ECB's avenues to intensify climate action in quest “of punch”

Monetary policy tightening, responding to 2022’s inflationary spike, could hinder the green transition. Interest rates and raw material price increase create new barriers to low-carbon investments. ECB’s own goal to align with the Paris agreement adds up to the complexity to maintain price stability without hampering efforts to transition to a low carbon economy.

The ECB must navigate through a double constraint, maintaining price stability, which is crucial for the transition to occur at an appropriate pace and in an orderly manner - all the while intensifying its own decarbonization[1].

In a recent speech, Isabel Schnabel, an influential member of the ECB's Executive Board who is vocal on climate change, argued that the current ECB climate actions are insufficient to ensure carbon neutrality in its operations by 2050. The ECB has pledged to align with the Paris agreement as part of its climate change-related Roadmap[2].

Indeed, in October 2022, the ECB started tilting its corporate debt portfolio and collateral framework towards issuers with better climate performance through the reinvestment of redemptions[3]. But the change from half a decade of quantitative easing to a quantitative tightening put a halt to reinvestment perspectives and made that tilting approach inadequate. Schnabel stressed that “the tilting parameter lost part of its punch when we decided to stop net asset purchases”.

In order to intensify efforts to decarbonize itself, she suggests for the ECB to move from a flow-based (tilting ECB’s reinvestments toward better climate performers) to a stock-based (actively tilting ECB’s portfolio through capital reallocation) approach.

In her speech, Isabel Schnabel evoked other avenues to explore in the near future for the ECB to comply with its climate objectives:

- Enlarging the tilting approach to the public sector (sovereigns, supranationals and agencies);

- Greening its lending operations by limiting the share of highly carbonated assets that can be pledged as collateral when borrowing from the Eurosystem.

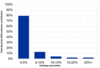

As of today, ECB’s climate ambition strongly relies on its portfolio’s assets own transition, half of which come from the public sector and the other part depending significantly on the actions of a few high-emitting companies (Figure 3).

On February 2nd, 2023, the ECB decided to intensify its flow-based approach and further tilt redemptions’ reinvestment in its CSPP towards best climate performers both on primary and secondary markets[4] - contrarily to covered bonds where it will now only buy in secondary.

Unarguably, the ECB’s board member Isabel Schnabel is willing to strengthen the ECB’s climate engagement, however, consensus within the institution, timing and details are highly uncertain. Therefore, her proposals must not be considered as reflecting what the ECB will do, but only could do.

From a flow-based (passive) to a stock-based (active) tiliting approach

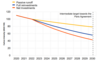

The current economic environment rendered the flow-based tilting approach inadequate. Ms Schnabel highlighted that “the forthcoming reduction in reinvestments will further significantly constrain the ability of a flow-based approach to decarbonise our corporate bond portfolio at a pace that is consistent with our climate ambitions”. Indeed, the asset purchase program is planned to decline to €15bn per month on average until June 2023 by not reinvesting full principal payments from maturing bonds.[5]. The decrease in net asset purchases hampers the capacity of the bank to progressively tilt its portfolio (figure 1).

Source: ECB calculations and presentation, January 10, 2022. Net investments refer to a scenario with net purchases of approximately EUR 2 bn per month. A passive runoff indicates a scenario in which maturing bonds are not replaced in the portfolio.

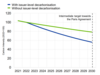

As a new feature Schnabel is now considering the possibility for the ECB to move to a stock-based approach, actively reshuffling its portfolio (figure 2). She mentions “reshuffling” the portfolio, giving more weight to greener issuers and less to browner ones, even divesting in some cases. She asserted “At the same time, we should not divest completely, at least not initially, from those companies whose actions are particularly important in managing the green transition, but rather foster incentives for them to reduce emissions further”. The adverbs completely and (not) initially are of the highest importance.

Source: ECB calculations and presentation, January 10, 2022.

Though it is made clear that the ECB’s green monetary policy should remain primarily incentive-based, it is hard to foresee an “active” tilting towards most virtuous issuers without divesting especially in a context of downsizing its balance sheet.

One can imagine worst climate performers to be penalized more strongly and even divested from. Especially considering the portfolio’s distortion towards highly intensive sectors: 5% of the portfolio representing 80% of its emissions (figure 3).

Source: ECB calculations and presentation, January 10, 2022.

Another solution to strengthen ECB’s climate efforts would be to extend the green tilting approach to covered bonds and asset-backed securities (ABS), with an appropriate framework to assess climate impact.

Enlarging the scope of green tilting

Schnabel insisted on the lack of sovereign progress and political climate commitments which constitute the largest barrier to a timely decarbonization. She called for stronger fiscal policies. Public sector’s bond holding currently account for around half of ECB’s balance sheet[6]. Expanding its green tilting approach to the public sector faces many constraints:

- the respect of capital key-based guidance for purchasing sovereign bonds (a country’s share in total population and gross domestic product of the EU)[7];

- the methodological complexity of assessing a sovereign, supranational or agency’s climate performance;

- additionally, the ECB might face political sensitivity arising from a sovereign climate-performance assessment.

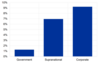

Instead of scoring SSAs on their climate strategies and performance as it does for corporates, Schnabel considers tilting public bond holdings on a product basis, prioritising green bonds. The only limit to that approach is the volume of green bonds issued by Sovereigns. On the other hand, agencies and supranationals can strongly enlarge the pool of eligible green assets (Figure 4). A question remains on whether social and sustainable bond could be considered eligible as they contribute to sustainability objective having in mind Schnabel’s January 2022 intervention: “Governments will need to push the energy transition forward, while at the same time protecting the most vulnerable members of society”[8].

Source: ECB calculations and presentation, January 10, 2022.

A larger greenium[9] to expect in coming years?

The ECB raises the point of German government twin bonds’ greenium (Figure 5) reaching record levels in absolute terms in January 2023 (-15 bps). An ECB green tilting towards green bonds might strengthen this trend for Germany and more broadly.

If the greenium effect is confirmed and if the ECB extends its tilting to the public sector, sovereigns could benefit from cheaper financing for green purposes and be further incentivized to invest in the transition.

Source: Bloomberg, ECB calculations and presentation, January 10, 2022.

The €250 billion NextGenerationEU green bond issuance programme[10] – the issuer being the European Commission – is set to drive the EU green bond supply in the next coming years. However, one highlights that green expenditures used in the NextGenerationEU program diminish the pool of eligible assets for sovereign green bond issuances (green recovery expenses are earmarked to the EU). It is therefore difficult to foresee a clear evolution in EU sovereign green bond supply.

[1] Isabel Schnabel, Monetary policy tightening and the green transition [speech], 10 January 2023.

[2] Detailed roadmap of climate change-related actions, 8 August 2021.

[3] Natixis Green and Sustainable Hub, ECB to decarbonize its corporate bond purchasing and collateral framework: from intent to almost immediate action, 5 august 2022. Natixis Green and Sustainable Hub, Climate worst performers under strain from ECB's Green QE, collateral and parliamentary proposals for capital rules changes, 4 November 2022.

[4] ECB, ECB decides on detailed modalities for reducing asset purchase programme holdings, February 2023.

[5] ECB, ECB decides on detailed modalities for reducing asset purchase programme holdings, February 2023.

[6] Natixis Green and Sustainable Hub, ECB to decarbonize its corporate bond purchasing and collateral framework: from intent to almost immediate action, 5 august 2022.

[7] ECB, Capital subscription, updated on 1 January 2023.

[8] ECB, Climate and the Financial System, Jan. 8th 2022.

[9] Greenium corresponds to the spread between conventional and green debt’s interest rates: the cheaper the green debt, the larger the greenium becomes.

[10] European Commission, NextGenerationEU Green Bonds, website page.