The precarious future of the Inflation Reduction Act

Introduction

The Inflation Reduction Act (IRA) was signed into law by President Joe Biden on 16 August, 2022. The act is a landmark legislative action that presented the largest clean energy investment program in the U.S. history. Over two years into its initiation, several provisions of the program are under the risk of a roll back. President Donald Trump has signed an executive order named “Unleashing American Energy” on his first day in the Oval Office, ordering to freeze the disbursement of all IRA related funds. In March, EPA’s Greenhouse Gas Reduction Fund took the first hit with over a $20 billion spending cut. The future for the rest of the program is uncertain. The administration is expected to target several provisions concerning tax credits and federal loan programs. However, a full repeal at the legislative level is unlikely, as the Republicans are far from reaching a consensus with biggest beneficiaries of the program

The main target of the act was reducing federal government’s long term budget deficit while lowering prescription drug prices, and promoting investment in domestic clean energy production. The IRA’s main provisions cover:

- Implementing a minimum 15% tax rate for corporations with incomes over $1 billion and imposing a 1% excise task on stock buybacks,

- Empowering Medicare to negotiate certain drug prices and implementing,

- Allocating $80 billion to bolster operations of the Internal Revenue Service (IRS) over the next decade,

- Extending health care coverage for more than 3 million individuals through the Affordable Care Act subsidy extension, which will now continue until 2026,

- Investing in energy security and climate initiatives, providing tax credits to reduce household energy costs and supporting clean energy production and carbon emission reductions.

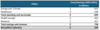

Based on the initial projections done by the Congressional Budget Office (CBO), the IRA is expected to lead to a total cost of $499 billion during the period between 2022-2031 while generating additional savings and revenues of $738 billion.

Source: Committee for a Responsible Federal Budget, CBO Scores IRA with $238 Billion of Deficit Reduction.

However, the exact IRA spending is difficult to estimate, various groups have projected the fiscal cost of the act over a decade, with estimates ranging from $780 billion to $1.2 trillion. The Congressional Budget Office in 2024 adjusted its estimates for energy-related tax provisions, aligning its forecast with these external projections.[1]

Clean energy provisions

The clean energy and climate-related provisions of the Inflation Reduction Act (IRA) were estimated at nearly $400 billion between 2022 and 2031, being delivered through a mix of tax incentives, grants and loan guarantees. The majority of the funding comes in the form of tax credits, at over $250 billion, while funding directed to loan and grant programs accounts for $125 billion. Among the tax credits, $216 billion is available to corporations to encourage private investment in clean energy, transportation, and manufacturing. Additionally, $43 billion of the funding allocated to tax credits is designated for consumer incentives applicable to EVs, energy-efficient appliances, rooftop solar panels, geothermal heating, and home batteries.

From $125 billion of allocated federal funds, the Department of Energy’s Loan Program Office received roughly $12 billion. These funds are used for direct loans and loan guarantees, which translate into a $367 billion loan program. As of January 2025, almost $50bn in Department of Energy loans had already been agreed and another $280bn worth of loan requests were under review.

Upon his return to the office, President Donald Trump signed an executive order titled “Unleashing American Energy,” on January 20th, to review and revoke climate actions from the Biden administration. The executive order states that all agencies shall immediately pause the disbursement of funds allocated under the Inflation Reduction Act of 2022 (Public Law 117-160) or the Infrastructure Investment and Jobs Act (Public Law 1127-58). This includes, but is not limited to, funds for electric vehicle charging stations made available through the National Electric Vehicle Infrastructure Formula Program and the Charging and Fueling Infrastructure Discretionary Grant Program.

Executive action

In the United States, the President has the authority to intervene in the execution of the IRA through executive actions that impose stricter limits on tax credits, withhold certain loans and grants, or revise rules that are still pending final approval. President Trump’s “Unleashing American Energy” executive order revokes President Biden’s Executive Order 14082, on the implementation of the IRA, and of any offices established. With this, it is likely that the White House Office on Clean Energy Innovation and Implementation, responsible for coordinating the IRA's execution, will be dismantled. A presidential administration may also direct agencies to refrain from publishing proposed or final rules or to delay the effective dates of finalized rules that are yet to take effect. This approach allows for the revision of factual, legal and policy issues arising from such rules and for potential amendments and/or repeal.

Legislative repeal of the IRA

Congress can partially or fully repeal the IRA through legislation, potentially using the repeal of IRA tax credits to fund an extension of Trump's 2017 tax cuts. Any repeal must be explicit, as courts are hesitant to recognize implicit changes. Since the IRA was passed under a Budget Resolution, it can be repealed with a simple majority in both the House and Senate, avoiding filibuster challenges. The ability to repeal the IRA depends on the congressional makeup. Many Republican districts benefit from IRA investments, making full repeal difficult. A Republican-controlled House could facilitate budget cuts for the EPA and other relevant agencies, which is likely to slow down or restrict the implementation of the IRA.

What are the elements under the greatest risk?

The parts of the IRA that are likely to be targeted for a repeal, based on previous attempts by House Republicans, include:

- The Greenhouse Gas Reduction Fund, a $47 billion program designed to finance clean energy and climate resilience projects. $27 billion is managed by the EPA for projects related to zero-emission technologies and environmental justice, while $20 billion is allocated through grants to states, tribes, and other entities. On 11 March, EPA terminated $20 billion in grants allocated under the program.

- Methane Emissions Reduction Program aims at helping to reduce emissions of methane and other greenhouse gas from the oil and gas sector. It provides $1.36 billion in financial and technical assistance through multiple funding opportunities through EPA.

- The energy efficiency rebates are tax incentives provided under the Inflation Reduction Act (IRA) to encourage homeowners to improve their energy efficiency. They cover many improvements, including heat pumps, insulation, heat pump water heaters, and energy-efficient windows and doors.

- Clean vehicle tax credits: The IRA allows a maximum credit of $7,500 per new clean vehicle.

- DoE Energy Loan Program offers loan guarantees and direct loans to support innovative energy projects in the United States.

The impact of repealing the Greenhouse Gas Reduction Fund is uncertain since the EPA has already awarded $27 billion from it as of August 2024, allowing recipients to access funds. The Methane Emissions Reduction Program faces a higher risk of repeal. On March 14, 2025, a joint Congressional resolution disapproved the Waste Emissions Charge (WEC) Rule, one of the key components of the program. The Waste Emissions Charge (WEC) Rule, implemented by the EPA, provided crucial guidance for imposing a tax on methane emissions from the oil and gas sector and was considered one of the strongest enforcement tools included in the Inflation Reduction Act (IRA). If the rule had remained in effect, oil and gas companies would have faced an estimated $560 million in fines under the program. However, a methane fee regulation is still mandated by the IRA. While it is highly unlikely that the Trump administration will collect this fee, unless Congress removes the waste emissions charge provisions from the law, a future administration may choose to enforce it.[2]

Energy tax credits have earned bipartisan support, particularly in areas where clean energy projects have created jobs and investments, leading several Republican lawmakers to advocate for retaining these credits. Additionally, home energy rebates appear to be safe, as most states, including those with Republican leadership, are participating in these programs, reflecting cross-party support. While President Trump's executive actions have targeted wind energy and electric vehicles, solar power has not been mentioned for. "I'm a big fan of solar," Donald Trump stated during the presidential debate in September 2024.

Special focus: Future of hydrogen and CCUS incentives

The clean hydrogen production tax credit (Section 45V) now operates under finalized IRS rules issued in January 2025. They define a tiered credit structure based on the lifecycle greenhouse gas emissions of hydrogen production. The finalized rules confirm the strict “three pillar” requirements for hydrogen made using grid electricity: additionality (electricity must come from new clean resources), regional deliverability, and hourly time matching (effective 2030).

In the case of carbon capture, utilization, and storage (CCUS) incentives were delivered through both the IRA and the Bipartisan Infrastructure Law. The IRA significantly expanded the existing section 45Q tax credit – raising it to $85/ton for geological storage and $60/ton for utilization – and lowered the eligibility threshold to include smaller facilities meanwhile the Infrastructure Bill complements these tax incentives by providing over $11 billion in direct funding for CCUS infrastructure and transportation projects. Related IRS rules for 45Q were finalized earlier in 2021, but important guidance was issued recently in 2024 and January 2025 to clarify procedures for lifecycle emissions accounting in utilization projects, credit transfer, and labor compliance.

Now future of both these initiatives seem uncertain under the Trump administration. The finalized 45V hydrogen production tax credit rules, particularly the “three pillars” requirements, are likely to be revisited since industry groups have been pushing for their relaxation for a long time. In addition, recent reports indicate that the DOE is considering significant funding cuts to several hydrogen hub projects, an internal DOE list[1] suggests defunding four out of seven hydrogen hubs, specifically targeting those located in Democratic-leaning states. These hubs represent approximately $4 billion in pledged funding. On the other hand, 45Q carbon capture credits, a program that enjoyed bipartisan support for a long time managed to avoid the administration’s attention so far.

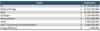

Almost two years after the Inflation Reduction Act (IRA) was signed into law on August 16, 2022, a total of 305 companies have announced at least 380 major new clean energy and clean vehicle projects across the US. Of the announcements, 277 included estimates on the number of jobs the projects are expected to create and/or investment amounts. Based on this information, the projects, if completed, would create 117,218 new jobs and bring in $131 billion in private investments[5].

While sectors throughout the clean energy industry are expanding over the past two years automakers and their suppliers took the lead. During the period, 254 EV or battery plants and related factory investments were announced.

The top five investors together represent more than 10% of total investments, with Stellantis Group holding the fifth position. Stellantis has six investment locations across three states and is one of two foreign investors in at the head of the list, alongside Toyota.

Since the Inflation Reduction Act (IRA) was signed into law, three French groups have announced investment decisions in the clean energy sector. These investments, concentrated in eight locations across five states, primarily target the electric vehicle and battery/storage sectors, aligning with the prevailing industry trend.

Republican Constituencies among biggest beneficiaries of IRA

Although Republican control in both houses of the Congress could facilitate the repeal of the IRA, forming a large enough coalition in Congress is challenging, as some lawmakers want to keep incentives that benefit their constituents. In March 2025, 21 Republican House members, whose districts benefited billions in new investment thanks to the IRA, sent a letter to the House Ways and Means Committee chair Jason Smith urging him to protect the IRA’s energy tax credits. A Senate Finance Committee advisor also indicated that a full repeal of clean energy tax incentives is unlikely, given past bipartisan support.[6]

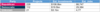

Republican districts have benefited from the IRA, with over half of clean energy and vehicle projects located there (Table 1). From September 2023 to September 2024, Nevada and Wyoming saw the highest clean investment as a percentage of GDP, at 2.65% and 4.11%, respectively. Nevada, Kentucky, and Georgia led in clean manufacturing investment, while California and Texas received the most federal funds overall. Notably, Nevada and Wyoming had the highest federal investments per capita relative to their GDP, including tax credits, grants, and loans. In other words, the extent of the rollback will test whether Republican representatives put the interests of their voters ahead of their loyalty to the president.[7]

Two federal judges have ordered the Trump administration to end its freeze and release money from programs.

In a series of legal challenges against the Trump administration, federal judges have intervened to ensure the continuation of taxpayer funding to Democratic-leaning states and the District of Columbia for congressionally approved programs. On January 31, Judge John J. McConnell Jr. ordered the administration to resume funding[8], marking a significant victory for states' attorneys general who had sued to block a funding freeze that disrupted essential services such as Medicaid and housing subsidies. This ruling underscores the ongoing conflict over presidential authority in spending, particularly in light of the Supreme Court's stance that presidents cannot withhold congressionally allocated funds. However, in early February Judge McConnell Jr. said the White House was defying his order by withholding funds. While some funds have begun moving, many remain stalled.

As of early March, at least 35 court rulings had temporarily halted some of the President's actions, with new decisions emerging almost daily. Higher court rulings are anticipated in the coming weeks.

The duration of the fund freeze remains uncertain. The administration is likely to attempt to postpone the implementation of IRA-related rules and programs until a consensus is reached within the Republican Party to roll back the legislation in Congress. However, this outcome appears uncertain, as many Republican constituents are significantly benefiting from IRA programs, which have a positive impact on investment and employment figures at both local and national levels.

Footnotes & References

Footnotes

[1] U.S. Department of the Tresuary, The Inflation Reduction Act’s Benefits and Costs, 1 March 2024, available here.

[2] Bloomberg Law, GOP Repeal of Biden’s Methane Fee Complicated by Climate Law, 7 March 2025, available here.

[3] Reuters, US weighs funding cuts to four of seven hydrogen hubs, 26 March 2025, available here.

[4] Reuters, US weighs funding cuts to four of seven hydrogen hubs, 26 March 2025, available here.

[5] For tables 2-6 data sourced from E2, Clean Economy Works Database covering investments announced until 17 February 2025, available here.

[6] Politico, House Republican support grows for keeping clean energy tax breaks, 3 March 2025, available here.

[7] Financial times, Senior Republicans seeking to tear up IRA enjoy $130bn investment spree, 19 February 2025, available here.

[8] The New York Times, Judge Further Blocks White House Spending Freeze, 3 February 2025, available here.

References

- Federal Judge Orders White House to Keep Money Flowing to 22 States - The New York Times

- Unleashing American Energy – The White House

- What if the Inflation Reduction Act were repealed? | Lombard Odier

- Trump’s Return: Which Sectors Will Benefit Most? | Investing.com

- Donald Trump halts more than $300bn in US green infrastructure funding

- Senior Republicans seeking to tear up IRA enjoy $130bn investment spree

- Trump freezes IRA funding | Utility Dive

- Trump initially ordered a pause on IRA funding—what does it mean for solar? | EnergySage

- What’s in the Inflation Reduction Act (IRA) of 2022 | McKinsey

- What will happen to the Inflation Reduction Act under a Republican trifecta?

- https://www.epa.gov/inflation-reduction-act/methane-emissions-reduction-program

- How Trump Has Undermined U.S. Climate Policy - The New York Times

- https://e2.org/announcements/

- Judge Further Blocks White House Spending Freeze - The New York Times

- https://www.politico.com/news/2025/03/10/house-republican-clean-energy-tax-breaks-00218126

- https://www.reuters.com/business/energy/us-weighs-funding-cuts-four-seven-hydrogen-hubs-2025-03-26/

- https://news.bloomberglaw.com/environment-and-energy/gop-repeal-of-bidens-methane-fee-complicated-by-climate-law