ECB climate stress test unveils shortcomings in climate risk management

8 - minute read

***

Executive Summary

Recent climate stress test results from the European Central Bank[1] and Bank of England[2] provide a window on the challenges banks face in preparing for climate change and on the expected consequences of a late or disorderly transition towards climate change objectives. Both tests covered a large cross section of institutions, with the ECB including 104 banks, and the BoE covering 28 banks and insurers. Neither test concluded that there was any major solvency risk across the industry, but the challenges of climate change present a material drag on profitability estimated at 10-15% on average per annum by the BoE. The tests highlighted deficiencies in data and firms’ capabilities to model the risks of climate change.

These stress tests sit in the broader context of work by regulators to prepare the financial sector for climate change. The ECB completed exercises scoring banks climate and environment risk governance[3] and disclosure[4] in the past year; the Basel committee recently adopted principals on climate risk[5] which broadly align with the existing supervisory expectations of the ECB[6] and the BoE[7]. Anil Kashyap (Member of the Financial Policy Committee, BoE) recently concluded “It is apparent that modelling climate risk will require financial services firms to look at their customers differently than they do now. For many customers, business as usual will become impossible to sustain”[8].

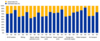

Unlike a traditional stress test, the results will not have direct consequences for institutions’ capital requirements, but the ECB intends to address any shortcomings during the upcoming Supervisory Review and Evaluation Process (SREP). Both tests do demonstrate significant shortcomings in risk management and data. For example, 70-80% of the reported Scope 1/2/3 emissions data rely on proxies, and there are wide dispersions on estimated Scope 3 emissions data at individual borrower level. There is also little current consideration of climate risk by management: almost 60% of firms in the ECB test do not yet have a climate stress test framework (CST) in place; 40% of those that do, do not use this to guide management planning; just 19% of those with a CST framework use it to inform their lending process.

Figure 1 - Use of actual counterparty data vs proxy in GHG emission data

Source: ECB, Bank Submissions

Looking ahead, the ECB will prepare a set of best practices (expected in Q4 2022) that cover recommendations on how to overcome challenges to implementing climate stress test. The BoE will host a research conference on the interaction between climate change and capital in Q4 2022. Frank Elderson (Vice-Chair of the Supervisory Board of the ECB) said, “The good news is that […] banks are starting to progress in their management of these risks. The bad news is that this progress is not across the board, and laggards remain in all areas”[9] showing that expectations from the ECB and the BoE towards these firms on risk management practices are achievable.

***

Contents

II. Results of the stress tests.

III. Key takeaways & next steps.

Both stress tests used qualitative and quantitative methods to assess firms both from a risk perspective, and in terms of ability to understand the impacts of climate change. Firms were asked to provide their own data submissions and stress test projections. All were subject to a common methodology and scenarios (see Table 1) but for the ECB, only 41 banks were involved in the bottom-up stress test. The scenarios were built on those developed by the Network for Greening the Financial System (NGFS)[10].

Neither stress test covered the totality of firms’ balance sheets, for example excluding liquid asset portfolios and trading assets, so the results do not provide a complete picture and may under-report losses. In the BoE test, loss projections were focused on the credit risk associated with their lending activities, the ECB focused on credit risk exposures. That resulted with exposures accounting for only one third of total exposures of the 41 banks stressed by the ECB. The BoE based loss projections on fixed balance sheets as they stood at the end of 2020, the ECB considered a static balance sheet for the short-term scenario and a dynamic balance sheet for the long-term scenario.

Table 1 - Summary of impacts in the ECB and the BoE stress tests scenarios

Source: European Central Bank’s 2022 Climate Risk Stress Test, Bank of England Results of the 2021 Climate Biennial Exploratory Scenario

II. Results of the stress tests

Both the ECB and the BoE indicated that the results they found should be interpreted with caution. Results likely underestimated climate risks as they do not factor any intervening economic downturn(s). For both the ECB and the BoE, these stress tests were the first exercise of that nature and no supervisory overlays applied in the bottom-up projections. For the participant firms, the exercise showed that their current data and modelling capacity incorporates a limited sensitivity to climate factors. Hence the tests represent a narrow coverage of the climate risks and reported exposures only targeting specific portfolios.

Financial institutions participating in the tests are making progress in their climate risk management but there remains plenty of scope for improvement. As outlined above 60% of EU banks do not yet have a climate risk stress-testing framework and the ECB scored 49% of the participants at its weakest score for governance and risk appetite. Just 20% of EU firms use climate risk as part their lending process.

The ECB estimates that firms could lose up to EUR70 billion under its short-term scenario (a three-year time horizon) due to climate-related risks - broken down between EUR53 billion of losses under the short-term disorderly transition, plus a further EUR17 billion of short-term physical risks - a figure to put in the context of the 41 largest significant ECB-supervised[11] banks representing over EUR22 trillion of total assets. The losses will be lowest with early action to reduce greenhouse gas emissions as shown in the BoE test: the losses with early action for all participants on a 30-year time horizon is estimated around GBP200 billion but the losses with no additional action would be highest at around GBP330 billion. Overall, firms are likely to be able to absorb the costs of transition without substantial impacts on their solvency positions.

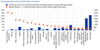

The ECB showed that banks generate on average 65.2% of their interest income from the 22 climate-relevant GHG-intensive sectors, albeit with differences due to business model. This is slightly overweight vs the 54% of the EU economy these sectors represent. 21% of income comes from the most polluting corporates[12]. In the BoE test, the sectors most affected by transition risks accounted for 30% of banks’ provisions, despite these sectors only accounting for 14% of banks’ corporate exposures.

Figure 2: Interest & Fee Income from 22 carbon-intensive industries, and industry median GHG intensity

Source: ECB, Bank submissions

The ECB stressed physical drought and heat risks. Credit losses are shown mainly on outdoor sectors such as agriculture, construction, or mining. Location of bank’s exposure also impacts the credit losses, particularly in regions more vulnerable to high temperatures.

[1] https://www.bankingsupervision.europa.eu/press/pr/date/2022/html/ssm.pr220708~565c38d18a.en.html

[2] https://www.bankofengland.co.uk/stress-testing/2022/results-of-the-2021-climate-biennial-exploratory-scenario

[3] https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.202111guideonclimate-relatedandenvironmentalrisks~4b25454055.en.pdf

[4]https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.ECB_Report_on_climate_and_environmental_disclosures_202203~4ae33f2a70.en.pdf

[6] https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.202011finalguideonclimate-relatedandenvironmentalrisks~58213f6564.en.pdf

[7] https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/supervisory-statement/2019/ss319

[8] https://www.bankofengland.co.uk/speech/2022/july/anil-kashyap-speech-on-climate-reporting-and-risk-management

[9] https://www.bis.org/review/r220622a.htm

[10] https://www.ngfs.net/sites/default/files/media/2021/08/27/ngfs_climate_scenarios_phase2_june2021.pdf

[11] https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.listofsupervisedentities202205.en.pdf?d0f183f19f9e36e98cd0c664b45d6107

[12] Sectors with GHG emission intensity above 1,000 tCO2 per EUR1m revenue

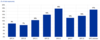

Mortgage loss projections have been analysed under the Energy Performance Certificate (EPC) scheme for both the ECB and the BoE stress tests. Results showed higher losses to the lowest EPC ratings while these categories represent less than 1% of banks’ total mortgage portfolios in the BoE test. The ECB stress showed a near 60bps range between best (EPC A) and worst (EPC G/Unknown) cumulative loan losses in the short-term disorderly scenario.

At the asset class level, corporate exposures not secured by real estate showed higher loan losses than corporate exposures secured by real estate exposures and energy efficiency of the underlying collateral is one of the factors of differentiation of the mortgage losses projections. The BoE estimates costs of energy efficiency improvements for UK mortgage customers to be around GBP75billion.

Overall, banks have limited exposures to high flood-risk areas; these high and medium flood risk regions account for half of the losses while representing just 31% of exposures with corporate real estate collateral being a more vulnerable sector than residential. These losses can be mitigated with insurance, but the ECB stress test found less than 25% of banks included private insurance coverage in their projections. For half of those banks, the insurance covers more than 50% of the collateral loss.

One of the main challenges is the lack of data that has been shown in every area of the assessment (23% of banks with no climate stress-testing framework in place indicate that data was a challenge, in the ECB test).

The ECB and the BoE have stated that firms should rely less on proxies instead of actual counterparty data (70% of the reported Scope 1, Scope 2 and Scope 3 emission rely on proxies, in the ECB test). The lack of harmonised legislation for Scope 3 disclosure requirements is highlighted as a major hurdle, as Scope 3 emissions are the major driver of carbon intensity emission for banks. Proxies are the first step towards closing the data availability gap, but various proxy techniques or data sources greatly influence the reported data, leading to deviations in reported scope emission for the same counterparty across banks. The ECB will analyse further the underlying assumptions of the proxies of its stress test.

Data deficiencies have been noted also in EPC ratings. Even though EPC ratings are mandatory in the EU for real estate transactions, obtaining the right data has been challenging for the participants (65% of the firms used proxies to report their exposures with an EPC rating, in the ECB test). Moreover, in the ECB test, firms were unable to allocate 17% of their reported collateral to an EPC rating. For proxies related to real estate, most banks used the construction year or energy costs of the collateral as the main input factors.

Figure 3: Real estate exposures per EPC rating

Source: ECB, Bank Submissions

III. Key takeaways & next steps

As part of recommendations to banks, both the ECB and the BoE have highlighted in their reports good practices they have identified on firms.

On the corporate lending, the BoE expects banks to include more climate risk features on their corporate lending’s model. Banks are expected to address data deficiencies in real estate EPC ratings by using information from comparable properties. Coupled with the flood risk, banks should be able to review their estimates of physical risk vulnerability on an on-going basis.

The ECB made a series of recommendations to banks:

- Banks need to integrate climate risk stress tests into their Internal Capital Adequacy Assessment Processes (ICAAPs)[13] (if not the case so far)

- Banks need to enhance their climate risk stress-testing frameworks to account for various transmission channels and asset classes; they should cover both physical and transition risks

- Banks need to establish a robust governance structure for their climate risk stress-testing frameworks and integrate climate risk stress test outputs into their banking activities/planning

- Banks need to incorporate climate risk scenarios into their stress-testing models, reflecting both physical and transition risks, as well as long- and short-term horizons

- Banks should enhance climate risk management, understand their client's transition plans and strengthen their strategic plans to exploit the opportunities of the green transition

- Banks need to invest much more in climate-relevant data collection by engaging with customers and improving their proxy assumptions

Both the ECB and the BoE have stated that firms will need to invest in their climate risk assessment capabilities, both on the modelling techniques and on data availabilities. Most banks have included the transition to net zero in their targets but associated key performance indicators are still to be established (in the ECB test, 61% of banks delivered information on future actions that are not yet associated with concrete targets). The common objective for banks is usually to reduce their exposures of the most polluting sectors, but the current actions undertaken are mostly driven by high-level objectives.

The ECB will publish its own good practices by end of 2022 and has already listed general high-level practices as implementing proper climate risk credit modelling capabilities. With these publications, both the ECB and the BoE will follow their supervisory agenda with for the ECB the consideration of the outcomes from its stress test when conducting its 2022 Supervisory Review and Evaluation Process (SREP)[14]. For the BoE, the outcomes of its stress test will be part of the Financial Policy Committee (FPC) thinking on financial stability policy issues related to climate risk. The BoE will hold a conference to assess the links between climate change and capital adequacy in 4Q22.

[13] The Internal Capital Adequacy Assessment Process (ICAAP) allows firms to assess their capital adequacy and requires them to have appropriate risk management techniques in place. This process is summarised in the ICAAP document which should be completed by firms on a regular basis.

[14] Supervisors assess the risks banks face and check that banks are equipped to manage those risks properly. This activity is called the Supervisory Review and Evaluation Process, or SREP, and its purpose is to allow banks’ risk profiles to be assessed consistently and decisions about necessary supervisory measures to be taken.