Air France – KLM €1bn inaugural sustainability-linked bond

On January 9th, 2023, Air France-KLM has successfully placed its first sustainability-linked bonds, for a nominal amount of EUR 1 billion, linked to the company’s target to reduce its well-to-wake[1] scope 1 and 3 jet fuel greenhouse gas (GHG) emissions per revenue tonne kilometer (RTK) by 2025, compared to a 2019 baseline, as part of its 2030 SBTi approved[2] trajectory. Natixis acted as sole sustainability structuring advisor and global coordinator of the transaction.

Bridging the gap between the corporate sustainability roadmap and the financial strategy

Air France – KLM Group, inaugurating its very first Sustainability-Linked transaction with a dual tranche emission, a premiere in EUR for the aviation industry and one of the first for the sector.

The Group selected the most relevant and material KPI for its sector covering more than 90% of its total carbon footprint. The ambition set demonstrates a significant improvement compared with business-as-usual trajectory with important associated investments expected for the coming years and credible means for achieving the SPTs (see Figure 1 below), notably including a target to use 10% of certified sustainable aviation fuel (SAF) by 2030.

Source: Air France KLM Sustainability-Linked Financing Framework

Characteristics of the bonds are linked to the achievement of the reduction of its “well-to-wake” GHG emission intensity metric tons of CO2 equivalent per RTK by 10% by 2025 compared to its 2019 baseline, as part of a 2030 trajectory validated by SBTi in December 2022. With this transaction, Air France – KLM Group also reopened the unrated segment that was closed for over a year.

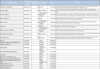

This transaction issuance is framed into the newly set Air France-KLM Group's Sustainability-Linked Financing Framework[3], which received a Second Party Opinion[4] from Moody’s Investors Services (MIS) with a qualification of “Significant contribution to Sustainability” and “Best Practices” alignment with market principles. MIS’ SPO confirmed the solid ambition of Air France – KLM Group compared with the targets of most of its sector peers and international standards.

Source: Air France KLM Second Party Opinion

With this inaugural transaction, the company is aligning its financial strategy with its climate roadmap, setting an additional milestone in Air France-KLM Group’s ambition to act as a leader for a more sustainable aviation industry.

Transaction insights

The company announced its intention to access the market on 3 January 2023 and, after a two-day roadshow on 4 and 5 January 2023.

The final offering was composed of two tranches:

- a EUR 500 million with a 3.3-year maturity and a coupon of 7.250%;

- a EUR 500 million with a 5.3-year maturity and a coupon of 8.125%.

Strong investor demand, with an orderbook around €2.6bn that covered c.2.6x the size of the bonds, is a testament to investors’ confidence in Air France-KLM Group’s sustainability ambition and measures taken to restore the Company’s creditworthiness following the Covid-19 crisis.

Geographically, the distribution was well diversified with France and UK & Ireland leading with respectively 37% and 32% of the allocations for the Long 3-Year and 23% and 41% for the Long 5-Year, followed closely by DACH[1] with about a quarter of the allocations. Regarding investors profile, distribution was widely dominated by Asset Managers with 76% (L3Y) and 67% (L5Y) of the allocation, ahead of Banks & Private Banks with 10% (L3Y) and 9% (L5Y) and Hedge Funds with 9% (L3Y) and 17% (L5Y). About a third of the allocations went to investors considered as “dark green” by Natixis CIB.

Analysis of the Air France-KLM sustainability strategy

The Air France-KLM and its subsidiaries airlines are committed to reducing their environmental footprint as part of a transparent and responsible approach to sustainability, with the objective to diminish its well-to-wake scope 1 and 3 jet fuel greenhouse gas emissions by 30% per revenue tonne kilometre (RTK) by 2030 compared to 2019.

To illustrate its determination to achieve this ambitious target, the Group decided to place its emission reduction trajectory through a Science-Based Target Validation approval by SBTi[6] in December 2022.

The SBTi confirmed the Group scope 1 and scope 3 emissions reduction targets as being in line with a well-below 2°C objective, as determined by the Paris Agreement signed in 2015.

In January 2023, only 8 Airlines have had their near-term targets independently validated by the SBTi, all in line with a well-below 2°C objective.

Source: SBTI website: company taking action

To reach its target, the Group relies on four decarbonization levers:

Renewal of the fleet

Source: Air France KLM Sustainability-Linked Financing Framework

Aircraft considered as Next generation aircraft: A220, A320 NEO, A350, B787, Embraer 195-E2.

Sustainable Aviation Fuels (SAF)

SAF has become a big growth area and hot topic in the industry. A variety of biofuels and synthetic fuels are being developed, but supply is very limited. Air France and KLM have been pioneers in the use of these fuels, which will play a key role in the decarbonization of air transport, as they reduce greenhouse gas emissions by an average of 80% over the entire life cycle.

The Group is committed to include a, 10% SAF component by 2030 and selects only fuels whose sustainability is proven and certified by independent, reliable bodies like the Roundtable on Sustainable Biomaterials (RSB) or the International Sustainability and Carbon Certification (ISCC). It requires a more than 75% reduction in CO2 emissions, a minimal impact on biodiversity, no competition with food production or access to food resources, no use of palm oil which is a major driver of deforestation and a positive impact on local development.

Source: Air France-KLM Investor presentation

In October 2022 Air France-KLM signed contracts with Neste and DG Fuels to buy a combined 1.6 million tonnes of SAF between this year and 2036. In December 2022, it reached a preliminary understanding with TotalEnergies for another 800,000 tonnes over the next 10 years.

All-in-all, these contracts represent a first step by the Group towards achieving its 10% SAF incorporation targets by 2030 and will cover approximately 3% of those 10%.

Operational measures

The search for greater efficiency in its operations, by favouring more direct trajectories and applying procedures that limit fuel consumption (lighter aircraft, single-engine taxi, continuous descent). Air France and KLM have set themselves the target of carbon neutrality for ground operations by 2030.

Source: Air France KLM website

Intermodality

Combining different modes of transport, wherever possible, by offering its customers the possibility of combining different modes of transport (intermodality). Air France and KLM are offering its customers a service that allows them to combine train and air travel in the same reservation, with guaranteed connections. This offer, called “Train + Air” and “Air/Rail” respectively in partnership with the SNCF and Thalys. The “Train + Air” product is used every year by more than 160,000 customers travelling to and from Paris-Charles de Gaulle and Paris-Orly airports.

The intermodality offer developed by the Air France – KLM Group should pursue its rapid growth as, in December 2022, the European Commission[7] approves the proposal made by the French Parliament to ban short domestic flights across France when an equivalent train journey of less than 2h30 exists.

What did ESG specialists think about it?

Air France-KLM belongs to the hard-to-abate sector family. Therefore, as mentioned by Global Capital[8], the issuance of its Sustainability-Financing Framework was expected and appears as an obvious approach to encompass a robust decarbonisation pathway. Nevertheless, it raised scrutiny from the market.

For the Anthropocene Fixed Income Institute[9], “by issuing SLBs, Air France-KLM is shifting from post-pandemic government support to debt products that both increase transparency and their commitment to reducing emissions […] Setting the reduction from 2019 is therefore more ambitious, and the probability of pay-outs in the SLB structure commensurately higher.”

Despite the absence of a KPI monitoring the absolute GHG emissions reduction of the company[10], ABN AMRO ESG and corporates strategist said to Environmental Finance[11] that “the SLB framework – and validation sought from the SBTi – was a “landmark” deal which resulted in a “positive step towards airline companies taking more responsibility” for decarbonisation. ABN AMRO added “We hope it encourages other airline peers to follow Air France-KLM’s lead”.

On the other way, AFII and ABN AMRO advocate for a reshuffling of the coupon step-up market standard practices for Sustainability-Linked Bonds. AFII specified that “while significant for an investment grade issuer, this has a more muted impact on the funding spreads for Air France-KLM[12]"

In conclusion, quoting AFII, “the Air France-KLM SLB issuance is a positive step in towards supporting its climate transition, delivering greater transparency and a commitment to reducing emissions, while providing financial benefits for investors”.

[1] Corresponds to the sum of both scope 1 emissions from jet fuel combustion and scope 3 category 3 “fuel- and energy related activities” emissions from upstream production and distribution of jet fuel

[2] Link to the Press Release: Air France-KLM CO₂ emissions reduction targets for 2030 approved by the Science Based Targets initiative (SBTi)

[3] Link to the Air France KLM Sustainability-Linked Financing Framework

[4] Link to the Moody’s Investors Service Air France KLM Second Party Opinion

[5] An abbreviation DACH stands for D — Deutschland (Germany), A — Austria, CH — Confœderatio Helvetica (Switzerland). Therefore, it refers to German-speaking Europe.

[6] Founded by the Carbon Disclosure Project (CDP), the United Nations Global Compact and the World Wildlife Fund (WWF), SBTi assesses and checks companies' CO2 emissions reduction targets based on a scientific approach and criteria, ensuring that the targets are in line with the Paris Agreement.

[8] Link to the GlobalCapital article

[10] Link to the ABN AMRO article

[11] Link to the Environmental Finance article

[12] The 5y SLB had an initial pricing target of 8.5%