Success of AFD Group’s €2bn inaugural issuance under its new SDG Bond Framework

Natixis acted as Sole Sustainability Structurer and Joint Bookrunner for AFD’s inaugural Sustainable Development Goals Bond (€ benchmark 7-year SDG Bond), under its new SDG Bond Framework.

Highlights of the transaction

This inaugural €2 billion 7-year transaction (maturing on the 28th of October 2027), offered a spread of 27 basis points over the interpolated French curve (OAT 1.00% 25/05/2027 & OAT 0.75% 25/05/2028).

The transaction was favorably received by international investors. At the closing, the orderbook totaled more than € 5.6 billion in demand from high-quality investors.

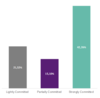

A significant portion of the transaction (~79%) was allocated to investors with sustainable investment strategies (i.e. incorporating ESG criteria in their FI investments) according to Natixis’ proprietary methodology based on our market intelligence.

- 43% of the transaction was allocated to “strongly committed” funds (i.e. dedicated green and/or sustainable bond funds and/or mandates)

- 15% of the transaction was allocated to “partially committed” funds (i.e. that incorporate ESG criteria in their investment decisions)

- 21% of the transaction was allocated to “lightly committed” funds (i.e. PRI signatories, but not truly active players in the broader RI market)

These allocations confirm the quality and attractiveness of AFD’s new SDG issuance framework for SRI accounts.

Philosophy of the SDG Bond framework

This SDG Bond Framework thereby replaces the Climate Bond framework releaased by AFD Group in 2017, in order to broaden the universe of eligible loans to social expenditures, and in particular to health and education. In addition, the new framework helps the financing policy of AFD to better align with its Group strategy to further enhance the Group’s active contribution towards the Sustainable Development Goals.

The major innovation of this Framework relates to the eligibility criteria and the selection process of the loans that include:

- Dynamic for progress and transformation by integrating loans conditioned on reaching sustainable development results. Disbursements of the loans can be linked to indicators negotiated between AFD and the counterparty. This result-based approach is truly innovative and is paired with safeguards to ensure concerned indicators the access for improvement to essential services for targeted populations.

- Impact measurement through various ex ante indicators and the development of ex post evaluations.

- Attention to interlinkages both positive or negative between SDGs: only projects with neutral or positive impacts will be selected.

Vigeo Eiris has been mandated to provide a Second Independent Opinion[1]. The SPO provider has considered this issuance framework to be compliant with ICMA's Green Bond Principles and Social Bond Principles but has also recognized that it corresponds to market “best practices”.

An innovative eligibility

This framework goes into further depth than the SDG “branding”. AFD has adopted an approach that selects loans according to their contribution to the SDGs.

Under this SDG Framework, a loan is eligible if it satisfies all the following three conditions:

- Contribution to the SDGs: the purpose of the financing is identified as i) contributing to at least one SDG other than SDGs 1 on poverty and 17 on partnerships (i.e., loan attached to a “group of SDGs”), ii) responding to one of the six transitions in the AFD Group’s strategic plan, and, finally, iii) addressing one of the eligible categories of ICMA’s SBP/GBP/SBG.

- Theme-based & technical eligibility: the loan meets at least one of the three technical eligibility criteria

A. Theme-based eligibility: depending on the intrinsic nature or purpose of the activities/projects

E.g.: Access to potable water; Access to healthcare infrastructure; School equipment; Waste collection and processing; Support entrepreneurs with digital innovation; Legal infrastructure

B. Climate performance eligibility: depending on the minimal climate performance level of mitigation projects

E.g.: Reduction or avoidance of at least 10 000 tons of CO2eq per year thanks to the project

C. Transformation eligibility: conditioned on reaching sustainable development results

E.g.: Transformational loans with results-based approach; Milestones must be reached before disbursements are made (financing on the theme of justice that includes an achievement indicator on the feminization rate in the recruitment of magistrates or on shortening of court delays).

- Interlinkages between SDGs are taken into account : the loan must i) comply with the AFD Group’s general exclusions and specific diligence requirements that are specific to the relevant activity sector, ii) for AFD projects only have neutral or positive grades in all of the six dimensions in the sustainable development analysis and opinion, or with respect to Proparco projects be graded DEV1 or DEV2.

The Group AFD will be sharing its experience on SDG contribution and finance during the “Finance in Common” Summit that it will organize in November (to be held virtually from 9 to 12 November). It will be the first global summit of public development banks. After the structuring of Mexico’s SDG Bond Framework, Natixis Green & Sustainable Hub confirms with AFD its expertise in this area of SDG Finance.