State of the Green, Social and Sustainable Sovereign Bonds markets, what is next?

15-minute read

OVERVIEW

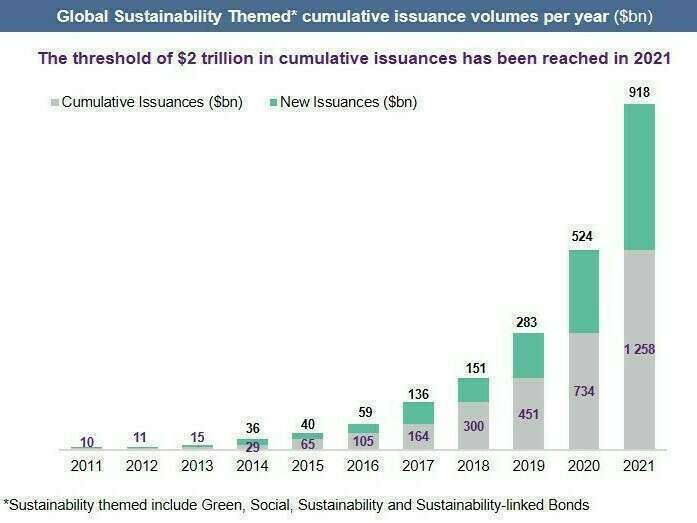

While many countries have beefed-up their NDCs at the COP26, the Green, Social and Sustainable (GSS) Sovereign Bonds Market has exceeded $200bn in cumulative issuances in 2021. However, the correlation between the two phenomenons is equivocal. Indeed, if more than 135 countries have announced their intent to become carbon neutral between 2040 and 2060, not all of them have engaged in GSS bond programs issuance or could.

Larger is the “climate action gap” (the mismatch between one country’s pledges and its short-term efforts to fulfill them), the more inept a country is to identify enough sustainable expenditures that underpin GSS bonds issuances. For other countries with narrower action gap, hesitations to issue Green or Sustainable Bonds revolve around reluctance to earmark proceeds to specific expenditures (universality principle: all resources are fungible, and/or cumbersomeness of the process), concerns to fragment debt with potential discrepant curves, or lack of systematic pricing benefits.

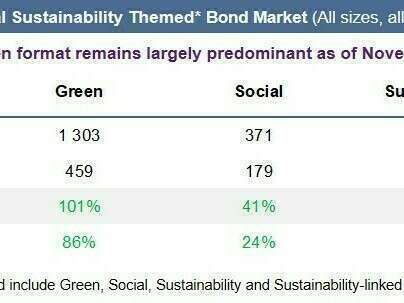

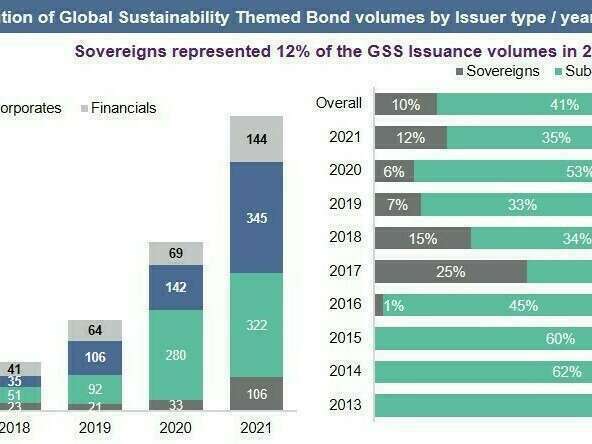

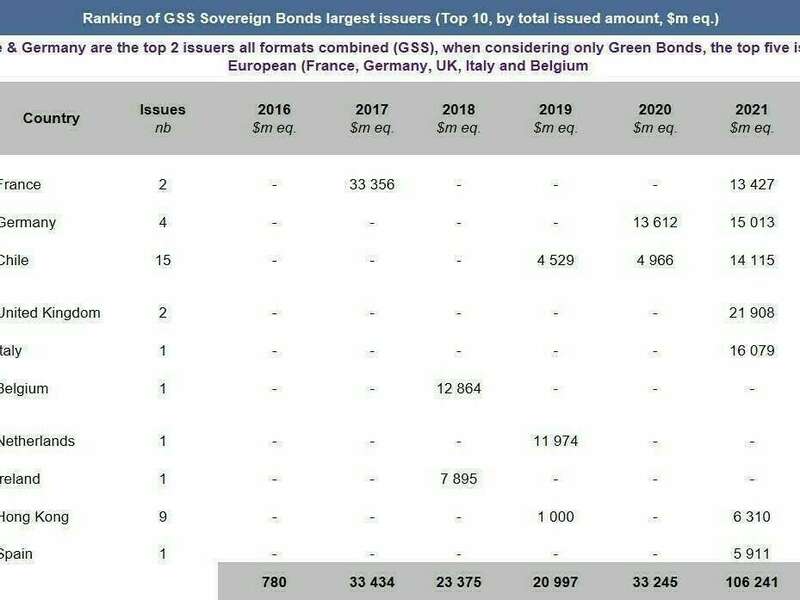

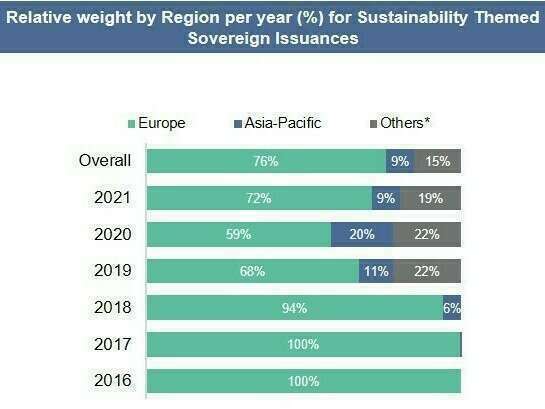

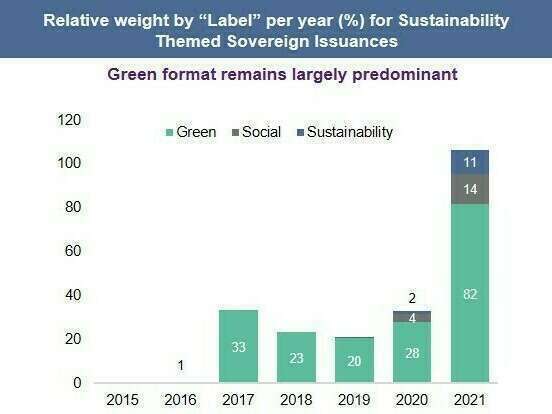

Europe is the main growth engine of this Sovereign GSS market (with repeat issuers such as France or Germany, or recent newcomers like Spain or Italy). European countries account for three-quarter of Sovereign global issuance overall. France and Germany are the two largest Green Bond issuers worldwide before the UK, Italy and Belgium. As of today, the Green format is still predominant, but it is noticeable that several emerging or middle-income countries have adopted Social and Sustainable formats. Overall, we do not foresee developed or high-income countries to issue pure social bonds. Nevertheless, in the context of the ongoing sophistication of eligibility criteria and frameworks, we believe that the socially “harmful” consequences of low-carbon policies will become inevitable items in Green Bond issuances (the Green Gilt introduces such “social co-benefits” layer of analysis for reporting purposes).

One of the outcomes of the COP26 is that countries are urged to submit short and-medium term targets to the United Nations, as well as to harmonize their objectives formulation. One thus expects pressure to amplify efforts and greater comparability. In this context, countries may want to highlight and/or increase their decarbonization efforts and accordingly issue (more) green bonds. The standardization around the setting of targets is meant to facilitate ambition and alignment benchmark. It could spark the issuance of Sustainability Linked Bonds (SLBs), whose one of the cornerstones is the comparability of KPIs.

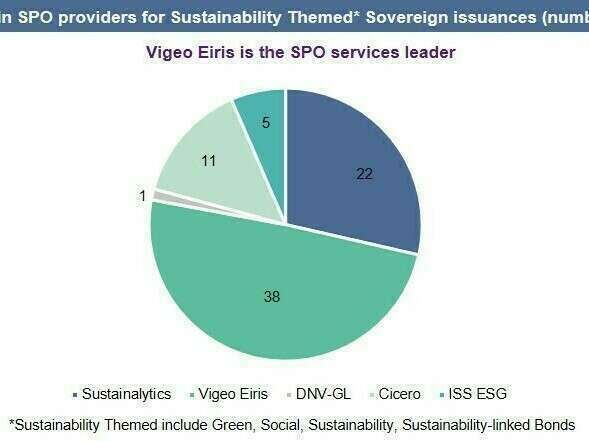

Despite investors’ growing appetite for Sustainability-Linked Bonds (more than $105bn eq. issued by 130 issuers, 98% being non-financial corporates), the suitable recipe to adapt this format to countries issuances has not been found yet. The overall shift from a logic of means – through use-of-proceeds – to a logic of results – through KPIs, reveal investors’ growing attention to ESG “performances” amid greenwashing backlash. With investors refining their sovereign ESG strategies and sometimes even divesting because of ESG considerations, Sovereign issuers’ approaches, methodologies and reporting will have to gain in granularity and robustness. Such improvement may have to be accompanied by further involvement of third parties. Independent committees can for instance opine on eligible expenditures or reporting, see for instance the latest Green OAT impact report on the innovation strategy of the investments for the future programme. One also mentions UNDP’s role in Mexico’s SDG Bond (see our article on the 1st impact reporting), the SDSN partnership with Benin, or Carbon Trust’s on the Green Gilt (see infra).

This paper provides a critical overview of the state of the GSS sovereign bonds markets alongside innovation projections.

We wish you a good read.

[1] See our article about COP26 - A fragile win, here.

Table 1: Key items of our analysis

|

|

|

|

|

|

|

|

Please contact us to obtain our full report

Overview of the GSS Bond Market for Sovereigns

Source: Natixis market data