1st "conseil de défense écologique" announcement

Authors: Cédric Merle, Dominique Blanc, Radek Jan

Green & Sustainable

Finance Watch

-

1st "conseil de défense ecologique" announcement, incl. the creation of "France Transition Ecologique"

On May 23rd, Emmanuel Macron, the French President, summoned the 1st meeting of the Conseil de défense écologique[1] which gathers the Prime Minister, the main ministers influential in the success of the ecological transition - Environment, Economy, Budget, Foreign Affairs, Agriculture, Local Authorities, Health, Housing, Overseas - and the key State operators.

The purpose of this new set-up is to define policy guidelines for the ecological transition, especially the fight against climate change, the preservation of biodiversity, the protection of the environment and natural resources and financing of the aforementioned goals. It is poised to set priorities and to guarantee that ecological criteria are systematically factored in the design and implementation of public policies and reforms.

Few landmark announcements have been made:

- the monitoring of the French budget alignment with the 2°C trajectory

- the fight against deforestation

- the transition agreements accompanying the exit from coal, scheduled by 2021

- the proposal to create a new entity called “France Transition”

Tough, very little details have been provided so far on the modalities of each of those commitments, the latter draw our attention in the context of the active involvement of French public agencies and authorities in the financing of the French energy transition.

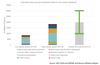

The concept of this new entity was drawn from the Rapport Canfin-Zaouati[2], it is meant at scaling up the flows of private capital into the ecological transition in France through a public-private risk-sharing scheme (sort of “derisking” and “uncertainty clearing” mechanisms). According to I4CE, the actual investment gap to meet the French climate objectives was of between an additional €10bn to €30bn for 2018 alone[3] (on the top of the currently nearly €40 bn invested each year from households, companies and public authorities).

At first, France Transition is intended to receive an intervention envelope of €1bn over a three-year period coming from budgetary and/or European resources. This injection is expected to mobilize an additional €10 bn of private investments over the same period (i.e. an average leverage effect targeted of 10, but may range from 3 to 12 depending on the projects, instruments and risk levels). To put this number in perspective, it amounts to between one tenth and one third of the investments required to meet the French National Low-Carbon Strategy (Stratégie Nationale Bas-Carbone (SNBC))[4] and the Multi Annual Energy Plan (Programmation Pluriannuelle de l’Energie (PPE)).

The proposal also highlights the possibility to include European financing of half that amount, which would limit the French budgetary contribution to €500m over three years - that is €166m per year. It is noteworthy that Pascal Canfin, MEP elected for La République en Marche (LREM, i.e. the majority / presidential party), immediately in the aftermath of the European elections results reiterated the intent of the French Government to propose to its partners as early as June the creation of an EU Bank for climate investments. Very few details have been provided so far and it is unclear what such a new Bank would bring additional as compared to the EIB, whose climate change and sustainability credentials are already extremely robust. The proposal was championed by French economist Pierre Larrouturou and top climate scientist Jean Jouzel who suggested that it would provide 0%-interest loans for climate projects to each EU member state worth up to 2% of their GDP.

What is now unquestionable, is that the results of the European elections, and the foray of the Green Parties (cf. increase by almost 40 % of their MEPs), especially in Germany with a strong agenda regarding coal phase-out, shed a stronger light on the climate topics and will strengthen the impetus in favor of green finance. The Parliament’s Green group has indeed secured enough seats to make itself an almost essential partner in any functioning coalition. Several Green MEPs have for instance advocated a brown taxonomy.

What justifies the need for such an institution?

The Canfin-Zaouati report (December 2018) concludes that some sectors pivotal for the ecological transition encounter financing hurdles in France despite the existence of mature technologies and/or certain profitability:

- the energy renovation of buildings

- the deployment of low-carbon vehicles

- certain renewable energy sources such as agricultural methanisation

- the agroecological transition at a large-scale.

It results from the combination of two main issues: a lack of profitable projects added to a shortage of affordable financing. See in Appendix (“Estimated future annual investment deficit for the sectors analyzed”).

How to overcome such hurdles?

The report also states that the solution to this issue can be found in an appropriate use of risk-sharing financial instruments able to scale up the financial flows for the ecological transition. France Transition aims at providing public-private risk-sharing financial instruments such as guarantees but also subsidized loans, equity and quasi-equity for several identified sectors. The Canfin-Zaouati report specifies several measures going in this direction.

Specific measures and identified sectors

- to encourage renovation of buildings in the tertiary and residential sectors through different mechanisms:

- the development of refinancing capacity of third-party finance companies (“Sociétés de Tiers Financement”)

- guarantee and advance payments of grants (“avance de subventions”) for the suburban habitat.

- to support the development of the recharging infrastructure for low-carbon vehicles. For this purpose, an establishment of a loan guarantee fund for low-carbon recharging infrastructure has been previewed. Project developers would be covered against the risk of underuse of charging infrastructure during the first few years.

- to create an equity contribution tool for the deployment of anaerobic digestion (methanisation) in agriculture.

The recently announced Franco-German cooperation plan on battery cell production (a €700m investment from France over the next five years) has not been mentioned but would be a good candidate.

How would France Transition work?

France Transition is not supposed to create an additional entity that would duplicate existing initiatives. Instead, the idea is to bring them all together under one entity. Consequently, France Transition would regroup the specialists working in the field of public investment dedicated to the energy and ecological transition from:

- Caisse des dépôts et consignations (CDC) for territorial funding, obviously via the Banque des Territoires ;

- BPI France for the financing of companies;

- ADEME to encourage projects, provide the necessary technical assistance and finance through its intervention programs;

- Agence Française de développement (AFD) for the overseas territories.

Chart 1: Organization proposal for France Transition as presented in the Canfin-Zaouati Report

(no confirmation for the moment on the set-up)

Source: For the creation of France transition (December 2018)

France Transition would be under the supervision of the French Ministry of Ecological and Solidarity Transition as well as theMinistry of Economy and Finance and the General Directorate of the Treasury. Since some of the considered members currently enjoy the situation of not being under the direct supervision of the French government, this new entity may raise reluctancies. One can wonder whether a unique entity would facilitate the task of private investors (lowering transactions costs for climate change related investments) by clarifying the current institutional patchwork and thereby increase the leverage effect of public investments. The exact perimeter and governance are though yet to be defined. Agence France Locale (AFL) and la Société de Financement Local (SFIL) are for instance not mentioned so far.

Undoubtedly, the pooling of expert teams, the firepower and audience of France Transition could be unique.

One can also wonder whether the status of the existing green / sustainable bond frameworks (from AFD or CDC) will raisepotential coexistence questions (with double-counting challenges if for instance France Transition receives funding from the Green OAT).

Will France Transition issue green / sustainability bonds on behalf for instance of AFD and CDC? It is very unlikely.

Will it on its own be authorized / legally capable to issue (green) debt? It is also unlikely considering the proposal from the Canfin - Zaouti Report that states “France Transition does not have its own budget but an “intervention envelope”, which is then allocated to the institutions that compose it according to the projects and the type of financial instrument developed. The financial instruments that it follows and coordinates appear in the State budget and / or the entities that make it up and that operate the financial instruments. France Transition follows their good implementation by the adapted institutions”.

Does that mean that eligibility and impact reporting methodologies from the different entities are going to converge? Possibly. On all those pending questions, we are looking forward to hearing clarifications once the implementation of such commitment comes to life.

Entrez votre texte ici

[1] Fiat on the Conseil de défense écologique (May 15, 2019) Available here : https://www.legifrance.gouv.fr/affichTexte.do?cidTexte=JORFTEXT000038475228&categorieLien=id

[2] Recommendation n°1 « réunir une équipe d’investissement publique dédiée à la transition énergétique et écologique dans une démarche unique, en créant « France Transition ». Full report (only in French) available here: https://financefortomorrow.com/wp-content/uploads/2018/12/Rapport_Canfin_Zaouati_VFINAL.pdf

Summary (available in English) available here https://financefortomorrow.com/wp-content/uploads/2019/02/Rapport-Canfin-Zaouati_ExecSum_EN.pdf

[3] 2018 edition of I4CE’s Landscape of Climate Finance. Available here https://www.i4ce.org/wp-core/wp-content/uploads/2018/11/I4CE-Landscape-of-climate-finance-2018-EN-summary-vf.pdf

[4] National Low Carbon Strategy Project. Available here : https://www.ecologique-solidaire.gouv.fr/sites/default/files/Projet%20SNBC%20EN.pdf

© Shuttertock