Green Funds: Market is getting structured as its attractivity flourishes

4-minute read

The year 2020 has witnessed a new record in terms of green funds growth as documented by two recently released reports by Environmental Finance and Novethic. The peak is of course not reached yet and the market is expected to grow in the next few years, driven notably by the entry into force of demanding regulation is such as the EU Sustainable Finance Action Plan in the European Union.

In a report on the “Dynamics of European Green Funds in 2020” released earlier this month, Novethic has analysed 340 European “green funds” (all asset classes combined) that total EUR 130 in Assets under Management (AuM). This is the result of a 120% growth in 2020 fed by exceptional performance of the funds as well as (and consequently) very strong inflows over the year. Novethic distinguishes three categories :

- Environmental funds;

- Low Carbon funds ;

- Green Bond funds.

While the first category gathers funds of all asset classes with environmental themes more broadly, the second category is dedicated for funds aiming “low-carbon transition”, according to Novethic, with or without explicit greenhouse gas emissions reduction target. The third one focuses only on ‘pure green bond funds’. This last category, composed of fixed income funds majoritarily invested into green bonds, totals 64 European funds: 43 funds with more than 12 months track record, 6 ETFs and 15 funds “in conversion” .

Graph 1. Dynamics of European Green Funds in 2020

Source: Novethic

Environmental Finance in its “Green Bond Funds – Impact Reporting Practices 2020 report” concurs with this last figure as they have identified 49 green bond funds (including 6 ETF) with at least 12 months of existence, globally.

Evolving green bonds characteristics and increasing regulation

Fixed income funds are traditionally rather diversified and green bonds funds do not differ on this: indeed, Novethic notifies that 26 green bond funds have more than 150 holdings. However, green bond funds historically showed little diversity in terms of geography, sector allocation and maturity, but new dynamics tend to change the market. In fact, green bonds tend to have a longer maturity lately, from 5/7 years to 10 years maturity. Moreover, the market shifts from a European-centered approach towards a more global allocation. However, green bond issuances are still very much focused on two sectors: Utilities and Financials.

From a regulatory standpoint, as funds try to market themselves, the new EU SFDR regulation will probably add new perspectives, and help classify and differentiate the numerous existing funds. The SFDR regulation requires to define the classification of each product (therefore fund) according to its characteristics (see our February 2021 article):

- Article 6: the product has no sustainability objective

- Article 8: the communication of a product incorporates environmental and social characteristics even if it is not its central point, nor the central point of the investment process. The product promotes environmental or social characteristics, or a combination thereof, provided that the companies in which the investments are made apply good governance practices.

- Article 9: the product has a sustainable investment objective.

European fund managers have already reclassified their funds according to this regulation. Following this, we can expect more scrutiny and more attention to impact reporting in the following months as green bond fund managers - and sustainable fund managers more broadly - will try to demonstrate their good faith and engagement.

Obviously, green bonds funds are rather well positioned to be regularly classified as Article 9, thus able to meet the most demanding investors expectations when it comes to sustainable objectives.

Impact reporting has progressed significantly, even if room for improvement remains.

Environmental Finance’s “Green Bond Funds – Impact Reporting Practices 2020” report realized observes that almost 3 out of 4 green bond funds already issue impact reports, a similar proportion as the one (76%) identified by Novethic on it’s global panel of European Green Funds. Best practices recorded by Environmental Finance are those from Amundi, Mirova, BNP Paribas and Lombard Odier. However, only two thirds of funds report impact metrics in line with the Harmonized Framework for Impact Reporting – the guidance on impact reporting written by the International Capital Markets Association (ICMA). In fact, even impact reports in line with ICMA’s recommendations are really diverse in the format: information reported could be completely different depending on size, level of details, frequency, etc. This finding is notably due to the challenge in collecting impact data from reports produced by issuers. Note that some investors share with issuers their “Excel File KPI templates” in order to have greater consistency and comparability in terms of impact data reported.

Regarding the Key Performance Indicators (KPIs) reported, GHG emissions reduced/avoided seem to be most widely used (81%). Amongst environmental KPIs that found consensus appear:

- Carbon footprint/intensity

- Clean energy generated

- Power saved through efficiency measures

- Water treated/cleaned.

From the social side, job creation is the most widespread KPI. A positive point is the strong correlation between the impact metrics which investors are most interested in and the metrics against which green bond funds report, as shown by the investors survey conducted by Environmental Finance.

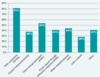

Graph 2. What environmental metrics does your impact report cover?

Source: Green Bond Funds – Impact Reporting Practices 2020, Environmental Finance

Key areas for improvement in impact reporting therefore reside in transparency, data collection and standardization of the reports. ICMA’s guidelines and EU SFDR regulation are expected to drive enhancement. This should help attract more capital towards green bonds and green bond funds, as more than two-thirds of surveyed investors regard impact reports as ‘crucial’.

Expectations on reporting should be high for fixed income investors in green bond funds, and the progress made in 2020 and early 2021 should drive the market towards a more comprehensive approach going forward. Challenges remain however hudge:

- as green bonds issuers do not use standard reporting frameworks, agregation at fund level is still a difficult task

- past performance doesn not provide forward looking impact assessment metrics, which may be of interest to investors when choosing their funds

- Impact metrics often vary between sectors, some offering double counting effects of questioning the choice between absolute or relative KPIs to be seen in the perspective of a sustainability trajectory.

All these challenges are food for thought for issuers and their third-parties, be it underwritting /structuring banks or second party opinion providers (SPOs), and responses will be more and more urged by investors as they progressively sophisticate their sustainable investment strategies.