Towards ESG disclosure standardization in leveraged finance transactions

3-minute read

The European Leveraged Finance Association (ELFA), the Loan Market Association (LMA), together with the Principles for Responsible Investment (PRI), have released a joint guidance summarizing why and how sub-investment grade borrowers should disclose ESG data in leveraged finance transactions.

The joint guidance summary is accompanied by a general ESG Fact Sheet as well as three dedicated ESG Fact Sheets focusing on the following three sectors: Telecoms, Paper & Packaging, and Debt Collection. The ELFA intends to publish additional ESG Fact Sheets, covering the chemicals, healthcare, industry, retail/consumer, software/technology, and towers/infrastructure sectors over the coming months. The ESG Fact Sheets are designed to help borrowers prepare ESG disclosures and facilitate engagement on critical ESG topics between investors and the companies to which they lend.

This guide for “Company Advisers on ESG Disclosure in Leveraged Finance Transactions” (the “Guide”) is designed to serve as a practical tool for company advisers when incorporating the ESG Fact Sheets into company offering materials and ongoing financial reports.

ESG investing has become increasingly important to credit risk and portfolio management professionals. Further, the ELFA/LMA recognize ESG factors are gaining impetus, rendering them a critical element of credit analysis in European leveraged finance.

An ELFA/PRI survey conducted in November 2019, through which 100 investors submitted their views on ESG investing, indicates that “almost 90% reported fielding questions from their end-investors on ESG “usually” or “at almost every meeting””. Unfortunately, while many investors agree that ESG disclosure should be in standard company offering materials, existing frameworks might be too comprehensive and aspirational for smaller-sized leveraged finance borrowers. Therefore, ESG metrics and reporting for sub-investment grade borrowers may differ largely depending on the issuer’s sector, size, or sensitivity to ESG topics.

ELFA’s ESG Disclosure Initiative was launched in June 2019 with the goal of increasing ESG disclosure by borrowers and reduce investor reliance on individual ESG questionnaires.

The Guide finds that the following benefits could be derived from the integration of ESG data into company offering materials and periodic reports: Investor’s confidence; timely information; mechanism for updates; market consensus; consistency amongst borrowers; avoiding selective disclosure.

Financial regulatory and enforcement momentum, focusing on ESG issues is building up from recent activities by financial regulators, notably in Europe. The Guide outlines the current regulatory landscape (Taskforce on Climate-related Financial Disclosures (TCFD); European Non-Financial Reporting Directive (Directive 2014/95/EU); The EU Taxonomy Regulation (Regulation (EU) 2020/852) ; Principles for Responsible Investment (PRI); ESG Investor Associations, Standards and Codes) and highlights the potential impact of these regulations on sub-investment grade borrowers.

Until recently, the lack of available, reliable, and comparable data for sub-investment grade corporates has delayed the integration of ESG factors in the high-yield (HY) bond asset class. However, ESG incorporation is accelerating in the HY market, encompassing different approaches, depending on each investors' ambition.

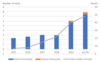

According to S&P Global, from the beginning of 2019 to June 2020, ESG-related assets under management in sustainable HY corporate and municipal mutual funds skyrocketed from $1.7 billion to $46.3 billion, with the number of ESG-based HY funds mushrooming from $7 to $43 billion. S&P noted, however, that this dramatic growth (by 26 times, versus 6.6 times for overall sustainable funds) largely resulted from the rebranding of existing funds in conjunction with amending fund prospects to reflect the adoption of sustainable investing strategies.

According to Morningstar, there are currently 48 distinct ESG HY bond strategies, representing ca. $8 billion of assets, and their average track record is less than 3.5 years, at end-June 2020. Morningstar defines this universe as open-end funds and ETFs that use ESG criteria as a key part of their security selection and/or portfolio construction. Its sustainable funds group does not contain the growing number of funds that now formally integrate ESG factors in a nondeterminative way into their investment processes.

Table 1. ESG High-Yield bond funds (assets are in $ billion)

Source: Morningstar Direct, Morningstar Research. Data as of June 2020

As shown in the graph above, the trend is clear, and the increased sensitivity from HY bond investors with respect to ESG, supports a greater need of disclosure on sustainability-related topics from companies in this market segment. In this manner, the guide could help in that way because it provides a whole roadmap in order to incorporate ESG criteria, including business strategy, risk factors, management, shareholders, related party transactions and financial statement.

From a purely qualitative ESG data standpoint, the Guide for cooKAYmpany advisers underlines that the materiality of ESG factors varies a lot depending on the sector. However, it highlights that “the adoption by companies of widely recognized, comparable and easily understood ESG KPIs, will allow investors to readily assess the genuine impact of ESG factors on a business”. As an example, the European Commission Guidelines on reporting climate-related information set out six key principles for effective ESG reporting:

- Material

- Fair, balanced and understandable

- Comprehensive but concise

- Strategic and forward-looking

- Stakeholder orientated

- Consistent and coherent.

Fact sheets are complementary to the Guide, as they offer specific questions and points of attention for each ESG pillar.

Sub-investment grade borrowers should pay attention to the Guide and ESG Fact Sheets, as all Leverage Finance market participants – investors, credit rating agencies, private equity sponsors, bankers and lawyers – will now have documentation to which they can refer. This Guide is welcome for sub-investment grade borrowers, as it creates factual documentation with key questions to answer in order to retain and/or attract ESG-driven investors. It could also serve investors to define the extent to which they need to adapt their ESG policies to HY bonds issuers.

TO GO FURTHER

- European Leverage Finance Association, ESG Fact Sheets (January 2021) - available here

- S&P Global, "ESG Investing is Becoming Critical for Credit Risk and Portfolio Management Professionals" (March 2020) - available here.

- S&P Global, "This is How High-Yield Managers Are Addressing ESG" (September 2020) - available here.