The Covid-19 crisis has had severe implications across the world to date and represent significant challenge to the economy. During such an unprecedented time, governments, agencies, financial institutions and corporates need to have access to capital in order to tackle the effect of the crisis and finance covid-19 related measures. One of the solutions is to access the social bond market.

Reminder: What is a social bond?

Social bonds are debt capital markets instruments where the proceeds are applied for ‘social’ purposes or outcomes. Those eligible outcomes are defined in the Social Bond Principles, and can be linked to the financing of affordable basic infrastructure, access to essential services like healthcare, food security etc. Some of these eligible categories are directly linked to the financing of Covid-19 related measures. Relevant projects could be undertaken by various industries and sectors where the aim of the project(s) is to mitigate COVID-19- related social issues and bring about positive social outcomes.

What has been done so far?

As of today, we have identified 3 loose categories of Covid-19 response bond issuers:

- Existing Social/Sustainability Bond Issuers who are leveraging their existing framework and relevant Eligible Project categories to Issue Social bonds where they identify eligible project categories relevant to the coronavirus crisis (for instance CDeP, EIB, IBRD, Council of Europe, IFC, AfDB…).

- Issuers issuing general corporate purpose bonds that include an explicit description in the Use of Proceeds that all or part of the proceeds will be allocated to budgets or expenses specifically linked to the coronavirus crisis (such as funding the health service, funding production of vital equipment such as ventilators or funding research into vaccine research or other treatments) but without any framework with respect to the Social Bond Principles (such as IDB, AFD, ADB, IDB invest… or several sovereign issuers).

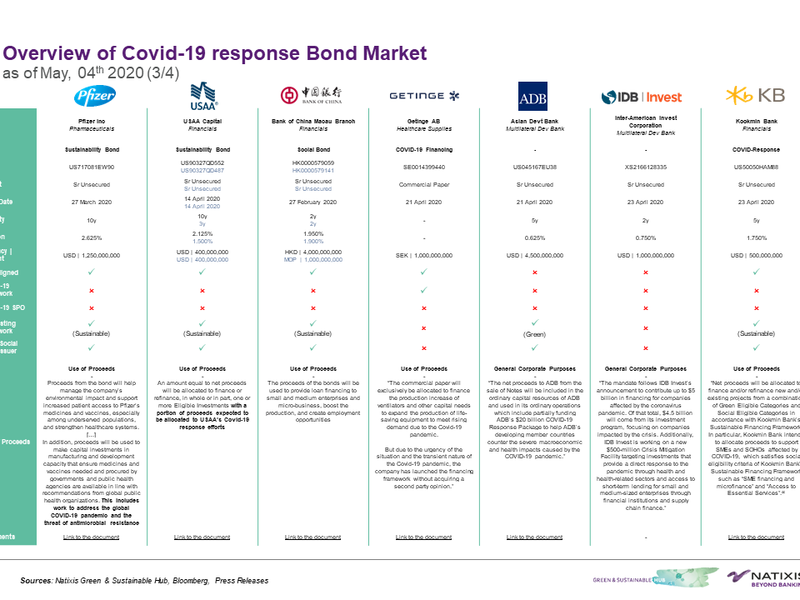

- Issuers entering the Social Bond market for the first time with a covid-19 social bond or issuers setting-up dedicated frameworks solely tied to covid-19 bonds (such as Getinge, NIB, Bpifrance). For instance, Pfizer, an American multinational pharmaceutical corporation has issued a sustainability bond. The proceeds from the bond will be used to “make capital investments in manufacturing and development capacity that ensure medicines and vaccines needed and procured (…) This includes work to address the global COVID-19 pandemic and the threat of antimicrobial resistance”. Another example is Getinge, a Swedish global medical technology company, which has issued a “Covid-19 financing” commercial paper which will exclusively be allocated to finance the production increase of ventilators and other capital needs to expand the production of life-saving equipment to meet rising demand due to the Covid-19 pandemic.

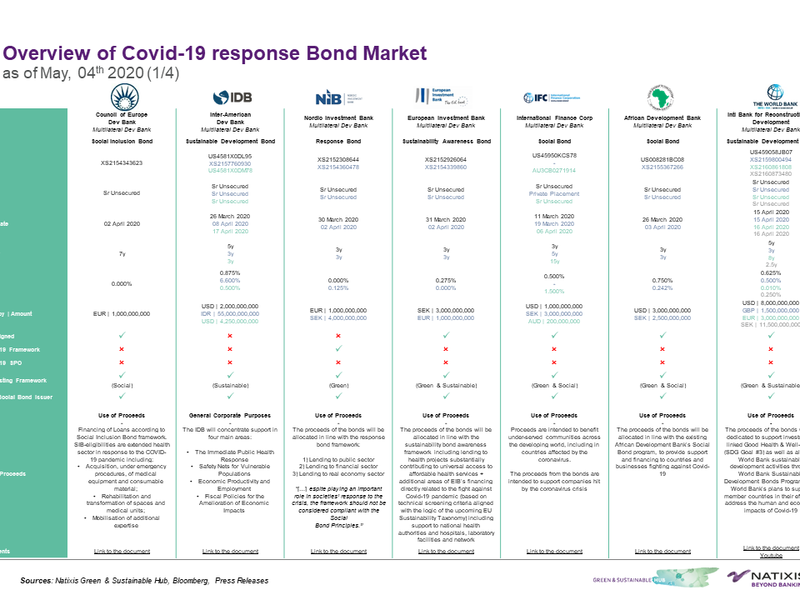

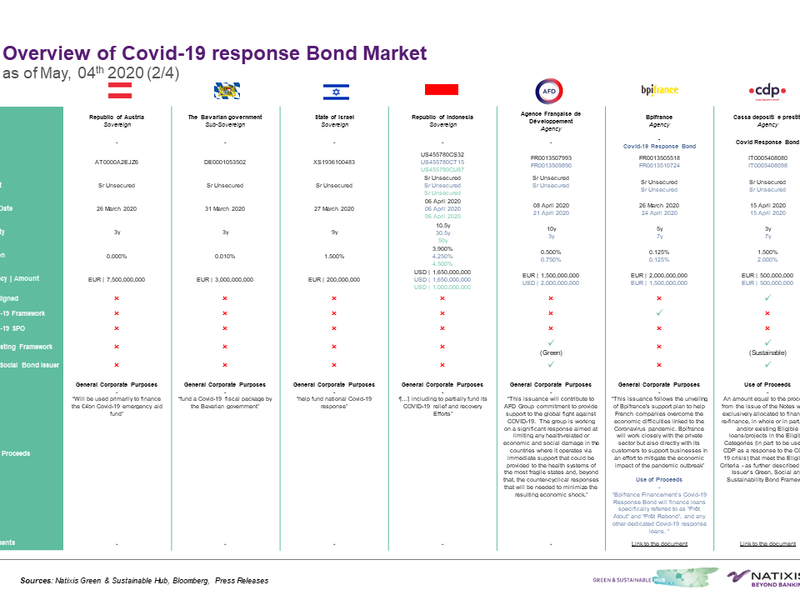

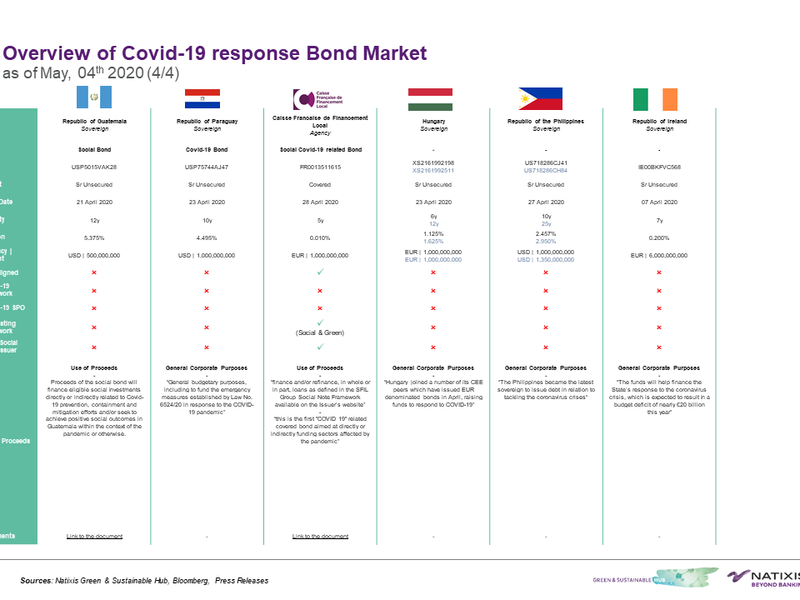

The four tables below are a detailed overview of the covid 19 response bond market as of May, 4th 2020: