Banks’ prudential requirements: towards a comprehensive integration of ESG risks into the EU prudential framework

20-minute read

On October 27th, the awaited review of the Capital Requirements Regulation (CRR) and of the Capital Requirements Directive (CRD) proposal was released by the European Commission with a noticeable dissemination of ESG across the board (reporting, planning, risk management, governance, remuneration, etc.). The package introduces explicit rules on the management and supervision of ESG risks, in full consistency with the goals set out in the EU Sustainable Finance Strategy (see our July Article). Furthermore, it gives supervisors the necessary powers to assess ESG risks as part of regular supervisory reviews.

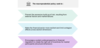

The envisioned integration of ESG factors into the EU Prudential framework spans over a large spectrum of measures around i) systemic risk buffer (SysRB on non-cyclical or macroprudential risks); ii) internal capital adequacy (whose amounts, types and distribution would need to be adequate to cover ESG risks) ; iii) internal governance (requiring effective processes to identify, manage, monitor and report ESG risks) ; iv) treatment of risks (in particular on management bodies’ approval and review of strategies and policies, and so to take up, manage, monitor and mitigate present, short term and medium to long-term ESG risks); v) ESG risks (with financial supervisors henceforth entitled to monitor banks’ minimum standards and reference methodologies, plans content, specific timelines and intermediate quantifiable targets and milestones, as well as quantitative criteria for assessing ESG impacts on financial stability and for setting scenarios and methods). The European Commission also proposes to incorporate ESG elements in vi) SREP mandate (that would be broadened to include banks’ governance and risk process for dealing with ESG risks), vii) supervisory stress testing (a joint committee from EBA, EIOPA and ESMA would develop standards and methodologies on the matter) viii) supervisory powers (incl. the possibility for competent authorities to impose measures and changes in case of misalignment with EU’s sustainability objectives, a quite large and potent remit), ix) harmonization of ESG risks (e.g. ESG, environmental, physical, transition, social, governance and anchorage into the EU Taxonomy’s 6 objectives), x) reporting requirement & disclosure of ESG risks (based on EBA’s to be developed uniform disclosure formats). Last but not least, the review package also touches on xii) prudential treatment of exposures to environmental and/or social factors. A potential adjustment of risk weights for assets associated with high exposure to ESG risks, especially climate ones, notably in the fossil fuel sector, is envisioned. It is noteworthy that the deadline for EBA to deliver its findings on prudential treatment was advanced from 2025 to 2023. There is a growing pressure to accelerate on the topic. By June 2022, the European Commission is thus required to review the adequacy of the macroprudential regulation, and if appropriate, to submit a legislative proposal to the Parliament and the Council by December 2022.

This finalization of Basel III aims at “ensuring that EU banks become more resilient to potential future economic shocks, while contributing to Europe’s recovery from the Covid-19 pandemic and the transition to climate neutrality”. Although the legislative package adoption is likely to take months and not to apply before a while, the integration of ESG risks in the new prudential framework is consistent with the European Sustainable Finance Agenda. Market participants must begin to understand what is at stake and proposed, in order to engage in fruitful and sound discussions with policy makers and hence prepare themselves for future requirements.

With the European Union willing to leverage financial flows to achieve the transition towards a low carbon economy, the review of Basel III could meet both political priority (as set by the Green Deal and the Fit for 55 Package) as well as prudential policy objectives.

The introduction of ESG risks in prudential frameworks could not only encourage financial actors to further consider the environmental transition, but it could also contribute to the preservation of financial stability by avoiding a “green swan” effect. In our view, the so-called “risk approach” (primary objective of capital requirements being to increase banks’ resilience to risks and ensure financial stability[1]) should not be opposed to the “economic policy” approach (aimed at using capital requirements as a policy tool to channel financial flows towards a low-carbon economy). The implementation of Basel III goes hand in hand with the reform of the capital markets union that aims at supporting the economic recovery post-covid 19, create a more inclusive and resilient economy as well as helping Europe deliver the Green Deal.

Natixis’ Green Weighting Factor, which has been voluntarily deployed within Natixis CIB since September 2019, is a genuine illustration of this double purpose achievement. Indeed, by applying an analytical adjustment of the capital allocation depending to the degree of sustainability of each financing, this tool proved to be an excellent lever to foster the bank’s transition to sustainable finance. But also, to monitor its climate strategy, to progressively integrate climate transition risk in the overall risk assessment of lending transactions and ultimately to anticipate future regulatory evolution and nourish strategic client dialogue, client tiering and commercial planning.

Figure 1 : Different instrument, approaches and challenges

Source: IC4CE

A minimum uncertainty and a rule-of-thumb approach are unavoidable because backward-looking data cannot help supervisors in assessing ESG risks. As already stressed, a brown taxonomy defining asset or activities that are significantly harmful to climate objectives is crucial although not yet officially undertaken by any jurisdiction worldwide (see our benchmark “the New Geography of Taxonomies”).

Furthermore, the integration of ESG considerations in banks’ business strategies, processes and governance echoes the growing integration of climate considerations in monetary policies. The ECB’s latest Strategy Review (see in appendices) is a further evidence of that trend. Globally, the Network for Central Banks and Supervisors for Greening the Financial System (NGFS) is accumulating evidence that climate-related risks are a source of financial risks.

The following article will delve into two aspects:

1. Reminder on Basel Agreements that are the cornerstone of the European macroprudential policy strategy;

2. The introduction of ESG risk treatment through business strategies, processes and governance by the amendments of the Capital Requirements Directive and Regulation;

***

Due to the Covid-19 pandemic, the Basel Committee postponed the Basel III reforms, meaning that implementation dates of the Basel III standards (finalized in 2017), the revised Pillar 3 requirements (finalized in 2018) and the revised market risk framework (finalized in 2019) were all deferred to 2023.

As stated above, on October 27th, the European Commission released its draft review of the Capital Requirements Regulation (CRR) and the Capital Requirements Directive (CRD) to “ensure that EU banks become more resilient to potential future economic shocks, while contributing to Europe’s recovery from the Covid-19 pandemic and the transition to climate neutrality”. Before becoming legally-binding, the Proposals will have to be discussed both by the European Parliament and Council so no publication in the EU Official Journal is expected before end of 2022-2023. The new European macroprudential rules are predicted to apply from January 2025 as the proposal foresees additional time for Banks and Supervisors to properly implement reforms in their processes.

i). Basel Agreements: the cornerstone of the European macroprudential policy strategy

According to the European Central Bank (ECB), the “ultimate objective of macroprudential policy is to preserve financial stability” by containing systemic risks that can arise from severe macroeconomic shocks and financial imbalances (e.g., excessive credit growth leverage, maturity mismatches and contagion effects). To circumvent systemic risks, macroprudential policies rely on instruments such as capital-based measures, borrower-based measures and liquidity-based measures.

Figure 2: Objectives of macroprudential policy

Source : European Central Bank

To strengthen financial stability, Basel Agreements have progressively moved from a narrow definition of risks – Basel I essentially focused on credit risks through the “Cooke ratio” – to a more comprehensive definition. After Basel II integrated market and operational risks, Basel III added assets, liquidity, transformation and rate risks. Interestingly enough, the new legislative package reviewing Basel III incorporates ESG risks in this definition.

Overall, the legislative proposal intends to reinforce the financial sector’s resilience to economic shocks (implementation of Basel III), to contribute to the green transition and to acquire stronger enforcement tools by ensuring sound management of EU banks and better protect financial stability.

ii) Overview of the introduction of ESG risk treatment through business strategies, processes and governance by the amendments of the Capital Requirements Directive and Regulation

The following items are analyzed in the table below: Systemic risk buffer, Internal Capital, Adequacy Internal governance , Treatment of risks, ESG risks, SREP Mandate, Supervisory Stress Testing, Supervisory powers, Harmonization of ESG Risks, Reporting requirement, Disclosure of ESG risks, Prudential treatment of exposures to environmental and/or social factors

|

The amendment of the Capital Requirements (Directive 2013/36/EU) introduces further details, changes or innovations at multiple levels: |

||

|

Topic |

Relevant article |

Proposal analysis |

|

Systemic risk buffer |

Recital 36 |

Mention introduced by CRD VI:

|

|

Internal Capital Adequacy |

Article 73 |

Directive 2013/36/EU:

Mention introduced by CRD VI:

|

|

Internal governance |

Article 74 |

Directive 2013/36/EU:

Replacement introduced by CRD VI: “Institutions shall have robust governance arrangements, which include (…) effective processes to identify, manage, monitor and report the risks they are or might be exposed to in the short, medium and long-term time horizon, including environmental, social and governance risks.” |

|

Treatment of risks |

Article 76 (paragraph 1) |

Directive 2013/36/EU:

Mention introduced by CRD VI: the macroeconomic environment encompasses risks “resulting from the current, short, medium and long-term impacts of environmental, social and governance factors.” |

|

Treatment of risks |

Article 76 (paragraph 2) |

Directive 2013/36/EU:

Mention introduced by CRD VI: “Member States should ensure that the management body develops specific plans and quantifiable targets to monitor and address the risks arising in the short, medium and long-term from the misalignment of the business model and strategy of institutions, with the relevant Union policy objectives or broader transition trends towards a sustainable economy in relation to environmental, social and governance factors.” Natixis’ comment: This new mention is demanding in terms of transparency, explanations and accountability. The Union policy objectives are not specified and can be quite vague. As far as we understand, it could refer to net zero targets, 2030 and 2050 objectives, or other objectives deemed relevant. |

|

ESG risks |

New Article 87a |

Natixis’ comment: The EBA’s scope of work is extremely comprehensive, with high responsibility in setting such granular guidance. The output will be instrumental in steering the transition, their usability will be paramount criteria. There is a risk of a gap between supervisors’ ambitions and the comprehensiveness and usability of requirements. |

|

SREP Mandate |

Article 98 |

Directive 2013/36/EU:

Mention introduced by CRD VI: The SREP “shall include the assessment of institutions’ governance and risk process for dealing with environmental, social and governance risks, as well as of the institutions’ processes and exposures” while taking into account institutions’ business models. |

|

Supervisory Stress Testing |

Article 100 |

Directive 2013/36/EU:

Mention introduced paragraph 4 by CRD VI:

|

|

Supervisory powers |

Article 104 |

Directive 2013/36/EU:

Mention introduced by point m in the CRD VI: competent authorities will also have at least the power to “require institutions to reduce the risks arising from the institutions’ misalignment with relevant policy objectives of the Union and broader transition trends relating to environmental, social and governance factors over the short, medium and long term, including through adjustments to their business models, governance, strategies and risk management” Natixis’ comment: such prerogative for competent authorities extends powers significantly beyond current practice by effectively giving powers to require alignment with EU policy . The level of granularity and specification of the requirements to adjust business model or risk management is uncertain. |

|

The amendment of the Regulation 2013/575/EU makes other significant contributions: |

||

|

Topic |

Relevant article |

Proposal analysis |

|

Harmonization of ESG Risks |

Article 4 |

As aligned to the definitions proposed by the EBA report on ESG risks, the CRR III adds: (52d) “environmental, social or governance (ESG) risk” means the risk of losses arising from any negative financial impact on the institution stemming from the current or prospective impacts of environmental, social or governance (ESG) factors on the institution’s counterparties or invested assets; (52e) “environmental risk” means the risk of losses arising from any negative financial impact on the institution stemming from the current or prospective impacts of environmental factors on the institution’s counterparties or invested assets, including factors related to the transition towards the following environmental objectives: (a) climate change mitigation; (b) climate change adaptation; (c) the sustainable use and protection of water and marine resources; (d) the transition to a circular economy; (e) pollution prevention and control; (f) the protection and restoration of biodiversity and ecosystems; Environmental risk includes both physical risk and transition risk.

(52f) “physical risk”, as part of the overall environmental risk, means the risk of losses arising from any negative financial impact on the institution stemming from the current or prospective impacts of the physical effects of environmental factors on the institution’s counterparties or invested assets; (52g) “transition risk”, as part of the overall environmental risk, means the risk of losses arising from any negative financial impact on the institution stemming from the current or prospective impacts of the transition of business activities and sectors to an environmentally sustainable economy on the institution’s counterparties or invested assets; (52h) “social risk” means the risk of losses arising from any negative financial impact on the institution stemming from the current or prospective impacts of social factors on its counterparties or invested assets; (52i) “governance risk” means the risk of losses arising from any negative financial impact on the institution stemming from the current or prospective impacts of governance factors on the institution’s counterparties or invested assets. |

|

Reporting requirement |

Article 430 |

Mention introduced by CRR III:

|

|

Disclosure of ESG risks |

Article 449a |

Article 449a as replaced by the CRR III: “Institutions should disclose information on ESG risks, including physical risks and transition risks.” Information should be disclosed on an annual basis by small and non-complex institutions and on a semi-annual basis for other institutions.

|

|

Prudential treatment of exposures to environmental and/or social factors |

Article 501c |

Article 501c as replaced by the CRR III:

1. methodologies for the assessment of the effective riskiness of exposures related to assets and activities subject to impacts from environmental and/or social factors compared to the riskiness of other exposure; 2. the development of appropriate criteria for the assessment of physical risks and transition risks, including the risks related to the depreciation of assets due to regulatory changes; 3. the potential short, medium and long-term effects of a dedicated prudential treatment of exposures related to assets and activities subject to impacts from environmental and/or social factors on financial stability and bank lending in the Union. To better align the prudential timelines, the deadline for EBA to deliver its findings on prudential treatment was advanced from 2025 to 2023.” |

[1]The correlation between the greenness of an asset and its risk profile could be challenging to demonstrate. Regarding physical risks arising from climate change, there might be no difference between green and brown assets in the event of extreme weather events. Regarding transition risks (higher carbon price or taxation, command-and-control policies), various factors are at play. If low-carbon substitutes do not exist, at scale and affordably, brown assets might not become riskier.

***

Appendix 1: full article 87a, Environmental, social and governance risks (CRD IV)

1. “Competent authorities shall ensure that institutions have, as part of their robust governance arrangements including risk management framework required under Article 74(1), robust strategies, policies, processes and systems for the identification, measurement, management and monitoring of environmental, social and governance risks over an appropriate set of time horizons.

2. The strategies, policies, processes and systems referred to in paragraph 1 shall be proportionate to the scale, nature and complexity of the environmental, social and governance risks of the business model and scope of the institution’s activities, and consider short, medium and a long-term horizon of at least 10 years.

3. Competent authorities shall ensure that institutions test their resilience to long-term negative impacts of environmental, social and governance factors, both under baseline and adverse scenarios within a given timeframe, starting with climate-related factors. For the testing, competent authorities shall ensure that institutions include a number of environmental, and social and governance scenarios reflecting potential impacts of environmental and social changes and associated public policies on the long-term business environment.

4. Competent authorities shall assess and monitor developments of institutions’ practices concerning their environmental, social and governance strategy and risk management, including the plans to be prepared in accordance with Article 76, as well as the progress made and the risks to adapt their business models to the relevant policy objectives of the Union or broader transition trends towards a sustainable economy, taking into account sustainability related product offering, transition finance policies, related loan origination policies, and environmental, social and governance related targets and limits.

5. EBA shall issue guidelines, in accordance with Article 16 of Regulation (EU) No 1093/2010, to specify:

(a) minimum standards and reference methodologies for the identification, measurement, management and monitoring of environmental, social and governance risks;

(b) the content of plans to be prepared in accordance with Article 76, which shall include specific timelines and intermediate quantifiable targets and milestones, in order to address the risks from misalignment of the business model and strategy of institutions with the relevant policy objectives of the Union, or broader transition trends towards a sustainable economy in relation to environmental, social and governance factors;

(c) qualitative and quantitative criteria for the assessment of the impact of environmental, social and governance risks on the financial stability of institutions in the short, medium and long term;

(d) criteria for setting the scenarios and methods referred to in paragraph 3, including the parameters and assumptions to be used in each of the scenarios and specific risks.

EBA shall publish those guidelines by [OP please insert the date = 18 months from date of entry into force of this amending Directive]. EBA shall update those guidelines on a regular basis, to reflect the progress made in measuring and EN 86 EN managing environmental, social and governance factors as well as the developments of policy objectives of the Union on sustainability.”

Appendix 2: full article 104, Supervisory powers (CRD III)

1. “For the purposes of Article 97, Article 98(4), Article 101(4) and Articles 102 and 103 and the application of Regulation (EU) No 575/2013, competent authorities shall have at least the following powers:

(a) to require institutions to hold own funds in excess of the requirements set out in Chapter 4 of this Title and in Regulation (EU) No 575/2013 relating to elements of risks and risks not covered by Article 1 of that Regulation;

(b) to require the reinforcement of the arrangements, processes, mechanisms and strategies implemented in accordance with Articles 73 and 74;

(c) to require institutions to present a plan to restore compliance with supervisory requirements pursuant to this Directive and to Regulation (EU) No 575/2013 and set a deadline for its implementation, including improvements to that plan regarding scope and deadline;

(d) to require institutions to apply a specific provisioning policy or treatment of assets in terms of own funds requirements;

(e) to restrict or limit the business, operations or network of institutions or to request the divestment of activities that pose excessive risks to the soundness of an institution;

(f) to require the reduction of the risk inherent in the activities, products and systems of institutions; (g) to require institutions to limit variable remuneration as a percentage of net revenues where it is inconsistent with the maintenance of a sound capital base;

(h) to require institutions to use net profits to strengthen own funds;

(i) to restrict or prohibit distributions or interest payments by an institution to shareholders, members or holders of Additional Tier 1 instruments where the prohibition does not constitute an event of default of the institution;

(j) to impose additional or more frequent reporting requirements, including reporting on capital and liquidity positions;

(k) to impose specific liquidity requirements, including restrictions on maturity mismatches between assets and liabilities;

(l) to require additional disclosures.

2. The additional own funds requirements referred to in paragraph 1(a) shall be imposed by the competent authorities at least where, (a) an institution does not meet the requirement set out in Articles 73 and 74 of this Directive or in Article 393 of Regulation (EU) No 575/2013; (b) risks or elements of risks are not covered by the own funds requirements set out in Chapter 4 of this Title or in Regulation (EU) No 575/2013; (c) the sole application of other administrative measures is unlikely to improve the arrangements, processes, mechanisms and strategies sufficiently within an appropriate timeframe; (d) the review referred to in Article 98(4) or Article 101(4) reveals that the non-compliance with the requirements for the application of the respective approach will likely lead to inadequate own funds requirements;

(e) the risks are likely to be underestimated despite compliance with the applicable requirements of this Directive and of Regulation (EU) No 575/2013; or

(f) an institution reports to the competent authority in accordance with Article 377(5) of Regulation (EU) No 575/2013 that the stress test results referred to in that Article materially exceed its own funds requirement for the correlation trading portfolio.

3. For the purposes of determining the appropriate level of own funds on the basis of the review and evaluation carried out in accordance with Section III, the competent authorities shall assess whether any imposition of an additional own funds requirement in excess of the own funds requirement is necessary to capture risks to which an institution is or might be exposed, taking into account the following:

(a) the quantitative and qualitative aspects of an institution's assessment process referred to in Article 73;

(b) an institution's arrangements, processes and mechanisms referred to in Article 74;

(c) the outcome of the review and evaluation carried out in accordance with Article 97 or 101;

(d) the assessment of systemic risk.

Appendix 3: Detailed roadmap of climate-related actions