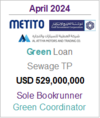

Al Wakra and Al Wukair Sewage Treatment Plant Successfully Secures its USD 529m Green Loan

Al Wakra and Al Wukair Sewage Treatment Plant Successfully Secures its USD 529m Green Loan

In April 2024, financial close has been reached on the USD 729m Al Wakrah and Al Wukair sewage treatment plant in the region of Al Wakra in Qatar, with a capacity of 150,000 m3/day (phase 1). The ultimate capacity of the plant will reach 600,000 m3/day to be developed in four stages.

The project comes with a strong rational aligned with Qatar’s National Vision 2030, where the government intends to improve the development of the wastewater sector in the country, along with the intention of enhancing the participation of the private sector. The achievement of this project is a key milestone supporting the Government’s strategy to promote sustainable and efficient use of water, noting that Qatar is one of the most arid countries in the world.

The project Sponsors are Metito Utilities Limited, Gulf Investment Corporation, and Al Attiya Motors & Trading Company. The offtaker is the Public Works Authority (Ashghal) through a 25 year public private partnership agreement.

The proceeds of the loan will be used to finance the design, development, operation, and maintenance of the sewage treatment facilities.

The Green Loan Framework is aligned with the APLMA/LMA/LSTA Green Loan Principles, with the project being eligible under the category of sustainable wastewater management and wastewater treatment and contribute to the EU Taxonomy Regulation’s sustainable use and protection of water and marine resources, and pollution prevention and control objectives.

S&P Global Ratings provided a Secondary Party Opinion on the Green Loan Framework and concluded that the transaction achieves S&P Global Ratings’ highest score in its assessment.

Natixis participated in the transaction as a Mandated Lead Arranger Bookrunner, Structuring Bank, Facility & Security Agent and Green Loan Coordinator.