[1], the ECB announced on July 4th 2022 (press release here), the greening of its corporate debt portfolio and collateral framework.

First-time actions against a turbulent backdrop

The green tilting of ECB's corporate sector purchase programme (CSPP) will begin from October 2022 while the integration of climate considerations in the collateral framework will supposedly start before the end of 2024. This long-debated move has been in the making since a couple of years. Back in 2019, we already commented C. Lagarde’s hearing for nomination (“Christine Lagarde sees climate change as “mission critical” for the ECB and opens the door to EU taxonomy-based asset purchases programs”).

The announcements are particularly groundbreaking because of the monetary context in which they occur. Due to soaring inflation, the ECB decided on July 21st to raise its three key interest rates by 50 basis points. In June, it also announced that it will stop expanding its balance sheet[2]. From October 2022, it will only reinvest principal payments from maturing securities. From 2023, reportedly circa €30bn could be reinvested towards companies with a better climate performance every year. To put this €30bn figure into perspective, as of July 22nd, the total CSPP holdings stood at almost €345bn[3]. To get a glimpse on which businesses this tilting might have an impact, see the figure 3 below on the estimates of the ECB's 15 top corporate holdings under the CSPP.

The corporate debt issuers’ climate performance will be measured with reference to lower greenhouse gas emissions (i), more ambitious carbon reduction targets (ii) and better climate-related disclosures (iii). The measure does not affect the volume of corporate bond purchases but only the assets breakdown. Thus the share of assets on the Eurosystem’s balance sheet issued by corporates with a better climate performance will be increased compared to those with poorer climate performance. Meanwhile, the ECB will start publishing climate-related information on corporate bond holdings regularly as of the first quarter of 2023.

Furthermore, the Eurosystem also announced that it will limit the share of assets issued by entities with a “high carbon footprint” that can be pledged as collateral by individual counterparties when borrowing from the Eurosystem. This will start before the end of 2024 provided that the necessary technical preconditions are in place. Moreover, the Eurosystem will, as of this year, consider climate change risks when reviewing haircuts applied to corporate bonds used as collateral (reductions applied to the value of collateral based on its riskiness). This measure may strongly influence investor demand and liquidity premiums.

Blurred implementation details and scope limitations

There is no clear guidance at this stage on underlying data, thresholds and methodologies for both corporate holdings and collateral announcements. One ignores how the ECB intends to tackle GHG emissions and reduction targets usual comparability and reliability challenges (to assess and/or compare ambition levels, methods, baseline, intermediate dates selected, objectives, breadth of scope, changes in scope, gross or net figures, see our related article on “Insightful benchmark of climate and fossil fuels practices of French financial institutions and corporates by the AMF and the ACPR”.) The potential use of EU Taxonomy ratios is unknown. The availability of reliable data at a large scale is again crucial to successfully implement the decision.

As this announcement only applies to corporate purchases, the scope of this measure is not financially systemic. Indeed, sovereign debts are not included despite accounting for the majority of Eurosystem’s portfolio. It is fairly understandable from a political standpoint, but less from a climate risk mitigation perspective.

Regarding the collateral framework, the limits announced will at first apply only to marketable debt instruments issued by non-financial corporations. Additional asset classes may fall under the new limit regime once the quality of climate-related data has improved. The ECB will only accept as collateral, assets and credit claims from companies and debtors that comply with the Corporate Sustainability Directive (CRSD) once it is fully implemented. The new eligibility criteria are expected to apply from 2026.

Criteria transparency and predictability will be key for market participants. Indeed, the implementation of the new ECB measures is heavily reliant on the finalization of the CSRD. As stated by the ECB “as the implementation of the CSRD has been delayed, the new eligibility criteria are expected to apply as of 2026”, what is being done in the interim will matter.

Meanwhile, at this stage, we ignore if Green, Sustainability and Sustainability-Linked Bonds (SLB) will be given any sort of preference and overweighted. Issuer level criteria are more likely, possibly penalizing Use-of-Proceeds instruments. Even if the EU Green Bond Standard (EU GBS) is still under negotiation, in its current discussed form, bonds compliant with it are likely to be scarce, meaning that such EU-GBS criteria would lead to a narrow purchasing universe for the central bank (see our latest article, “The EU Green Bond Standard: intense negotiations on instrumental aspects”).

Still a turning point for us

Overall, the ECB is facing a nexus of challenges with different time horizons: containing inflation (with a new expected annual record high of 8.9% in July[4]), narrowing spreads amid fragmentation risk concerns in the Eurozone, while starting to really tackle climate change risks and greening its interventions. Since the arrival of C. Lagarde at the helm of the institution, the Covid-19 financial shock and the continuation of the “whatever it takes”, the ECB displays rising activism and less conservatism (see our June 2020 editorial, “Covid-19 crisis in Europe: a midwife for a federalist green & social leap forward”[5]). To avoid obstructing sustainable finance innovation, the ECB decided to accept Sustainability-Linked Bonds (SLB) as collateral for Eurosystem credit operations and also for Eurosystem outright purchases with a string of conditions (press release here and FAQ on eligibility criteria). Before that, any structured or step-up format was banned.

However, the new decisions commented here are of a different nature and trailblazing. Those measures may strongly incentivize corporates to improve their climate performance and transparency to hedge against rising interest rates and the end of accommodative monetary policies. Moreover, this may signal the near end of a tenet, the so-called “market neutrality”, as it is incompatible with the climate risk management of its balance sheet. The principle has already been strained by the application of eligibility criteria for asset purchase programs (APP) and the Pandemic Emergency Purchase Program (PEPP) meaning that those schemes not necessarily reflect proportionally market capitalization.

The rationale put forward is compelling

Evidence that quantitative easing programs reproduce the inherent bias of the markets towards heavily emitting industries have been piling up[6]. Furthermore, as the environmental transition seems to be inflationary by nature (see our article “Greenflation, the new normal?”), it is incongruous to oppose the greening of monetary policy and price stability - ECB’s primary mandate - as laid down Article 127 of Treaty on the Functioning of the European Union. Given Europe’s ambitions in terms of carbon neutrality, and as an orderly transition is likely to minimize economic disruptions, the secondary mandate of the ECB to support the general economic policies in the Union’s objectives[7] also provides a strong rationale for further integration of environmental considerations in monetary operations.

This does not mean that monetary policy should or can tackle climate change alone, as repeatedly stressed by C. Lagarde, but that in conjunction with the policy-making ecosystem, it is an essential lever to meet the EU’s climate targets. While further details will follow shortly, more implementation challenges are to be expected. To avoid unintended effects – including the amplification of market inefficiencies – the tilting mechanism must be thoroughly designed. One especially wonders whether the foundations for greening ECB’s monetary policies and collateral frameworks are adequate.

Overall policies consistency is required

In our view, to ensure the relevance and beneficial effect of the announced measures, this monetary push should go hand in hand with supervisory adjustments. Given the relative scarcity of green assets as compared to the bond universe, adequate supervision of capital (through risk models, pillar 2 supervisory practices, etc.) would reinforce the logic underpinning the greening of the monetary policy, and vice versa. Because risk-weighted assets (RWA) constraints currently do not factor decarbonization, such ECB’s measures could spur green assets demand, inflate their prices and not necessarily create additional green collateral. The main way to detain green assets for banks could become through central bank refinancing.

In conclusion, regardless of implementation hurdles and consistency loopholes, the ECB decisions mark a turning point as it could provide an unprecedented impetus to the transition towards a low-carbon economy.

***

Figure 1: Overview of the measures announced in July 2022

to further incorporate climate change into ECB’s monetary policy operations

Source: Authors (based on the ECB Press Release)

***

Content

Executive summary

I. Amid "green swan concerns", a foreseeable sustainability shift of the ECB

II. The greening of the collateral framework: a strong incentivizing measure

III. Tilting corporate bond holdings towards better climate performers: a new material and financial incentive to speed up decarbonization?

IV. Is "further" enough? A benchmark of central bankers' practices

a) The Swedish central bank: a pioneer in the greening of assets purchases

b) The Bank of England (BoE): a similar "tilting purchases towards stronger climate performers" approach

V. Acknowledging market failures: towards market efficiency

VI. Conditions for a successful portfolio rebalancing approach

VII. What's next?

***

In line with its climate action plan, the ECB will account climate change in its corporate bond purchases by October 2022 and will regularly start publishing climate-related information on corporate bond holdings as of the first quarter of 2023. Before the end of 2024 “provided that the necessary technical preconditions are in place”, the share of assets issued by entities with a high carbon footprint that can be pledged as collateral by individual counterparties when borrowing from the Eurosystem will be limited. As of this year, climate change risks will be considered when reviewing the haircuts applied to corporate bonds used as collateral. Overall, the new measures reportedly aim at (i) reducing the climate-related financial risks weighing on the ECB’s balance sheet, (ii) encouraging transparency and (iii) supporting the environmental transition of the economy.

***

I. Amid “green swan concerns”, a foreseeable sustainability shift of the ECB

Even though the primary responsibility for tackling climate change belongs to governments, the global and the all-encompassing nature of the challenge calls for a wider involvement of all policymakers including central bankers. Such awareness and involvement institutionally began with the creation in 2017 of the Network of Central Banks and Supervisors for Greening the Financial System (NGFS).

While climate change, green transition and monetary policy have long been opposed, their interplay is increasingly evidenced. Indeed, climate change and the environmental transition are increasingly seen as affecting (or assumed to affect) key macroeconomic indicators including inflation, growth, employment, financial stability and the transmission of monetary policy. Climate change is also considered to lead to greater climate-related financial risk by affecting the value and risk profile of assets, including on Eurosystem balance sheet [8]

There is a growing consensus at the ECB on the fact that the greening of its monetary policy serves its mandate by helping to maintain price stability and contributing to the EU general economic policies) as enshrined in the Article 127 of the TFEU.

These announcements come as there are rising concerns among central banks with “green swan” events. It refers to potential extreme environmental events which have the potential to disrupt the financial stability. The results of the ECB economy-wide climate stress test published on July 8th, 2022, illustrate the shortcomings in climate risk management and provide loss projections (read our article “ECB climate stress test unveils shortcomings in climate risk management”).

At the occasion of its first strategic review since 2003, on July 8th, 2021, the ECB committed to a comprehensive action plan to further incorporate climate change considerations in the monetary policy framework. Willingness to shift the corporate bond purchases and collateral rules away from heavy-emitting companies as part a dedicated action plan (see below) were announced along other general measures including:

- Further incorporation of climate change considerations into its monetary policy framework;

- Expansion of its analytical capacity in macroeconomic modelling, statistics and monetary policy regarding climate change;

- Integration of climate change considerations in monetary policy operations in the areas of disclosure, risk assessment (as well as in the collateral framework and in the corporate sector asset purchases);

- Implementation of the action plan with respect to EU policies’ progress and initiatives in the field of environmental sustainability disclosure and reporting.

Figure 2: Overview of the ECB roadmap to integrate climate change in monetary policy

Source: Authors (based on the ECB roadmap)

As compared to the ECB initial roadmap, actions in some areas of the monetary policy framework - statistical data, macro-economy and monetary policy transmission are still awaited. On July 4th, the ECB has however published more details on the integration of environmental considerations in the collateral framework and disclosure requirements as well as in the corporate bond purchases.

II. The greening of the collateral framework: a strong incentivizing measure

Central banks provide credit to banks conditional on collateralization, applying eligibility criteria[9] for the collateral to be provided. The Eurosystem collateral framework (ESCF) is essential to (i) liquidity management and strategic planning of banks and (ii) the feasibility of central bank operations, financial conditions, financial stability and the transmission mechanism of monetary policy, in particular in stress conditions. Note however that it only applies to “unsecured” asset refinancing: as assets are not mobilized, they can be monetized if needed or to act in the event of a crisis.

Collateral frameworks have a “conservative design”, with a focus on strict requirements for collateral quality and high haircuts[10]. Haircuts refer to a reduction applied to the value of an asset. In the context of the collateral framework, the ECB deducts a percentage from the collateral value to establish the borrowing potential. It depends on the price volatility, the relevant assets and the prospective collateral liquidation time. [11]

The ECB has now announced that before the end of 2024, “the share of assets issued by entities with a high carbon footprint that can be pledged as collateral by individual counterparties when borrowing from ECB” will be limited. Note that ECB will only accept as collateral assets and credit claims from companies and debtors that comply with the Corporate Sustainability Directive (CSRD)[12] once the directive is fully implemented. The new eligibility criteria are expected to apply from 2026. This measure should help improve climate-related data and disclosures. At first, this will only apply to marketable debt instruments issued by non-financial corporates. Marketable assets must meet credit quality requirement as defined by the Eurosystem credit assessment framework (ECAF)[13].

As the data quality improves, the measure may be extended to more asset classes[14] according to the ECB’s official communiqué. In addition, as of this year, the ECB will also consider climate change-related risks when reviewing the haircuts applied to corporate bonds used as collateral. This new regime aims to reduce climate-related financial risks in the ECB credit operations.

New suggested collateral framework may influence investor demand – thinking of bank liquidity buffers for example and demand for HQLA Level 2A and 2B securities. Applying a different haircut and collateral eligibility rules to “carbon intensive securities” may have a knock-on effect on liquidity premiums for such securities both at secondary and repo market levels. The limit placed on the share of the assets issued by carbon-intensive issuers that can be pledged as collateral may indeed trigger a reduced investor demand for such securities. This may result in an additional reduced access to capital for those highly-emitting issuers which may encourage them to undertake transformation of their activities. A parallel can be drawn with the SLB market where inverse dynamics have been observed. In contrast, the decision of the ECB to integrate sustainability-linked Bonds (SLB) in its collateral framework and bond purchase programs may have possibly contributed to the development of the market.

This may also trigger a “second-round effect” as the measures may affect liquidity/bank’s liquid reserve. For collateral with weak ratings, liquidity may be reduced, thereby resulting in an increase of banks’ liabilities.

Overall, the greening of the collateral framework seems to be a strong incentivizing measure. To a certain extent, this is reminiscent of the measures implemented to support access to credit for firms and households (easing of collateral standards and haircut) through targeted longer-term refinancing operations (TLTRO) during the Covid-19 crisis.

Currently, green assets’ universe remains small as compared to the ECB “purchasing” universe. As risk-weighted assets (RWA) constraints currently do not factor decarbonization, such a measure may make green assets less profitable for banks, thereby hampering their own greening strategies. This may further result in a foreclosure effect for some of the financial actors (unless capital and leverage constraints for green assets are simultaneously relaxed). Given green assets scarcity and a fortiori a low profitability for banks (due to heighted demand and higher price), the main way to detain green assets would be through central bank refinancing. This means that it would not create additional collateral but rather that the bank will only act in “pass through” for the ECB to act as lender of last resort (LOLR). For the ECB to perform such an investor role, the availability of green assets is crucial.

“The Eurosystem aims to gradually decarbonize its corporate bond holdings, on a path aligned with the goals of the Paris Agreement”[15]. Starting in October 2022, the ECB’s €~345 bn corporate sector purchase[16] portfolio will be “tilted towards issuers with better climate performance, through the reinvestment of the sizeable redemptions expected over the coming years.” The figure 3 below presents the ECB’s top 15 corporate holdings under CSPP according to our estimates.

Figure 3: Estimates of the ECB's 15 top corporate holdings under the CSPP

Source: Natixis' Corporate Syndicate estimates

According to Frank Elderson and Isabel Schnabel, two members of the ECB Executive Board, approximately €30 billion will be reinvested towards companies with a better climate performance every year[17]. While corporate bond purchases will continue to be guided by ECB’s inflation target, the central bank will gradually reinvest matured bonds towards good climate performers by looking at (i) lower greenhouse gas emissions, (ii) more ambitious carbon reduction targets and (iii) better climate-related disclosures.

The relative reduction of assets purchased from poorer climate performers aims at reducing ECB’s balance sheet exposure to environmental risk according to the ECB. The central bank will start publishing climate-related information on its corporate bond purchase scheme regularly from the first quarter of 2023. As most market players (banks, insurers, asset managers) and even the ECB now seek green assets to decarbonize their balance sheet, the prices of the latter might increase while risk premiums and margins may decrease. However, as evidenced by the experience with quantitative easing, the arrival on the market of central banks whose macroprudential liquidity, capital and leverage constraints differ from banks may compress the margins of the latter.

From an issuer perspective, given the rise of interest rates, this measure could possibly provide incentives to companies looking to reduce their borrowing costs and/or enhance their access to capital to improve their climate performance and/or disclosure.

Overall, the combination of the greening of the collateral framework and of the corporate sector purchase programme may have a scissor effect. It could increase credit cost for issuers in heavily emitting industries due to a double penalty: less mobilizable assets and increased cost of capital. Such outcomes may even go beyond the EU by adding pressure on non-EU companies that issue EUR denominated bonds.

IV. Is “further” enough? A Benchmark of central bankers’ practices

Some observers described the measures “to incorporate climate change into ECB’s monetary policy operations” as “overdue”. As compared to the roadmap published in 2021 (see Figure 2 above), the announcement thus comes late in particular as significant more details are still awaited, including on the implementation steps, but also on the mechanisms themselves. As the CSRD has been delayed, this new debt collateral eligibility criteria are not expected to apply before 2026.

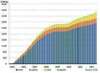

From a more macro-financial perspective, the corporate bond holding scheme accounts for ~11% of the assets bought under quantitative easing policy (APP accounted for ~3,2tn in June 2022[18]). As shown under by the cumulative net purchases of the ECB as of the end of June 2022, most of those assets are bought under the Public Sector Purchase Program (PSPP). Adapting tilting strategies for the public sector would however be challenging as those schemes are guided by capital key[19] (the key equally reflects the respective country’s share in the total population and gross domestic product of the EU[20]). From a risk management perspective, this means that the ECB will significantly remain exposed to climate-related risks.

Figure 4: the cumulative net purchases of the ECB as of June 2022 [21]

Source: ECB website

Similarly, the carbon-based collateral limits will only apply to the assets issued by non-financial companies, which accounts for less than 3% of the total collateral held by the ECB, after valuation adjustments, at the end of March according to the Financial Times[22]. However, to our knowledge, no other central bank has signaled such strong intentions in terms of integrating climate considerations in the collateral framework. By making green bonds eligible assets as collateral for its Medium-Term Lending Facility in 2018, the People’s Bank of China (PBoC) made a pioneering move.

Given the considerable expansion of the role of central bankers and the systemic importance of the ECB, that does not make the measures any less significant. As of today, the ECB’s measures are the most expansive in terms of size (~€386bn corporate bond portfolio as compared to a ~20bn portfolio for the bank of England).

a) The Swedish central bank: a pioneer in the greening of assets purchases

While implementing easing monetary policies, Riksbank was the first bank to explicitly target green and sustainable assets in January 2021. Instead of a tilting mechanism, the Swedish central Bank applies a norm-based negative screening when purchasing corporate bonds.

- Scope: SEK 12.4 bn (as of June 30th 2022 according to Riksbank’s website)

- Eligibility: in June 2022, Riksbank announced that, as of September 1st, 2022, it will only “purchase corporate bonds issued by companies that report their annual direct and indirect emissions of greenhouse gases (scope 1 and scope 2) in accordance with the recommendations of the Task Force for Climate-related Financial Disclosures”[23].

- Mechanism: This means that it only purchases corporate bonds from companies deemed to comply with international standards and norms for sustainability (see our Article “Swedish Central Bank as a first mover” on the matter).

b) The Bank of England (BoE): a similar “tilting purchases towards stronger climate performers” approach

The Bank of England (BoE) has published significantly more information on its approach to the greening of monetary policies than counterparts[24]. As the United Kingdom has committed to a target of net zero greenhouse gas (GHG) emissions by 2050, the BoE targets a 25% reduction in the carbon intensity of the Corporate Bond Purchase Scheme (CBPS) by 2025.

- Scope: the £20bn corporate bonds holding programme.

- Eligibility: firms that meet public climate disclosure in line with the UK Government’s requirements, from 2022, and for higher-emitting sectors (energy and utilities) public emissions reduction targets. Issuers with any coal mining activities are ineligible. Unless stringent criteria in line with science-based pathways are met, issuers using thermal coal in their activities are also ineligible.

- Tilting: the scorecard incorporates level of emissions intensity in latest data, past reductions in absolute emissions (relative to sector-specific pathways for high emitters), publication of a climate disclosure, and publication and third-party verification of an emissions reduction target.

- Escalation: annual review of the calibration of CBPS, increase of the requirements as coverage and robustness of data and metrics improve, escalation of the intensity of actions, including, where appropriate, loss of eligibility and divestment where climate performance is inadequate.

However, according to Reclaim Finance, the Bank of England approach “falls short on several fronts, notably by failing to oppose fossil fuel development and to cover all GHG emissions” (scope 3 emissions). It finds additionally that the use of a carbon intensity target for the portfolio is flawed in the sense that it allows absolute emissions to grow if the portfolio does. Note that the first limit emphasized is now also applicable to the approach announced by the central bank of Sweden last week.

V. Acknowledging market failures: towards market efficiency

The adequacy of the market neutrality (i.e., implying that the corporate sector purchase programme should reflect the overall eligible market to ensure no distortion) has been questioned by multiple influential personalities, including Banque de France Governor François Villeroy de Galhau[25], ECB Executive Board Member Isabel Schnabel and President Christine Lagarde. As it is increasingly evidenced, there is an inherent debt capital market bias towards carbon-intensive industries. This means that the corporate bond buying programmes, as developed by central banks may be benefitting heavily emitting industries (see table below) in conflict with the EU Climate Agenda.

Figure 5: Contribution of the carbon-intensive sectors to the euro-non bank corporate bond market (outstanding amount), the ECB list of bonds held under CSPP/PEPP (outstanding amount) and the euro area gross value added (GVA)

Source: “Decarbonizing is easy: beyond market neutrality in the ECB’s corporate QE" study

According to the estimates of the “Decarbonizing is easy: beyond market neutrality in the ECB’s corporate QE”[26] paper, in the universe of euro non-bank corporate bonds, the share of carbon-intensive sectors stands at 45.5%. This share increases to 55.8% once the ECB’s eligibility set of criteria is applied supposedly because “carbon-intensive companies tend to receive a more favorable evaluation by credit agencies” as credit rating agencies barely integrate climate risk into credit risk evaluations. When applying the market neutrality principle (thereby mirroring the sectoral decomposition of the CSPP bond universe), the share of carbon-intensive sectors jumps to 62.7%, evidencing that market neutrality may reproduce and/or amplify market failures.

Interestingly, the study “an environmental mandate, now what?”[27] on the greening of the monetary policy by the Bank of England finds that “continued adherence to the market neutrality principle, leads to the tilting of the CBPS holdings within sectors so that the scheme continues to reproduce the underlying sectorial composition of the bond market”. Consequently, “the Bank’s tilting cannot reduce the representation of carbon-intensive activities in the CBPS and can paradoxically lead to some carbon-intensive companies getting better treatment than environmentally friendly companies”.

Two alternatives to the current design of the greening of the Bank of England’s corporate bond purchases - the strong tilting and the strong tilting and exclusion – are explored in the aforementioned study (see Box 1 below), meaning that lessons can be drawn for the limits underlined above when designing the ECB’s tilting mechanism.

|

Box 1: alternatives to simple tilting mechanism as proposed by the “an environmental mandate, now what?” study

|

As of today, no exclusion policy for the corporate bond portfolio has been brought up by the ECB. Yet, should the ECB opt for a “strong tilting” or “strong tilting and exclusion approach”, the European Taxonomy could serve as a basis for the tilting mechanism.

VI. Conditions for a successful portfolio rebalancing approach

Assessing good climate performers by looking at (i) lower greenhouse gas emissions, (ii) more ambitious carbon reduction targets and (iii) better climate-related disclosures raises multiple questions. ESG data challenges are well known, and one may wonder on which source the ECB will rely for climate data. Note that, last March, Carbon4 Finance was chosen to provide the Eurosystem (i.e., the European Central Bank as well as the National Central Banks of the euro area) with climate-related sustainable and responsible investment (SRI) data[28]

On top of data collection matters, it is not clear yet whether GHG emissions will be assessed on an intensity, absolute gross or net basis. Carbon offsets as well as carbon capture and sequestration are prone to debate. The scope of GHG emissions (scope 1,2 and 3) adopted has not been clarified either but as indirect emissions (scope 3) are most often material, it would make sense to include them.

Some research, like the “sustainable investing and climate transition risk: a portfolio rebalancing approach”[29] study published by Giacomo Bressan, Irene Monasterolo and Stefano Battiston however finds that GHG emissions, in particular scope 3 emissions, face accounting limitations as well as limited reliability and comparability. Due to these limitations and as GHG emissions do not take into account the issuers’ energy technology profile “which plays a key role in the firm’s alignment to climate objectives and drives the forward-looking exposure to transition risks” which makes it insufficient “alone to inform climate-related portfolio rebalancing” according to the same researchers.

For this reason, the authors suggest using enhanced measures of greenness such as one based on Climate Policy Relevant Sectors (CPRS). Beyond the GHG emissions profile of an activity (scope 1,2,3), the CPRS classification also integrates the energy technology profile, its business and revenue model as well as the relevance for climate policy implementation (i.e., their costs sensitivity to climate policy change), which makes it a more holistic but qualitative proxy. Under weaker allocation constraints (“weaker neutrality principle”), a rebalancing of the asset purchase program can achieve an aggregate reduction of exposure to economic activities with high climate transition risk of about 10% and a reduction of total aggregate GHG emissions of about 6%.

The ambition of carbon reduction targets is a well-worn subject for investors, that poses multiple challenges. First, carbon reduction targets suffer from little comparability in the sense that ambition levels, baseline years, intermediate dates selected, objectives (breadth of scope, changes in scope, gross or net figures), methodologies and geographies widely vary across issuers.

One may wonder how the ECB intends to look at the performance and against which universe. A best-in-class approach seems plausible. On ambition level more specifically, one can wonder how the ECB will manage to opine on “more ambitious” carbon reduction targets and against which scenario and benchmark. The benchmark adopted can be one of the following:

- International agreement (i.e., the Paris Agreement);

- EU legislative package (i.e., the Fit for 55 net neutrality objectives);

- Market standards (i.e., SBTi, ICMA’s recently published registry or climate transition finance guidelines , see our article on it);

- Peers? Against geographical and/or sectorial criteria?

Another issue with such a forward-looking component is that a target does not necessarily translate into results (Read our article on the matter “To pledge or not to pledge…Net neutrality, an international dilemma”). What if issuers then miss their targets? Will any “penalty mechanism” (i.e., selling the assets as the issuers can no longer be considered as a good climate performers) be envisioned?

The extent to which EU Sustainable finance regulation (i.e., the Sustainable Finance Disclosure Regulation, the Corporate Sustainability Reporting Directive and the EU Taxonomy) will allow “better climate-related disclosures” is as of today unknown. So far, we only know that to improve disclosures and generate better data for all stakeholders, the ECB will only accept assets and credits claims from companies and debtors that comply with the Corporate Sustainability Reporting Directive (CSRD) as collateral in Eurosystem credit operations. Yet, as pinpointed by the ECB, a “significant proportion of the assets that can be pledged as collateral in Eurosystem credit operations, such as asset-backed securities and covered bonds, do not fall under the CSRD”. To “ensure a proper assessment of climate-related financial risks for those assets as well”, this means that harmonized and better climate disclosures are necessary.

In ECB’s attempt to further enhance risk assessment tools and capabilities, rating agencies are urged to increase transparency on how climate-related risks are incorporated in ratings and their requirements on climate risks disclosures. This may be because for eligibility purposes, the ECB is reliant on credit ratings for its collateral framework. Credit rating agencies’ inertia, increasingly come under a cloud. Following the Call for Evidence (February 2022) to gather information on the market structure for ESG rating providers in the EU, the European Securities and Markets Authority (ESMA) found that shortcomings include a “lack of coverage of a specific industry or a type of entity, insufficient granularity of data, and a lack of transparency around methodologies used by ESG rating providers.” However, the role of credit agency is key in transparency, tackling greenwashing and improving ESG risk assessment in debt capital markets and in the Eurosystem.

VII. What’s next?

As first responder to economic policy, central banks are essential to address and ease the transition to a low carbon economy. As demonstrated by the ECB’s roadmap, central bankers can cascade environmental considerations in wide arrays of the monetary policy operations.

Some relevant areas for the greening of the monetary policy have not been explored yet even though they are meant to be so by the ECB according to its climate action plan. The next step of the decarbonization strategy of the ECB may be the introduction of requirements into the Eurosystem Credit Assessment Framework (ECAF) targeted to climate change risk. For corporates, eligibility rules are stringent and considerably reduce the universe of claims that can be used as collateral. Note that if the same rules were to apply to the green assets, this would considerably reduce the scope of the measures.

Even beyond monetary policy, environmental considerations are meant to be increasingly integrated in the banking supervision. Given the relative scarcity of green assets, a supervisory effort is necessary to enhance the origination of such assets. A coordinated action both on the monetary and the supervision sides may therefore initiate a virtuous circle. Greater origination of green assets through adequate supervision of capital (through risk models, pillar 2 supervisory practices, ect.) would reinforce the logic which underpins the greening of the asset purchase programme, and vice versa. Only a balance between those two axes would prevent a “second round” effect that would penalize the poorest performers without letting them have the time to put balance sheet greening strategies into place. Still on the supervisory level, there are still many areas for improvements in climate risk management. Indeed, as of today, the ECB found that:

- Three in five banks do not yet have a climate risk stress-testing framework.

- Most banks do not include climate risk in their credit risk models,

- Only one in five banks consider climate risk as a variable when granting loans.

Such results call for a greater push in supervisory activities to facilitate an orderly transition to a low carbon economy and thus minimize the bank’s losses.

***

For more information on the latest ECB measures, see:

- Christine Lagarde’s letter to Chair of the Committee on Economic and Monetary Affairs European Parliament, ECB, July 4th, 2022, available here;

- “ECB takes further steps to incorporate climate change into its monetary policy operations”, press release, ECB, July 4th,2022, available here;

- “A catalyst for greening the financial system”, ECB Blog, July 8th 2022, available here.

- Welcome address by Isabel Schnabel, Member of the Executive Board of the ECB, at the ECB DG-Research Symposium “Climate change, financial markets and green growth”, June 14th,2021, available here;

- “ECB detailed climate-change related actions”, available here.

References

[1] Read more about the greening of the corporate portfolio and the collateral framework in the letter of Christine Lagarde, “Further steps to incorporate climate change into ECB’s monetary policy operations”, July 4th 2022, available here.

[2] Read more about the last ECB monetary decisions in the associated Press Release, June 9th, 2022, available here.

[3] Note that CSPP holdings are published here with aggregate data, such as total holdings, a breakdown of primary and secondary market purchases, and a breakdown by rating, country and sector.

[4] See Eurostat “Flash estimate - July 2022 Euro area annual inflation up to 8.9%”, July 29st 2022, available here.

[5] Prior to the COVID-19 crisis, the ECB used to purchase government bonds in proportion to the capital each Member State contributes. However, its €750bn Pandemic Emergency Purchase Program (PEPP) is more flexible, allowing for instance, the purchase of more Italian and Spanish Bonds to prevent the widening of spreads. Issuer-limit that forbids the ECB from holding more than a third of any member’s sovereign debt has also been lifted.

[6] See in the “Decarbonizing is easy: beyond market neutrality in the ECB’s corporate QE” paper published by The New Economics Foundation, UK universities, Greenpeace in October 2020 here.

[7] As enshrined in the Article 3 of the Treaty on European Union.

[8] “Climate change and the transition to a greener economy affect our primary objective of maintaining price stability due to their impact on our economy and on the risk profile and value of the assets on the Eurosystem balance sheet” notes the ECB in Annex “ECB Climate Agenda 2022”, available here.

[9] The latest full list of eligible assets is made available by the ECB here.

[10] See “Occasional Paper Series: the Eurosystem collateral framework explained” published in May 2017 by the ECB here.

[11] As the Central Bank has a zero-default probability in domestic market operations, collateral providers are willing to accept severe haircuts to obtain credit. The higher the haircut (against valuation uncertainty before counterparty default or against value changes after counterparty default), the better the central bank is protected.

[12] As a reminder, the CSRD applies to large-public interest companies with more than 500 employees. This covers approximately 11 700 large companies and groups across the EU including listed companies, banks, insurance companies, other companies designated by national authorities as public-interest entities. More information on corporate sustainability reporting is available here.

[13] More information on the Eurosystem credit assessment framework is published by the ECB here.

[14] In addition to debt instruments issued by corporates, marketable assets include ECB debt certificates, central government debt instruments debt instruments issued by central banks, local and regional government debt instruments, supranational debt instruments, covered bank bonds, credit institutions debt instruments, and asset-backed securities according to ECB website.

[15] See in the ECB Press Release,“ECB takes further steps to incorporate climate change into its monetary policy operations”, July 4th 2022, available here.

[16] According to the preliminary figures on Asset purchase programmes, as of June 2022, available here.

[17] See in ECB Blog, “A catalyst for greening the financial system”, July 8th 2022, available here.

[18] According to the preliminary figures on Asset purchase programmes, as of June 2022, available here.

[19] “PSPP purchases are guided by the ECB’s capital key on a stock basis over the life of the programme. In order to implement the allocation, the Eurosystem gears its monthly purchases to align a jurisdiction’s share in the PSPP stock over the medium term as closely as possible with the respective share of the ECB’s capital key.” Read more about the Public sector purchase programme (PSPP) in the ECB Q&A here.

[20] Read more about capital subscription here.

[21] Note that PSPP stands for “Public Sector Purchase Programme”, CPBB3 stands for “Third Covered Bond Purchase Programme”, CSPP stands for “Corporate Sector Purchase programme and ABSPP stands for “Asset-backed Securities Purchase Programme”.

[22] See in the Financial Times, “ECB set for greener ‘tilt’ in €386bn corporate bond portfolio”, July 4th,2022, published here.

[23] Read more in the Annex to the minutes, “The Riksbank’s purchases of bonds during the second half of 2022”, June 29th 2022, published here.

[24] Read more about the Bank of England and the greening of its corporate portfolio on its website, “Greening our Corporate Bond Purchase Scheme (CBPS)” available here.

[25] See Speech by François Villeroy de Galhau, Governor of the Banque de France, “The role of central banks in the greening of the economy”, February 11th 2021, available here.

[26] The study “Decarbonizing is easy: beyond market neutrality in the ECB’s corporate QE” published by the New Economics Foundation, a UK thinktank, Greenpeace and UK universities in October 2022 is available here.

[27] The study “An environmental mandate, now what” published by university of London, University of Greenwich and the University of the West of England in January 2022 is available here.

[28] Read more about Carbon4 providing climate-related data to the Eurosystem on its website. Press release, “Carbon4 Finance selected by the Eurosystem to supply climate-change related investment data”, March 10th 2022, available here.

[29] Read more about the study “Sustainable investing and climate transition risk: a portfolio rebalancing approach” published by Giacomo Bressan, Irene Monasterolo and Stefano on June 20th 2022 here.