BP intensifies its transition efforts amid asset value and oil demand forecast revisions

In the oil sector, UK major BP stood out this summer by unveiling its scenarios for the evolution of oil demand. In its release, BP warned of a peak in oil demand within the next few years, signaling that the coronavirus pandemic is ushering in an earlier than anticipated decline for the fossil fuel era, which may come as early as 2025 or so [1]. The new report marks a dramatic change from last year when BP’s base case expected consumption to grow over the next decade reaching a peak in the 2030s.

Interestingly, this report comes after the UK Oil major made a series of key financial and strategic announcements last month and even earlier this year. The presentation of the Q2-20 results gave BP management an opportunity to unveil, in light of the current crisis, a downward revision of the value of its assets on the balance sheet with write-offs totaling nearly $11bn, but also an intensification of its energy transition strategy in order to achieve the carbon neutrality objective announced at the start of the year.

These striking announcements have to be put in the threefold perspective of oil prices experiencing a sharp pandemic-driven decline in Q2-20, mounting climate change awareness among various stakeholders (governments, NGOs, private commercial and industrial undertakings, etc.) and major energy companies stepping up efforts to better align with the carbon emissions trajectory underpinning the achievement of the Paris Agreement on climate change (i.e. achievement of net zero carbon emissions by 2050).

The near coincidence of these three series of announcements raises the question of asset stranding risk in the oil sector and, more broadly, the role / potential contribution of oil majors in achieving the energy transition by 2050.

As a preliminary point, it is important to define two concepts often wrongly assimilated and which will serve as a common thread for the analysis of recent announcements in the oil sector in terms of asset values and actions in the climate field.

- Asset write-offs that correspond to the accounting recognition of the loss of an asset’s economic value. As a reminder an asset is written down when the company expects that the asset will no longer be able to earn an economic return before the end of its economic life, i.e. the future cost of operating the asset will be greater than the return it will generate. In the oil sector, this loss of value results from an adjustment of the value of production fields according to the evolution of the price scenario underlying this estimate. In other words, the value of a field, i.e. the potential for extracting the hydrocarbon reserves located there, depends on a price scenario. Some reserves are recoverable at a price of $ 80 / barrel, others at $ 100 / barrel. If the valuation of all the fields was made on an assumption of oil prices at $ 60 / barrel and these fall to $ 40 / barrel, part of the resources is quite simply no longer exploitable. Write-offs therefore materialize the loss of value associated with the impossibility of exploiting certain reserves in a less favorable price environment

- The notion of stranded cost is broader. It describes a situation in which an asset permanently loses its use value as a result of regulatory, technological or economic developments. The regulatory developments in relation to the German nuclear sector in 2011 well illustrate this notion. In response to the Fukushima accident, the German Federal government unilaterally decided to shut down 8 of the country's 17 nuclear reactors. The economic value of these reactors (which were until then set to continue operating for a couple of years) was therefore reduced to 0, which led the electricity producers concerned (E.ON, EnBW, RWE at Vattenfall) to record assets write-offs on their balance sheet. In other words, the materialization of an asset stranding risk induces the recognition of asset write-offs, but asset write-offs do not necessarily result from a case of asset actually stranding, it is even rarely the case.[AO1] [AO2]

Following the economic crisis triggered by the sanitary crisis and lockdown measures, the oil sector has faced a sharp decline in demand. In July 2020, the oil demand was down by 15.8 million b/d from year-ago levels representing a decrease of almost 15% yoy according to the EIA[2]. It led several major oil companies such as Shell, Total, BP and Repsol to impair the value of their hydrocarbons production assets that are considered no longer profitable in the long term given the current price environment. These assets write-offs decisions are part of a broader and structural trend that we analyzed in an hoc research piece (see Newsletter’s June issue: European O&G Groups: actively trending towards electric utilities’ business models?)

BP's announcement on June 15th, 2020 caught attention. Details were expected following the bold but unsubstantiated release of its ambition to get to net zero emissions by 2050 (see our article).

The company has announced that it was revising its long-term price forecasts. BP's revised long-term price assumptions now stand at an average of around $55/bbl for Brent and $2.90 per mmBtu for Henry Hub natural gas ($2020 real), from 2021-2050. This is a far cry from the barrel price forecasts of recent years. BP also announced a write-down of these operating assets for the second half of the year: non-cash impairment charges and write-offs in the estimated to be in an aggregate range of $13 billion to $17.5 billion post-tax.

In the same context, the British oil company has also revised its carbon prices for the period to 2050 and these now include a price of $100/tCO2 in 2030 ($2020 real).

The press release issued on August 4th 2020 confirms BP's forecast that it has devalued $10.9 billion, including $9.2 billion in post-tax non-cash assets across the group largely arising from the revisions to its long-term price assumptions and $1.7 billion of post-tax non-cash exploration write-offs treated as non-operating items. Assets subject to these write-offs are located in Azerbaijan, Canada, Egypt, India, Mauritania & Senegal, the North Sea, and Trinidad. As a result, the company reported a net loss of $16bn for the second half of 2020 compared to a profit of $1.8 billion for the same period last year.

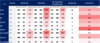

Table 1 - Forecast of the price assumptions made by BP from 2020 to 2025

The prices revised downwards are therefore on average approximately 27% to 31% lower for the period from 2020 to 2050 than the prices referenced in the BP Annual Report and Form 20-F 2019.

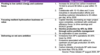

BP is not the first major oil company to announce huge amounts of asset write-offs. Over the last 18 months, European International Oil Companies (IOCs) have impaired a cumulated amount of $84bn ie c.11.7% of the book value of their end-2018 fixed assets. North American peers’ cumulated impairments stand at $18bn (mainly Chevron with $16.5bn), i.e.3.7% of their productive assets book value[3].

Table 2 – Writte-off risk under scrutiny

Early stages of greater financial risk

It remains to be seen whether the underlying factors behind these asset write-offs (massive demand destruction phenomenon driving oil and gas prices down) are temporary or are the harbinger of more structural changes in the global energy landscape driving the materialization of an overall asset stranding risk in the oil & gas sector. In this field, it is clear that BP’s revised oil demand forecasts suggest a potentially irreversible deterioration of the operating environment of the oil sector, as evidenced by the expected trends in demand.

Should the sanitary crisis-driven demand destruction phenomenon amplify and induce the landing of hydrocarbon prices at levels much lower than those seen today, oil companies may have to divest some of their assets by selling them. These divestitures carry a risk for the financial market. If the oil companies do not manage to sell these assets, which have a significant cost in permanently withdrawing the millions of producing, idle and orphaned shale wells, oil companies could end up with stranded assets impacting their balance sheet and therefore those of the banks and asset managers linked to them. , This point is worth stressing given these companies’ continue to enjoy a substantial share in their reference stock market indices.

Table 3 - Share of oil companies in their benchmark stock market index

It nonetheless remains to be seen how IOCs can mitigate this overall asset stranding risk and associated equity value destruction by entering into alternative strategies aiming to align their asset portfolio with a 2 °Celsius scenario. .

Ultimately, a phenomenon of massive and sustained equity value destruction in the sector could raise an overall financial stability issue. Scenario analysis and climate stress testing encouraged or imposed by supervisor’s aim, among other things, to reflect the reality of prices and avoid sudden adjustments in the value of certain assets.

In France, The Prudential Control and Resolution Authority (ACPR) estimated in 2019 that sectors sensitive to transition risks represent 12% (~€613bn) of banking assets and almost 10% (~€249bn) of insurance organizations[4]. In addition, we can also predict a domino effect on the economy as a whole,if these assets were to be abruptly depreciated. Using a forward-looking and dynamic approach, the results of stress testing and scenario analysis are inputs that feed into strategic planning to enhance flexibility and risk-bearing capacity of an organization over time.

In a context of mounting climate risk regulations (including carbon taxes, binding emissions standards or climate stress testing of financial institutions exposure to climate transition risks), methodologies to assess oil & gas companies’ preparedness and resilience to a carbon-constraint economy are extremely helpful (see our article this month on SBTi and ACT methodology here).

From an IOC to IEC: BP’s energy transition plan

In the meantime, oil companies are gradually stepping up efforts in the field of energy transition, implicitly drawing on various sectorial and regulatory trends, namely a potentially sustained low oil price environment, mounting pressure on carbon emissions in Europe and emerging disruptive technologies in the mobility sector such as electric vehicles. Against such backdrop, BP unveiled last 4 August a bold strategic plan, whose main pillar is to transition from an “international oil company towards an integrated energy company”. BP’s goal is to achieve the net zero ambition in 2050.

Table 4 - Main Measure of BP, press release 4th august

As part of this news strategy, BP plans to commission around 50 GW of renewable (wind and solar) capacity by 2030 - a 20-fold increase from 2019. The company also plans to rise its bioenergy production by 100,000 barrels per day from 22,000 currently, and its hydrogen business to have grown to a 10% share of its activity.

More recently, on 10 September, BP announced a partnership to develop offshore wind projects in the US with Norvegian peer Equinor. This includes the development of existing offshore wind leases on the US East coast and jointly pursuing further opportunities for offshore wind in the US. BP will purchase a 50% interest in both the Empire Wind and Beacon Wind assets from Equinor and bp will pay Equinor $1.1bn for interests in the existing US offshore developments[5].

BP’s ambition could be also achieved through external growth. There are ongoing rumors about the British oil major mulling the acquisition of such power generation companies as RWE, SSE or Orsted and deploying ambitious decarbonization strategies of their mix if and when needed.

Table 5 - BP & major IOCs GSH emissions targets

[1]. The company, in its annual energy outlook published on Monday 14 September, modelled three scenarios for the world’s transition to cleaner fuels that all see oil demand falling over the next 30 years. In the “business as usual” case, which assumes government policies, technologies and societal preferences evolve in a manner and speed as in the recent past, oil demand rebounds from the Covid-19 hit then plateaus in the early 2020s. In two other scenarios that model more aggressive policies to tackle climate change, oil demand never fully recovers, implying 2019 levels of 100m barrels a day will be the peak for consumption

[2] Short term energy outlook, September 9, 2020, U.S Energy Information Administration)

[3] Natixis analysis, source: companies report, ENR Solutions

[4] Le Changement climatique : quels risques pour les banques et les assurances ? Septembre 2019, ACPR