Mexico’s € 750m 7-year inaugural SDG Bond met strong investors’ appetite

On September 14, Natixis acted as Sole Sustainability Structurer and Joint Bookrunner for Mexico’s inaugural and historic Sustainable Development Goals Bond: € 750m 7-year SDG BOND at MS + 195 bps. The Bond in itself has several milestones worth attention. Not only was it the first ever SDG Bond by a sovereign, it is the first time the United Nations, through the United Nations Development Program (UNDP), was formally involved and provided an Alignment Letter on Mexico’s efforts to advance Mexico’s commitment towards the SDGs and the alignment of its framework with the principles and objectives of the Sustainable Development Goals.

Highlights of the transaction

The Federal Government of Mexico released on February 21 its “SDG Sovereign Bond Framework” and mandated BNP Paribas, Credit Agricole CIB and Natixis (who acted as Sole SDG Sovereign Structuring Advisor) to arrange an series of investor meetings in Europe and global calls Following a very successful roadshow Mexico was aiming to execute its inaugural SDG Bond, but due to market volatility surrounding the coronavirus outbreak, Mexico chose to postpone the transaction until September.

The transaction was announced at the UK open and IPTs were set at MS+235 bps area and the book steadily built throughout European morning hours. The deal was then re-announced into the U.S. open with the book exceeding €4bn in orders by 10AM NY time, and peaking at €4.8bn.

By 7:30am NY time, price guidance was announced at MS+215 bps area (+/- 2bps), and by 9:30 am the spread was set at MS+195 bps with the European books subject and U.S. books subject by 10:00 am. Soon after, the transaction launched $750mm at MS+195 bps, representing arguably a negative new issue concession.

The compression achieved allowed Mexico to print its second lowest coupon, and one of its largest order books, in the Euro market.

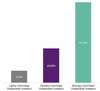

A significant portion of the transaction (~EUR 549mm out of EUR 750mm, thus ~73%) was allocated to what we can consider as “sustainable investors” (i.e. incorporating ESG criteria in their FI investments)

-

- 46% of the transaction (~EUR 349mm) was allocated to “strongly committed” funds (i.e. dedicated green and/or sustainable bond funds and/or mandates)

- 20% of the transaction (~EUR 149mm) was allocated to “partially committed” funds (i.e. that incorporate ESG criteria in their investment decisions)

- 7% of the transaction (~EUR 52mm) was allocated to “lightly committed” funds (i.e. PRI signatories, but not truly active players in the broader RI market)

Figure 1. Sustainable investors allocation breakdown

Source: Natixis GSH’s Syndication & Distribution’s analysis of the Book

The Proceeds raised through Mexico’s SDG Bonds issuances will finance projects located in 1,345 cities selected because of their illiteracy and low school attendance rates, level of health services deprivation, lack of toilets, drainage or piped water in houses, absence of electricity access or basic equipment such as fridges. Such “SDG localized Finance” guarantees that only budgetary programs targeting the most disadvantaged areas and vulnerable populations are eligible (indigenous, elderly and children).

The SDG Sovereign Bond Framework

The Mexican Government wished to establish a broad Framework that would leverage their substantial work over the past few years implementing and working towards achieving the 2030 Agenda. This includes their innovative work on mapping the Federal Budget to the United Nations (UN) Sustainable Development Goals (SDGs).

Under this Framework SDGs are used as entry point for eligibility criteria in a Framework and not as an afterthought exercise (ex post mapping). The innovative features of this Framework are:

- A transparent linkage of the entire Federal Budget to the SDGs;

- Application of a geospatial eligibility criteria ensure that only budgetary items targeting municipalities with the highest SDG gaps are selected;

- Open governance – the methodology and mapping are all public and the Government of Mexico invites others to use and learn from their process;

- In addition to the traditional Second Party Opinion (provided by Vigeo Eiris) the framework is also the first in the world to receive an opinion from the United Nations Development Program (UNDP) on the framework’s alignment to the SDGs; and

- This Framework combines program eligibility of green and social projects with geospatial eligibility for social related expenditures. Geospatial or territorial eligibility enable the prioritization of vulnerable populations living in landlocked and disadvantaged areas. It does not apply to Green &/or Environmental expenditures as they are designed to benefit society at large.

The 2030 Agenda is global, but its gaps are spatial and local. Public policies and incidentally Social or Sustainability Bonds Frameworks are often designed on national averages. By contrast, this Framework specifically targets the bottom range of territories and populations in Mexico, particularly those living in the South of the country. The geospatial eligibility is based on very granular open data collected through the Census of Population and Housing and analyzed by the National Council for Evaluation of Social Development. To factor regional disparities, a list of 1,345 municipalities (totaling roughly 22m of inhabitants out of national population of circa 120m) has been defined.

In addition to the unique two-step eligibility criteria, Mexico has made a focused commitment to impact reporting. This will create feedback loops, which will further improve the data available to the Government in addressing SDG gaps. The impact reporting will benefit from data provided by the individual Ministries along with National Institute of Statistics and Geography (INEGI in Spanish), and the National Council for Evaluation of Social Development Policy (CONVAL in Spanish). The UNDP will also act as an official observer on the impact reporting, ensuring the most relevant metrics are monitored.

To go further:

- Mexico’s SDG Sovereign Bond Framework

- UNDP’s opinion on the Framework

- Vigeo Eiris’ Second Party Opinion

- UNDP Press release “Historic $890 million Sustainable Development Goals Bond issued by Mexico”

- Natixis GSH’s Flagship report on Solving the sustainable development goals rubik’s cube