Climate stress test: banks and insurers must act now says French regulator

3-minutes read

The Autorité de Contrôle Prudentiel et de Régulation (ACPR), the French banking and insurance supervisory body, released early May the results of its first pilot climate stress test exercise, performed from July 2020 to April 2021. This study is a milestone for the French financial institutions and 15 insurance groups (examined sample covering 75% of total balance sheet of French insurers), as well as 9 banking groups (85% of total balance sheet of French banks covered) participated in the exercise.

Criteria retained for the exercise are considered as “ambitious” by the ACPR itself and are namely:

- A 30-year long horizon covering the period 2020-2050. It is consistent with the Paris Agreement and several initiatives recently led by insurance and banking companies on their commitment to be net-zero by 2050. It is however a very unusually long-time horizon for such exercise. Financial institutions will then probably need intermediary pathways to strengthen 2050 perspective.

- The combination of two hypothesis: assuming first a “static balance sheet” until 2025, a traditional framework of stress tests in banking supervision, and second a “dynamic balance sheet”, from 2025 to 2050, to analyse the strategy of financial institutions and the actions implemented to mitigate the effects of climate change. The dynamic balance sheet assumption was integrated as financial institutions can choose to modify their balance sheet over time. It is a key element because banks in particular could redistribute their corporate credit portfolio.

- The coverage of physical and transition risks was included with a classification by sector. It is a very granular approach with more than 50 sectors covered.

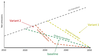

- Three scenarios were used to reach net-zero emissions by 2050. The orderly transition scenario is in accordance with the “Stratégie Nationale Bas Carbone” (French official Low Carbon Strategy)) roadmap. The delayed transition scenario assumes that the greenhouse gas emission reduction target is not met by 2030, which requires more proactive measures. Finally, the sudden transition involves a sharp rise in the price of carbon and lower productivity growth than in the orderly transition scenario.

Chart 1. Retained scenarios to reach net-zero by 2050

Source: ACPR

A “moderate” exposure to climate change risks but still with considerable physical risks consequences

According to the ACPR, the pilot exercise reveals an overall “moderate” exposure of French banking and insurance companies to climate change risks (both transition and physical risks). Indeed, France and Europe more broadly, seem less impacted than other regions – like the United States – based on the projections made by the Intergovernmental Panel on Climate Change (IPCC) which were used as an input into this stress testing exercise. The exposure of French institutions to the sectors most affected by the transition risk (oil, agriculture, etc.) is considered as relatively low.

However, an analysis from Carbon4, a French consultancy dedicated to climate analysis, suggests that the level of exposure of the French financial system to transition risks might have been underestimated. They point out that scenarios rely on continued GDP growth while reaching carbon neutrality. Concretely, such assumption would imply a significant decrease in emissions with no impact on GDP growth, which has still never been seen in the past. Furthermore, they state that the sectoral structure of bank’s balance sheets contributes to this underestimation, as the most impacted sectors (such as electricity and gas) represent barely 10% of banks’ corporate credit exposures. This limits the global exposure despite the fact that the cost of risk of these sectors is supposed to treble by 2050.

On the insurance side, the pilot exercise shows that the vulnerabilities associated with physical risks are far from negligible. Thus, the cost of claims could be multiplied by 5 to 6 in some French departments between 2020 and 2050, and insurance premiums are expected to rise by 130-200% in the next 30 years. The main hazards contributing to this increase are linked to the risk of "drought" on the one hand and "flooding" on the other hand, as well as the risk of cyclone storms in ultramarine territories. This finding is worrying as it will considerably raise the cost of insurance covering natural disasters globally.

Room for improvement regarding methodologies but a good step forward for future stress tests

As stated by the ACPR itself, improvement of a number of methodological tools is necessary. The limited variability between the scenarios induce a bias that supervisor and financial institutions need to work on. Current models to quantify the risks, especially for banks, are not adapted to incorporate financial and macroeconomics data in a long period of time.

Consideration of physical risk, particularly for the corporate portfolio, is also a point of improvement. It implies considering interdependencies and a good knowledge of value chains, which remains largely insufficient right now.

More broadly, models used by banks and insurers need to level up with better data quality in order to have a better consideration of climate risks. Several interesting methodological approaches have been implemented by financial institutions in the context of this exercise, which should be explored further. For example, there has been reallocation of portfolios or modification of reinsurance programmes for insurers, and healthy reissuance of exposure at defaults for banking institutions. Also, some have integrated sectoral differentiation by substituting in existing models, for a given economic activity, the shock of GDP by the value-added shock of the corresponding sector.

Despite all these limits, the climate stress test showed also encouraging results. Indeed, for the first time in a stress test, it has mobilized companies from banking and insurance sectors with the regulators, to work collectively on data and methodologies. The results will hopefully help raising stakeholder’s awareness of the risks of climate change,. It allowed to quantify and assess different scenarios which will serve as a foundation in future exercises.

So what’s next?

The European Central Bank (ECB) is preparing a similar exercise in 2022 at the EU level, and other international working groups will do the same. The European Insurance and Occupational Pensions Authority (EIOPA), the Basel Committee on Banking Supervision, the International Association of Insurance Supervisors and the Financial Stability Board will work on the basis of ACPR’s findings. The ACPR expects to conduct its next climate stress test in 2023/2024.

Overall, this work highlighted that banking and insurance companies must act as soon as possible to deepen their actions to fight climate change. It starts by integrating the risks into their financial risk assessment process. Further consideration of the risk of climate change is crucial to promote a better allocation of resources and ensure the financing of the transition and thus limit climate transition and physical risks to occur.

To go further:

-

Carbone 4, "Climate Stress Tests: How to read the results of the exercise?", May 2021 (English) - available here.

-

ACPR, 2020 Climate risk evaluation: "Les principaux résultats de l’exercice pilote climatique 2020", May 2021 (French) - available here.

-

ACPR, Climate risk analysis and supervision: "Climate Pilot Scenarios and Key Assumptions", July 2020 (French) - available here

-

L'Argus de l'Assurance, article: " Natural disasters: ACPR warns about a significant increase in insurance premiums", May 2021 (French) - available here.