France’s €100bn Recovery Plan: the government strikes a balance between socio-economic emergency and ecological transition

Introduction

After the agreement on a post-pandemic Recovery Plan at European Council level, the French government announced a €100 billion stimulus plan on September 3, 2020. Designed to be rolled out from now on up until end of 2022, the French package is based upon three pillars:

- Ecological transition

- Economic reviving and competitiveness

- Social and territorial cohesion

France’s Economic situation forecast slightly improved

The sanitary crisis acted as a stress-test for the French economy. It challenged the resilience of health systems and creates a tough environment for youth and unemployed workforce. While this plan’s purpose is to support the economy after an unprecedented recession, that is estimated to amount to a loss of -8,7% of GDP in 2020, it also responds to societal needs and transformations (see our April editorial: Covid-19 economic crisis: heated debate about public support’s conditionality). Emphasis has been given to the ecological transition which is also seen as a driver for job creation and activity.

The Banque de France adjusted its growth projections with a more favorable outlook on the recovery. As of June 2020, the Banque de France anticipated an economic decline of 10.3% while the projection stands at -8.7% as of September. By the end of 2022, activity levels of 2019 should be restored. In this context, the French recovery plan is deemed to contribute to the extent of 1.5 points (time frame is not mentioned) to the projected GDP growth rate[1]. By comparison, the $2,740 bn US recovery plan (which represents 12.8% of year 2019 GDP) is deemed to amortize a loss of 4.5 point of GDP decline via direct and indirect support to households and enterprises.

Prime Minister Jean Castex hopes the plan will create 160 000 jobs. However, more than 800 000 could be lost in 2020 according to the Banque de France. On the other hand, Minister of the Ecological transition Barbara Pompili claims the €30 billion that will be distributed into ecological projects are creating value and jobs along the value chains of construction, transport and recycling for instance; but the amount of green jobs expected is not yet known.

It is still hard to evaluate the economic impact of this stimulus plan alone, notwithstanding it is massive (it represents around 4% of France’s GDP in 2019, similar to Germany’s €130 bn recovery plan representing a bit less than 4% of its GDP) and will be a considerable strike-force. The extent of which the push for buildings’ energy-retrofitting or transport infrastructure projects will create jobs is also unknown, but one could sense coherence in the plan as measures aimed at youth training and education (€6.7 billion are intended) favor programs linked with the ecological transition, though a €25 million envelope might not enough.

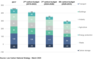

Sources of financing

Within the €100 billion announced, €40 billion are expected to come from the European Union in the form of grants or loans. The European Commission should issue bonds on the markets to finance the €750 bn NextGenerationEu Instrument. At least €225 bn of those bonds will be green bonds as announced by Ursula von der Leyen in her speech about the State of the Union on September, 17 when she also declared EU climate goal is now to reduce GHG reductions by 55% and not 40% in 2030 compared to a 1990 reference point[2]. For France, the baseline is 520 MtCO2 eq. in 1990.

Of the remaining €60 billion to finance the stimulus package, Caisse des Dépôts et Consignations will provide €26 billion of equity[3] (regulated savings increased by €85,6 billion since March in September 2020[4]), 80% of which will be invested in 2021 and 2022[5] and included in this 2-year Recovery plan.The French government will thus likely finance the remaining €40 billion of the recovery plan through debt (though €20 billion chunk of the recovery plan consists in production taxation reductions) that the relaxation of the EU budgetary convergence criteria and the low interest rate environment allows.”

In addition, Bpifrance and the Banque des Territoires have announced a climate plan of €40 billion that will be invested between 2020 and 2024, i.e. over a longer period than the plan's timeframe (2021-2022). As such, €26 billion of equity from the Caisse des Dépôts will be distributed to Bpifrance and Banque des Territoires branches who got their lion’s share of the French government effort on ecology (€20 billion should be invested in 2021 and 2022). The remaining of this €40 billion package will further be invested in the form of grants, equity and loans in 2023 and 2024[6].

Figure 1. The recovery plan’s architecture

Environmental benefits of the French recovery plan

According to the French High Council for Climate’s 2020 report[7], to meet its decarbonization targets as part of its Low Carbon National Strategy France has to focus on energy retrofitting and low-carbon heat, transport, agriculture and forests, as well as energy and carbon-intensive industries. As a reminder, a -1,5% yearly reduction in global greenhouse gas emissions is needed to respect the 2019-2023 carbon budget and average 422MtC02 eq. per year.

Figure 2. Sectorial allocation of French recovery plan's ecology pillar (in €bn)

One can highlight the consistency between the sectorial allocation of the Recovery plan and where France must abate most CO2 to meet its future carbon budgets.

Figure 3. Yearly average carbon budgets (in MtCO2 eq.) by sector and 2017 emissions

€6.7 billion will be allocated to the energy renovation of buildings, including €4 billion for public buildings. 20% of the investments will be directed towards green technologies and energies such as hydrogen.

The transportation sector, which accounts for 40% of France's emissions[8], will receive 33% of the €30 billion earmarked to ecology, i.e. nearly €8.7 billion. €4.7 billion will abound SNCF Réseau (railway network manager) to regenerate, modernize and secure (mainly level crossings) the railway infrastructure, develop night trains, rehabilitate low-density lines with regions to maintain public services, and sustain investment in “capillary” lines (necessary to access factories and production sites) to promote rail freight. €1.2 billion will be allocated to regions, departments and municipalities to both develop cycling routes and infrastructure, as well as develop new collective transport solutions like high-service buses. Another €550 million will finance other infrastructure projects like intermodal nodes, the Lyon-Turin railway project and Voies Navigables de France (French waterways) on behalf of its river infrastructure rehabilitating and developing activities.

Substantial resources will be allocated to projects related to biodiversity and agricultural transition (6%), circular economy and the fight against artificialization (5%), climate adaptation and resilience (1%) and other tools that will in turn finance projects related to the ecological transition of businesses to the tune of €2.5 billion.

Finally, some projects of the recovery plan that have been earmarked to the overarching “ecological transition” category can raise skepticism. The most controversial is probably the support for livestock farming and animal industries to the tune of €250 million. Then comes the support plans for aeronautics and the automotive industry (where few conditions on the sustainability of vehicles are mentioned) to the tune of €2.6 billion. By contrast, although criticized in the media, one can argue that the support to sub-sectors of the nuclear industry that are in tension is relevant. It concerns for instance boilermaking and welding as well as research and experimentation of small modular reactors (which should produce less waste and be less risky) to the tune of €470 million.

Not yet climate change mainstreaming into economic measures

One of the flagship measures of the recovery plan is the reduction of production taxes, which will represent 10 billion euros of reduction per year, i.e. 20 billion euros in total. According the Economic analysis council (CEA), the competitiveness of French companies is negatively impacted by the level of production taxation[9] while the 2013-2016 €18 billion overall tax credit for competitiveness and employment had a limited impact on job creation with an estimated net increase of 100 000 jobs[10]. As mentioned before, no condition is put on environmental performance but nor is it the case for social protection. Industry will benefit the most from these measures as well as 42% of intermediate size companies, 32% of SMEs and 26% of big corporates. One could be surprised environmental or social considerations do not condition access to these tax cuts as they could have created fiscal incentives towards carbon sobriety.

€3 billion will be allocated to reinforce SMEs’ equity in order to help them get over the crisis whereas the “Plan for investments for the future” will allocate €11 billion euros to digital transformation of public service and SMEs; support for R&D projects of technological start-ups (€2bn are anticipated); strategies related to economic independence and resilience (AI, cloud and cybersecurity, digital health, spatial, cultural and creative activities) through investment in both grants, loans and equity.

With digitalization and ecological transition, sovereignty is one of the three directions the French government wants to give to the economy through this stimulus package. That concept does not receive the precision needed, but it seems reference is made mainly to technology. Finally, sovereignty endorses a wider role and could be seen from the climate standpoint. For example, the national strategy on vegetal proteins (which will however only receive €100 million) is interesting in that sense because the strategy is seen as a vector to reduce dependence towards imported vegetal proteins like soy while carrying potential environmental benefits like resource use reduction and meat substitution. We would have expected an assessment of the consequences of economic sovereignty measures, strengthening and reshoring of some industries, on France’s total GHG emissions (factoring territorial but also imported emissions).

Finally, on the social and territorial cohesion side of the plan, €15.3 billion will be allocated to a panel of measures to protect jobs and maintain employment as well as favor employment of students, apprentices and the professional formation of youth. Sectors that will or already do face recruitment concerns should be targeted to address structural discrepancies in the labour market. The future need for jobs and skills in the ecological transition is an example of one such a stake put on training. €6 billion of public investment are to be invested in the coming five years to transform, equip and refurbish socio-medical institutions; build priority hospitals and enhance modernization and interoperability of digital health tools. The Banque des Territoires plans to build social housing with €3 billion of resources while additional €1.1 billion are to promote digital inclusion, development of sustainable tourism, and rehabilitation of road networks and bridges on metropolitan and offshore territory. At last, a €5.2 billion chunk will sustain local authorities’ revenues and investment needs.

Final thoughts

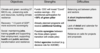

France failed to meet its 2015-2018 carbon budget and reduction goals and year 2019 (-0,9% reduction in GHG) was not successful to meet the necessary -1,5% yearly reduction for the 2019-2023 period. The recovery plan is said to allow the avoidance of 57 MtCO2 eq. on an unknown timeframe.

To our opinion, the Recovery plan will be impactful because:

- It puts efforts on the most emitting sectors and targets actions that contribute the most to GHG emissions reduction.

- It has a social perspective seemingly integrated or thought about in most measures related to ecology and competitiveness.

- Focus is put on strategic sectors and activities in a long-term perspective alongside industrial network preservation

Unfortunately, the urgent need for additional precision in the Recovery plan could impede its successful implementation. One expects sophistication and details to come over time.

Overall, the French recovery plan respects the do-no-harm principle even though precisions about the implementation of the plan are yet to come. For instance, while a fifth of the plan will serve to ease companies of all sizes from production taxation, one would wonder whether it has been considered to introduce some form of conditionality about this support. But for the governement, the priority is to strike a balance between social, economic emergency and ecological aspects. There is a need to inject funds rapidly in the economy and sourcing projects might be challenging. The more eligibility criteria are set, the smaller the scale of potential spending might be.

Table 3. Synthesis of the French recovery plan’s dimensions

To go further

- Detailed measures of the French recovery plan: https://www.gouvernement.fr/sites/default/files/cfiles/mesures_france_relance.pdf

- French recovery plan Press kit: https://www.gouvernement.fr/sites/default/files/document/document/2020/09/dossier_de_presse_france_relance_-_03.09.2020.pdf

- Caisse des Dépôts et Consignations €40 billion Climate Plan – Press release : https://www.caissedesdepots.fr/sites/default/files/2020-09/2020%2009%2009%20-%20CP%20Bpifrance%20et%20la%20Banque%20des%20Territoires%20-%20Plan%20Climat%2040%20Md%E2%82%AC%20.pdf

- State of the Union 2020 - President von der Leyen's speech: https://ec.europa.eu/info/sites/info/files/soteu_2020_en.pdf

[1]See the press report “France Relance”. Available here.

[2] For France, the baseline is 520 MtCO2eq in 1990. In 2019, France’s emissions were equal to 441 MtCO2 eq.(-15.2% compared to 1990). Source: Low Carbon National Strategy report, March 2020

[3] See Caisse des Dépôts’s press release. Available here.

[4] Banque de France, “Impact of the Covid-19 crisis on household and enterprises financial situation, September 2020. Available here

[5] See dedicated website: https://www.gouvernement.fr/france-relance

[6] Press report from Banque des Territoires and Banque Publique d'Investissement. Available here.