Market Insights from Enel’s updated Sustainability-Linked Bond Framework

Introduction to Enel’s latest Sustainability-Linked Bond issuance and updated Framework

On February 14th, 2023, Enel launched a dual-tranche “Sustainability-Linked Bond” (SLB) in the Eurobond market for a total of 1.5 billion euros. This issuance couples EU taxonomy and full decarbonization targets. Natixis acted as Joint Bookrunner.

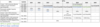

Enel’s latest transaction came after the publication of an updated Sustainability Linked Financing Framework[1] in February 2023. This Framework embeds now three new welcomed KPIs and additional SPTs for the existing KPIs highlighted in the following table in green.

The issuance embeds all three of these new KPIs and is structured in the following two tranches:

- €750 million, 8yr tranche maturing February 20th, 2031. If one or both of the following Sustainability Performance Targets (SPTs) are not achieved, a step-up mechanism will be applied, increasing the rate by 25 bps, as of the first interest period subsequent to the publication of the relevant assurance report;

- for the new KPI related to the “Proportion of CAPEX aligned to the EU Taxonomy (%)”, the achievement of a SPT equal to or higher than 80% on December 31st, 2025 for the 2023-2025 period (82% in 2022);

- for the existing KPI related to the “Scope 1 GHG emissions intensity relating to power generation (gCO2eq/kWh)”, the achievement of a SPT equal to or less than 130gCO2eq/kWh on December 31st, 2025;

- €750 million, 20yr tranche maturing February 20th, 2043. If one or both of the following SPTs are not achieved, a 25bps step-up mechanism will also be applied:

- for the new KPI related to the “Scope 1 and 3 GHG emissions Intensity relating to Integrated Power (gCO2eq/kWh)”, the achievement of a SPT equal to ZERO on December 31st, 2040;

- for the new KPI related to the “Absolute Scope 3 GHG emissions relating to Gas Retail (MtCO2eq)”, the achievement of a SPT equal to ZERO on December 31st, 2040.

Enel became the first issuer of sustainability-linked bonds after bringing the product to the market in September 2019. The issuer simultaneously pledged to no longer issue use of proceeds green bonds. Since then, the issuer updated its Sustainability-Linked Framework three times, respectively in October 2020, January 2021 and February 2023. Such frequent updates are not usual in the market among Sustainability-Linked issuers. However, it enabled the company to strengthen the governance of its program by confirming or improving the ambition of SPTs and broadening the set of KPIs and intermediary SPTs.

Reiterating and adding intermediary SPTs for the existing KPIs brought a lot of consistency and transparency around Enel’s ambition to reach its long-term sustainability goals. These updates where particularly scrutinized by the market who speculated that Enel may fail to meet its near-term carbon emissions targets. The risk to miss its scope 1 emissions 2023 SPT on nine of its bonds would come from the Italian government’s order to increase coal-fired power generation plants in the context of the European energy crisis. In a recent interview published by International Finance Review[2], Alessandro Canta, head of finance and insurance at Enel told “Any failure to achieve the objectives set in relevant sustainability-linked bonds would be solely attributable to the contingent situation linked to the gas crisis." "Our goal is, and continues to be, achieving zero emissions by 2040."

Should the 2023 SPT be missed, Enel would have to pay a coupon step-up of 25bp. This increased interest costs over the lifetime of the 9 bonds could cost the company about €120m. Legally, this extra cost could not be triggered by Enel as the Frameworks and financial documentations state that “failure to meet SPTs due to factors outside the company’s control may not result in step-up being triggered” such as “an amendment to, or change in, any applicable laws, regulations, rules, guidelines and policies, applicable to and/or relating to […] the closure of the thermo-electric power plants owned by Enel”. However, Canta said to International Finance Review that Enel will not use those clauses to avoid the step-ups: "The group would, in any case, not exercise any clause and, should the targets not be achieved, it would pay the step-up envisaged at the time of transaction ... respecting the structure designed at issuance". Natixis sees this commitment as a very strong message sent to investors especially because Enel can influence the trends of the Sustainability-Linked Bond market, being currently by far the largest issuer with close to US$25bn of outstanding SLBs.

What about EU taxonomy related KPIs?

We see the Sustainability-Linked bond market evolving towards greater integration of taxonomy related KPIs (CAPEX and share of revenues alignment) especially with CSRD implementation in 2024. So far, only two actors have tied their KPIs to the EU taxonomy climate mitigation criteria, namely SPIE and ENEL.

One of Enel’s new KPI added to its sustainability linked financing framework is related to the proportion of CAPEX aligned to the EU taxonomy (%). Such KPI is by design linked to green use of proceeds and helps to illustrate the means being deployed to reach transition goals, i.e. “a means” KPI. Taxonomy aligned CAPEX KPI displays a forward-looking dimension - their decarbonization benefits will materialize in the future and underpin the product or services mix of tomorrow – and a relative aspect (when expressed in % of total CAPEX) which is insightful. However, depending on the sectors, the correlation between green CAPEX levels (in %), total GHG emissions, and business model sustainability can vary. This holds particularly true for low-capex intensive brown activities such as trading of fossil fuels. In our view, it is preferrable to combine means-oriented KPI with result-oriented one (CO2e emission reduction).

In the case of Enel’s framework, this KPI articulates and brings credibility to the company’s commitment to transition towards net zero GHG emissions by 2040. It indicates the pace of the transition engaged by the company as it will strongly influence its ability to reach the SPTs related to Scope 1 and 3 GHG emissions Intensity. Indeed, the lion share of its capex alignment percentage is likely to come from the deployment of renewable energy capacities. However, the EU Taxonomy KPI offers a broader view than the Renewable Installed Capacity KPI as it also factors ENEL’s investments in renewable energy storage, distribution, energy efficiency, e-mobility. It also has the virtue to encompass DNSH criteria on other environmental objectives, inlcuding on biodiversity.

SPIE’s Sustainability-Linked Bond Framework, for which Natixis acted as ESG coordinator, offers a different and innovative view. Indeed, one of its KPI is the green share of revenue, i.e. revenue aligned with the E.U. Taxonomy climate mitigation criteria, as a share of total revenue. Because reporting against the Taxonomy will be highly standardized and is mandatory for the bulk of European firms, it is a great tool to design KPI-related financing instruments. Note that more specifically, the bulk of activities counted as aligned for SPIE are “enabling activities”, illustrating its business model to become an enabler of its clients’ decarbonization (what is sometimes depicted as scope 4). Indeed, the company’s four main businesses are efficient building, smart city, energy and industrial services.

Both Sustainability-Linked Bond Frameworks received a Second Party Opinion by Moody’s. The latter analyzed positively the reference to the EU Taxonomy as a “necessary tool to support companies in their transition to climate neutrality and a sustainable economy”[3]. Enel received the highest score on the relevance of the EU Taxonomy linked indicator “since it reflects 100% of Enel’s capital spending plan for 2023-25”. It is noteworthy that the relevance of the “results” KPIs Scope 1 and 3 GHG emissions intensity (Integrated Power scope) and Absolute Scope 3 (GHG emissions relating to Gas Retail scope) were assessed respectively as “moderate” and “limited”. They have been analyzed as if they were to be used on a standalone basis. Indeed, individually both KPIs cover a limited share of Enel's total carbon footprint (i.e. respectively 57% and 20% of Enel’s total carbon footprint in 2021). In that context, result indicators (CO2) were less valued than the mean indicator (CAPEX alignment). Natixis believes that, subject to the availability of SPTs, an ideal basket of KPI would combine “means” and “results” KPIs. In Enel’s specific case it could be Scope 1 and 3 GHG emissions Intensity relating to Integrated Power, absolute Scope 3 GHG emissions relating to Gas Retail and Proportion of CAPEX aligned to the EU Taxonomy.

The successful articulation of its 8yr tranche with the EU Taxonomy and GHG emissions (scope 1 intensity relating to Power Generation) reinforced Enel’s pioneering role in the sustainable finance market. It could be an ideal candidate for further innovative KPIs notably on biodiversity, social and just transition themes. Indeed, these are increasingly expected by investors. Environmental Finance’s research[4] identified $984 million combined assets under management (AUM) of funds or strategies mentioning “biodiversity” in 2022 (versus $313 million a year before). Since 2019, 14 EUR SLB issuances incorporating social KPIs, accounting for 10% of the total SLB volumes were identified. 9 out of them paired social KPIs alongside environmental ones (e.g from Teva Pharmaceuticals, Edenred and Schneider Electric) and only 5 contained social KPIs solely (Sanofi, Novartis AG, Mota-engil and M Finance SASU, for further details, see our editorial “Social bonds: Easy come and easy go?”). Note Natixis participated to the drafting of the social KPI registry for SLB within ICMA subgroup (see our last year article “ICMA’s newly released KPI registry to discipline SLB issuances”, we will comment the social registry once released). Such registry will guide issuers and underwriters in incorporating social KPIs in SLB frameworks. However, one notices that social KPIs tend to be more specific and granular than climate ones which can be all-encompassing (GHG emissions are fungible in a common denominator). Individual social KPIs are less holistic by nature and rarely comprehensive enough to be used in standalone for SLB issuance (i.e., with a single KPI and not a basket of KPIs). Although highly material, they require combinations with environmental and/or other socials KPIs to offer a large enough picture of a company’s overall contribution and impacts.

[2]IFR (February 2023), Enel raises €1.5bn from SLB despite pressure on targets, available here: https://www.ifre.com/story/3755160/enel-talks-up-esg-strategy-despite-pressure-on-targets-2fczx7zvqz

[3]https://www.enel.com/content/dam/enel-com/documenti/investitori/investire-in-enel/programmi-principali/en/second-party-opinion-on-sustainability-linked-financing-framework_february2023.pdf, https://www.moodys.com/web/en/us/hosted-assets/spo-second-party-opinion-on-spie27s-sustainability-linked-financing-framework.pdf

[4] Environmental Finance (February 2023), Biodiversity fund assets triple in 2022 to nearly $1bn, available here: https://www.environmental-finance.com/content/analysis/biodiversity-fund-assets-triple-in-2022-to-nearly-$1bn.html