Euro GSSS Bond Market: evolutions, trends and novelties

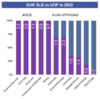

Euro GSSS (Green, Social, Sustainability and Sustainability-linked) issuances, all type of issuers combined, reached EUR 255 bn by the end of September. This represents a 17% decrease vs. 2021 YTD, in line with the European primary market 16% volume decrease. The share of GSSS bonds vs. total supply consequently remained stable, standing at 25% (vs 26% in 2021).

Yet GSSS bond issuance on the first three quarters, when broken down through the different formats (Green, Social, Sustainable, SLB), is very asymmetric, as illustrated in Figure 1. Green bonds issuance witnessed a 19% increase, whereas social bonds observed a 60 % decrease – with sustainability bonds and sustainability-linked bonds supply observing a 26% and 24% decrease respectively vs. 2021 YTD.

What lessons can we draw from such market figures? Does this signal green bonds’ resilience to markets slowdowns? Can we infer some countercyclical/cyclical dynamics per type of format and/or issuer?

What does this year’s market development tell us about the social bonds market’s potential evolution?

2022: Green bonds in full flight despite market slowdown

Green supply is up: supply amounts to EUR 162bn. These have witnessed a 19% increase (+ EUR 27bn) vs. 2021 YTD. More importantly, green bond issuance account for 85% of Financial Institutions Group’s (FIG) total GSSS issuances, 62% of corporates’ and for 55% of SSA’s, whilst one out of 2 inaugural GSSS is green. Green bonds supply equally accounts for 64% of the total GSSS supply, against 45% in 2021 YTD.

Most of this noteworthy supply increase differential, when compared to the previous year, is attributable to the European Union (EU) and the European Investment Bank (EIB)’s recent acceleration in terms of green bond issuance, under the Commission’s NextGenerationEU program and the EIB’s new issuance strategy.

Indeed, after having adopted the NextGenerationEU Green Bond framework, the European Commission issued its first NextGenerationEU Green bond in 2021 Q4, thereby raising EUR 12 bn. In comparison, up to EUR 17.5 bn have been issued in 2022, as of today. This base effect explains the supply differential between 2021 YTD and 2022.

The Commission aims to raise up to 30% of the NextGenerationEU funds through the issuance of green bonds, in order to reach the intended funding target and help Europe recover from the coronavirus pandemic. It aims to issue up to EUR 250 bn in green bonds between 2022 and 2026. [1]

Regarding the EIB, the increase in green supply is due to a change in issuance strategy on green issuances (Climate Awareness Bond), from a sub-Benchmark issuance type (minimum size EUR 500m) to a Euro Area Reference Notes (EARN) Benchmark type (minimum size EUR 3bn). This resulted in an additional EUR 8bn of green supply from EIB, printed on 2 Green EARN Benchmarks (EUR 4 bn 10yr in May and EUR 4bn 7yr in September). This Benchmark strategy is a way to boost green issuances and to converge vs. other European Supras (Next Generation EU) or Sovereign Green issuance mode by providing a comparable liquidity level between Conventional and Green Bonds.

As such, green supply increases is rather driven by an increasing funding needs (EU) and the consequence of a change in benchmarking strategy (EIB) rather than the recent adverse market conditions.

We expect green supply to be close to 2021 volumes (EUR 187bn), with EUR 14bn green to be issued through the NextGenerationEU program.

Social Supply: a marked slowdown

Social bonds supply is down: issuance volumes are down 60% vs. 2021, and accounts for only 17% of the GSSS supply vs. 34% in 2021. The decrease is mainly due to SSA issuers’ much lower funding needs this year compared to 2020-2021, during which the additional “Covid” funding needs from the EU (via Sure), Unedic and Cades amounted to EUR 140bn. The combined funding of these three issuers has decreased to EUR 54bn in 2022. Given the extraordinary magnitude of the pandemic-related measures, it seems unlikely that issuances will soon reach previous 2020 and 2021 volumes. We expect social issuances in Euro to reach EUR 50bn by the end of the year, half of the issuance volumes in 2021, bringing the outstanding over EUR 300bn.

Beyond decreasing issuances figures, there are ongoing transformations or initiatives which are underpining the market on the medium to long term, with more standardized and formalized approaches, including the launch of Social Bonds Funds on the investors side. Moreover, the total issuance numbers might hide dynamics in terms of Use-of-Proceeds categories breakdown (Figure 4 below).

The Covid 19 pandemic acted as a market catalyst or driver, inducing a shift in terms of social bond issuances frequency, by highlighting this format’s potential and relevance with social bonds witnessing an upsurge during the Q4 of 2020 and Q1 of 2021 (Figure 4). Socio-economic advancement and empowerment Use of Proceeds category especially increased over 2021 Q1. Employment generation use of proceeds category fluctuated a lot.

Whilst counter-cyclical social bonds were issued to bridge urgent funding needs related to the pandemic’s effects in the previous years (as seen on Figure 2), less volatile ones could also emerge as the market standardizes and demand on the investor side becomes more structured (see below on Social Bonds Funds).

We anticipate that the social market segment will follow new development patterns, with a continuous Use of Proceeds diversification (non-crisis related health services, retraining schemes in the context of the low-carbon transition… and so forth), some of them being less correlated to the economic and employment cycles. It could thus lead to recurrent and steady social bond issuances for UoP categories and/or issuers which are less countercyclical (i.e., with stable expenditures and funding needs).

What about GSSS bonds’ elasticity to the sanitary and economic context?

We may ponder on GSSS bonds’ elasticity and sensibility to other type of exogenous shocks: How elastic are different type of issuance formats and their volumes to the economic, sanitary and geopolitical situation? Beyond covid-19 related measures (on employment support, worker furlough schemes and health related measures), some green UoP categories volumes are also influenced by the broader context.

Several academic papers explore the link, for instance, between crude oil prices’ volatility and the issuance frequency of corporate green bonds.[2]

On that matter, Dina Azhgaliyeva, research fellow at the Asian Development Bank, demonstrates that crude oil flow demand shocks increase the probability of corporate green bond issuance by 10%.[3] Logically, it is likely that oil price increases may stimulate renewable energy investment, as there exists tendencies to substitute away from crude oil and towards alternative energy. This in turn may lead to the issuance of green bonds, especially in oil-importing economies. And indeed, the world is turning away from its dependency on oil and gas in times of geopolitical turmoil. The International Energy Agency executive director Fatih Birol stated that the crisis had “in fact accelerated the clean energy transition” citing the US inflation act and the REPowerEU plan.

The IEA forecasts global clean energy investment to increase by more than 50% to $2 trillion per year by 2030.[4] It is still far from the $4 trillion per year needed by 2030 to reach net zero emission by 2050 but enough to fuel green bond market growth for the next few years.

September – Further interesting developments on the Social and SLB market

As witnessed in September, new social issuers are joining the GSSS bond market. Some by creating new dedicated Social Bond Frameworks, just like the German Development Bank IBB did. Others by enlarging their Green Bond Frameworks to social themes, such as Swedbank: the Swedish bank updated and extended its 2017 Green Bond Framework to a Sustainable Funding framework with social eligible project categories.

In parallel, new social bond funds are being launched as a result of an increasing demand for investment strategies delivering social benefits. These new funds are classified under SFDR article 9 - defined as funds which “have sustainable investment as (their) objective or a reduction in carbon emissions as (their) objective.” Among the most recent ones:

- the NN Social Bond Fund launched by NN IP in July to promote and achieve social impact;

- the European Leaders Bond Fund, launched In September by Franklin Templeton, to be invested in a portfolio of Social Bonds.

Ostrum Asset Management also announced in September the launch of its first impact fund, around the concept of Just Transition (compliant with Greenfin Label), which has set itself an objective to promote social impact within local economies, in addition to targets relative to carbon footprint reduction, the preservation of ecosystems and local economies.

What’s on the Sustainability-Linked Bond (SLB) segment?

There has been a relative slowdown in terms of volumes: SLB Euro issuance is down by 20% vs. 2021 but represents a stable 30% share of Corporate GSSS issuance (vs. 70% on Use of Proceeds Bonds).

[AO1] As Euro SLBs were exclusively issued by corporates in 2022, the decrease may also be seen as the result of a “risk off” market backdrop, less favorable to corporates and less adapted to the SLB format. By construction, SLB formats are more fit for medium/long tenors, as the targets (SPT) are fixed at medium /long term (generally between 5 and 10yr from issuance date). But current high-rate environment is pushing issuers and investors on shorter maturities: the four SLB issued since September (by Henkel, Enel, Knorr and Carrefour) were on the 5–6-year part of the curve. Thus, Carrefour used on its recent 6yr SLB – as on its inaugural dual 4yr and 7yr SLB in March this year – its KPI #2 (tones of packaging avoided) and KPI #3 (food waste) on which observation dates are in October 2027 and did not use KPI #1 on GHG reduction by 2030, as the observation date is beyond bond maturity.

The format keeps developing, with over half of corporates inaugural GSSS bonds issued under the SLB format. The format is increasingly being use across sectors (cf. table 3&4) and by type of sustainability performance targets (SPTs) being used, as outlined by a report published in September by Fitch.[5]

Main developments seen in September: First SLB from a Mining Company in Euro

The inaugural SLB issued by the UK mining company Anglo American (EUR 745 mln 10yr) is the 2nd SLB from an Investment Grade Issuer on the Mining & Metal segment after Newmont (Baa1/BBB) launched its inaugural USD 1 bn 10yr SLB in Dec 2021, and the first in Euro. The Bond includes 3 KPI, including 2 KPIs around climate action (reduction of GHG Scope 1&2 and freshwater abstraction by 2030) and 1 Social KPI, to support 5 jobs off site for every job on site by 2030.

Third SLB Framework by a Sovereign issuer

On the sovereign side, Uruguay published its Inaugural Sustainability-Linked Bond Framework tied to Environmental Commitments under the Paris Agreement and confirmed on October 20th, 2022, the issuance of a 12-year dollar-denominated sovereign sustainability-linked bond.[6] This is the 3rd Sovereign issuer to publish a SLB Framework after Chile (which already issued USD 2bn 20yr SLB in March) and Ghana (no issuance so far), with the following KPI and SPT:

Source: Natixis GSH based on Uruguay’s SLB Framework.

Two innovations are to be noticed and creating more flexibility for sovereigns to issue SLBs:

- The sustainability performance target is defined as an interval, leaving more leeway for political adjustments and flexibility facing exogenous drivers;

- The coupon mechanism comprises a step up AND a step-down in case under- and over-performance. If at observation, the indicator is in the performance interval, no coupon adjustment applies.

These new features might help streamline the SLB format for further Sovereign issuances, that have historically been reluctant to the format (See our October 2022 article World Bank’s new SLB Platform for Sovereigns).

Yet, the innovation on KPI /SPT are not always done in a convincing manner, as seen on the Inaugural SLB by Knorr Bremse in September: The German company world’s leading braking systems manufacturer issued a Euro 700 mln 5yr SLB, where the Sustainable Performance Target itself is nothing else but the publication by August 2023 of a SBTI GHG Scope 3 target for the year 2030.[7] In other words, the target itself consists in fixing yet another target. Still, an SPO has been given by ISS ESG to confirm the ambitions and materiality of the issuer target.

As SLB segment is gaining attention, credibility and discipline are key issues, and a number of initiatives have occurred recently : after ICMA released a KPI registry to discipline SLB issuances in June (See our August 2022 article ICMA’s newly released KPI registry to discipline SLB issuances), CBI (Climate Bond Initiative) expended its Certification scheme to non-financial corporates and SLB, in order to enable corporates aligned with a 1.5°C pathway – or those that will be by 2030 – to be certified under a specific standard.[8]

What’s next: ECB’s green QE

Lastly, the ECB started, on October 1st, to decarbonize its own Corporate Portfolio (read our October article “ECB to decarbonize its corporate bond purchasing and collateral framework” ). Interestingly, the ECB mentioned in its announcement that it would give a “preferential treatment to Green Bonds in its primary market”.[9] This special treatment may create a distortion, for a same issuer, between its green issuances and its vanilla ones as the ECB states that the “aggregate purchases of each issuer will continue to follow the tilted benchmark”. Therefore, the fact of issuing Green Bonds is not factored when the ECB assesses the risk profile of a bond issuer, but the different format issuances of that same issuer are treated differently. Furthermore, it is worth nothing that the ECB did not make any reference to SLB, one wonder whether such green QE will be neutral or even detrimental to the SLB market development.

[1] European Commission (22 March 2022), “NextGenerationEU: European Commission completes the second successful bond issuance in 2022”.

[2] The literature is not extensive, but some studies include Kang et al.’s (2014), Apergis and Payne (2015), Shah et al (2018), Dutta et al. (2020)

[3] Dina Azhgaliyeva, Zhanna Kapsalyamova, Ranjeeta Mishra (2022), Oil price shocks and green bonds: An empirical evidence, Energy Economics, Volume 112, ISSN 0140-9883.

[4] Han Ghuan (October 2022), “IEA says carbon emissions will peak in 2025 in “historic turning point””, RFI.

[5] Sustainable Fitch, September 2022, “Sustainability-Linked Bond Progress Report”.

[6] Fernandez Medrano, Esteban (October 2022), “Uruguay confirmed innovative Green Bond issuance and debt swap”, Global Source Partners.

[7] ISS Corporate Solutions, (8 September 2022), “Second Party Opinion (SPO”, Sustainability Quality of the Issuer and Sustainability-Linked Bond Framework, Knorr-Bremse)

[8] Fatin, Leena (September 2022), “Standard and Certification Scheme set to expand to Corporate-entities and SLB instruments: Public Consultation Now Open!”, Initiative Climate Bond

[9] ECB, 2022, FAQ on incorporating climate change considerations into corporate bond purchases.