On March 23rd, 2023, the European Central Bank (ECB) released its two first climate-related financial disclosures for both its corporate bonds portfolio and non-monetary policy portfolios. As part of the Eurosystem approach to climate-related risks, such publication marks a milestone in the ECB’s Roadmap on climate change-related actions[1]. Information was especially expected as the ECB started to tilt its monetary policy towards best-climate performers in October 2022 (see our article here).

Disclosures show Eurosystem corporate sector portfolios and ECB non-monetary policy portfolios are on a decarbonisation path, nonetheless, the bank’s climate-related strategy and risk management policy leave room for improvement.

Despite its recent introduction, the ECB displays results of its monetary policy tilting towards corporate best climate performers

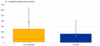

We were eager to get the results, and here they are. The ECB corporate bonds holdings’ decarbonization under the Corporate Sector Purchase Programme (CSPP) and the Pandemic Emergency Purchase Programme (PEPP) seems to be underway[2]. The report shows that the portfolio’s carbon intensity decreased by 30% between 2018 and 2022 (with tons of CO2e per million Euros of revenue falling from 372 to 262 tCO₂e). However, what catches attention is the major step crossed in the fourth quarter of 2022 whereby the weighted average carbon intensity of purchase flows has decreased by 65% compared with the first three quarters of the year (see the graph below).

This constitutes a sign of ECB’s monetary policy tilting’s efficiency. Until the end of 2022, ECB’s corporate portfolio decarbonization could be attributed to issuers’ decarbonation efforts and the improvement in financial metrics (for example, revenues and EVIC as mentioned by the ECB, without more details though). Nonetheless, the introduction of the Eurosytem framework for incorporating climate considerations into corporate sector purchases last October has started the proactive greening of ECB’s corporate bond holdings. The so called ECB “tilting framework” now prioritizing best-climate corporate performers (see our article here) constituted the main driver for the significant reduction in corporate reinvestments’ carbon intensity by the end of year 2022.

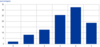

Looking at issuers climate-scores, it is therefore not surprising that half of them scored 4 or more out of 5 (see the graph below). As a reminder, the climate-score is made of three components: (1) the issuer’s backward-looking carbon emission intensity, (2) disclosures and (3) the forward-looking emissions (issuer’s transition plan aligned with the Paris Agreement).

Although one can applaud ECB’s transparency effort, it is a pity that the methodology used for each of the three components to be assigned a score is not detailed. One could expect taxonomy alignment ratios to be including in the scoring process in the future.

It would be appreciated and useful for issuers to have a detailed evaluation matrix to know what is a “5/5”. We also still lack information on each sub-score’s weight into the issuers’ final climate-score. It therefore remains hard to know which one is raising the score towards 5.

However, since the ECB mentions that the verification by a third party is particularly valued (and even necessary for the disclosure’s quality component to get the highest score), we can imagine that the second sub-score is crucial to get a higher score. For instance, it is said that as at year-end 2022, 59% of the corporate sector portfolios’ financial exposure was invested in assets of issuers with certified science-based carbon reduction targets. This therefore shows the ECB’s bias towards more ambitious and transparent issuers, especially knowing that “only 42% of all eligible issuer groups have carbon reduction targets”.

Finally, more granularity on climate-scores’ distribution would have also been welcomed, for instance, a distribution by sector.

ECB’s disclosures however remain encouraging as tilting means an increase in best climate performers share in the future, at the expense of lower scorers. This can be significant when looking at the corporate bonds portfolios’ size that is 385.2 billion euros compared to the ECB non-monetary policy portfolios (23 billion euros). Moreover, the ECB announced the current titling framework will be first revised at the latest in October 2023. This leaves the door open to incorporating other types of assets’ purchase in the tilting program (see our article here). In addition to providing climate-related updates on the portfolios annually, the ECB also intends to expand the scope of its disclosures to cover other monetary policy portfolios over time such as those under the public sector purchase programme (PSPP), the third covered bond purchase programme (CBPP3) and other assets under the PEPP.

In line with this desire of transparency and efficiency, the governing council will consider setting “interim” decarbonization targets for its corporate sector portfolios, as well as for its own funds portfolio and staff pension fund – introduced in the next part of this article. This could have a major impact on keeping the decarbonization pace.

According to the conjuncture and the end of quantitative easing, one can expect absolute emissions of ECB’s portfolios to decrease. Although efforts on portfolios’ carbon intensity look encouraging following the green tilting’s implementation, more could be expected on absolute emissions for the ECB to call itself aligned with the Paris agreement. The intrinsic variability of its portfolio’s size and therefore, absolute emissions, might forbid such statements.

.At the same time, non-monetary-policy portfolios’ decarbonization is progressively driven by the increasing share of green bonds in ECB’s own funds

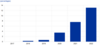

The second report[3] on climate-related financial disclosures of ECB’s non-monetary policy portfolios (NMPPs)[4] explores the ECB staff pension fund and its own fund portfolios. Together they make a total amount of 23 billion euros. In a nutshell, despite these portfolios’ decarbonization is highly dependent on issuers own decarbonization, it is progressively driven by the increase of the share of green bonds. Indeed, it increased from 1% in 2019 to 13% in 2022 in ECB's own funds portfolios (see Chart 3 below). This would be the result of both green bonds direct purchases in secondary markets during monthly rebalancing, and the investment in the euro-denominated green bond investment fund for central banks launched by the Bank for International Settlements (BIS) in January 2021. By the end of 2023, the target for green bonds has been set to 15% of the nominal value of the portfolio.

Since the ECB currently relies on the labelling of the International Capital Market Association (ICMA) to identify green bonds, one can expect it will progressively refer to the European Green Bond Standard (EUGBS) as soon as the regulation enters into force. This may constitute a significant incentive for issuers to adopt the new standard or to disclose their taxonomy alignment (see our article here).

However, as ECB’s own funds are mainly invested in bonds issued by euro area governments (at year-end 2022, 76% was invested in sovereign and sub-sovereign bonds), this portfolio’s decarbonization largely relies on countries’ efforts to reduce their emissions and meet the Paris Agreement. Between 2017 and 2020, sovereign issuers reduced their emissions only by 5% on average per year. However, the ECB advises to take these results cautiously notably because of the pandemic distortion effect and methodological limitations. More insights on how the ECB’s calculate the share of sovereigns’ emissions attributable to bonds in its portfolio would have been appreciated.

It is therefore hard to assess the extent to which ECB’s own portfolio is on a decarbonization path, but the increase in green bond holdings is a positive signal, at least creating incentives.

By contrast, ECB’s staff pension fund’s corporate investments’ carbon footprint, composed of equity and corporate bonds comprising 72% of the portfolio, has halved (see the graph below) between 2017 and 2022. This has been mainly driven by the introduction of benchmarks – i.e., the Paris-aligned Benchmark for bonds as of February 2022 and low-carbon equity benchmarks for equities as of May 2022. The funds are therefore reallocated towards sectorial most carbon efficient issuers following a best-in class approach.

The capital reallocation effect was most pronounced in carbon-intensive sectors: utilities (-66%), energy (-44%) and materials (-42%), and overall led to a reduction of the sectoral carbon intensity (emissions per unit of revenue) in 10 out of 11 sectors. This has significant implications for corporates which are therefore incentivized to perform better than their peers. In this direction, it was found that issuers’ own efforts have contributed to a smaller extent to the portfolio’s decarbonization with an average reduction by 2% of absolute scope 1 and 2 emissions. Moreover, 22% of the pension funds’ corporate issuers set science-based targets in 2022, showing a willingness to increasingly prove their data reliability (though we do not have previous reference to put this data into perspective).

This benchmark and exclusion approach is therefore proving right the ECB’s decarbonization approach of its staff pension fund. However, one should bear in mind it weighs 1.83 billion euros, that is more than 11 times less than ECB’s own funds portfolio (21 billion euros). Thus, despite constituting incentives for corporates, the impact of this portfolio’s greening on the real economy and the overall ECB’s decarbonization goals remains limited.

The ECB expresses the willingness to work towards portfolio-specific quantitative interim decarbonization targets for both its own funds and staff pension fund.

Overall, the ECB acknowledges climate data availability has improved in recent years, for corporates as for sovereigns, “reflecting a broader market trend towards enhanced climate-related reporting”. Additionally, a growing number of central banks are applying the recommendations issued by the Taskforce on Climate-related Financial Disclosures (TCFD) to their own portfolios, furthering transparency. This phenomenon will help progressively the ECB to improve its own annual climate-related disclosure and should promote risk management in a context of increasing climate-related banking supervision in the European Union[5].

[2] Climate-related financial disclosures of the Eurosystem’s corporate sector holdings for monetary policy purposes + FAQ

[3] Climate-related financial disclosures of the ECB’s non-monetary policy portfolios (NMPPs): Report, March 2023

[4] The ECB’s NMPP disclosures are part of a concerted effort by all Eurosystem central banks to publish climate-related financial disclosures on their euro-denominated NMPPs using a common framework that defines minimum reporting requirements based on the recommendations of the Task Force on Climate-related Financial Disclosures.

[5] The European Supervisory Authorities (ESAs) have been asked by the Commission to conduct a climate risk scenario analysis by 2025 to assess the resilience of the EU's financial system.